Question: B1 (Short Answer Quesitons). - Provide a brief explanation in the space provided to justify your answer. [5 marks each; 15 marks total] 1a. Consider

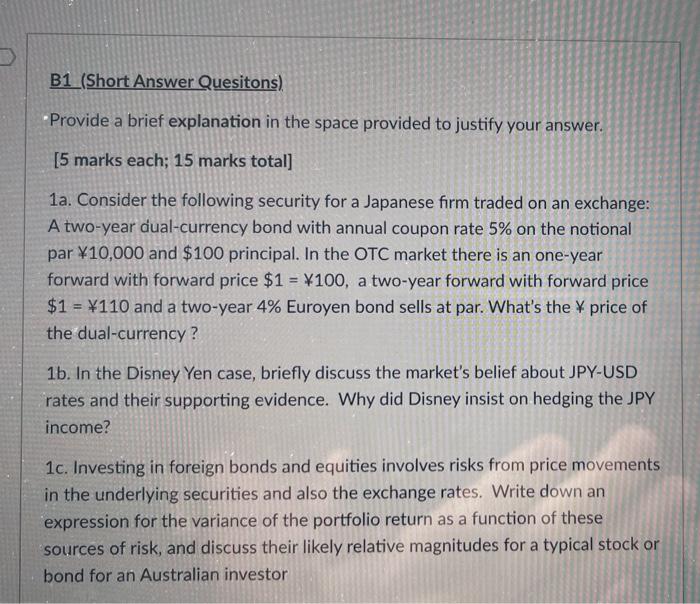

B1 (Short Answer Quesitons). - Provide a brief explanation in the space provided to justify your answer. [5 marks each; 15 marks total] 1a. Consider the following security for a Japanese firm traded on an exchange: A two-year dual-currency bond with annual coupon rate 5% on the notional par =10,000 and $100 principal. In the OTC market there is an one-year forward with forward price $1=$100, a two-year forward with forward price $1=110 and a two-year 4% Euroyen bond sells at par. What's the price of the dual-currency? 1b. In the Disney Yen case, briefly discuss the market's belief about JPY-USD rates and their supporting evidence. Why did Disney insist on hedging the JPY income? 1c. Investing in foreign bonds and equities involves risks from price movements in the underlying securities and also the exchange rates. Write down an expression for the variance of the portfolio return as a function of these sources of risk, and discuss their likely relative magnitudes for a typical stock or bond for an Australian investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts