Question: B1 is complete and shown for data B2 and B3 need completion use excel please B. Use the provided links or other links for the

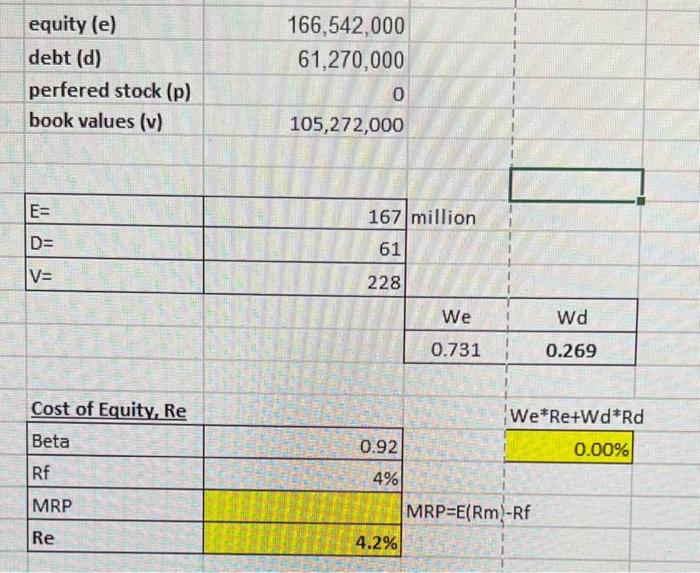

B. Use the provided links or other links for the following: 1) For your company, find and/or compute Market Values of f. Equity (E) g. Debt(D) h. Preferred Stock (P) (if any) and i. The company(V) (If you can't find Market values, use Book values for all.) Use the current corporate tax rate of 21%. 2) Estimate the costs of equity and debt (and preferred stock, if any) using the information gathered. For cost of equity, you may use either the DGM approach or the SML approach. 3) Compute the WACC using the information gathered and/or computed as described above. 4) Suppose, your firm is considering a project with the following expected cash flows and floatation costs: j. The project will cost $X where X is 10% of the firm's most recent annual sales. Compute and state project cost. (You may round it to the nearest thousand) k. It will bring an annual cash flow of $Y for 8 years where Y=0.2X. Compute annual cash flows and list all cash flows associated with the project in similar fashion to the examples done in class. 1. Floatation costs are 3% for equity, 2% for debt. Use your firm's target capital structure (or D/E ratio) as determined by its current capital structure to compute f. 5) Using the WACC, cash flows and the fA you computed above: a. Compute NPV of the project before floatation costs. b. Compute NPV (of the project) adjusted for floatation costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts