Question: b-1. Would you exercise the call if you had bought the September call with the exercise price $135 ? Yes No b-2. What is the

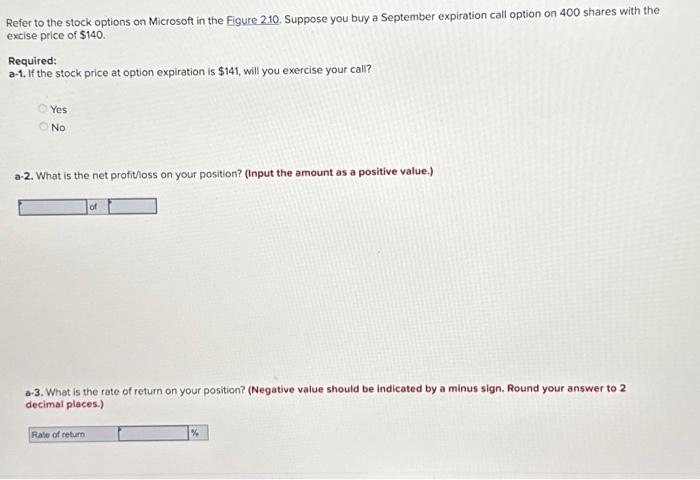

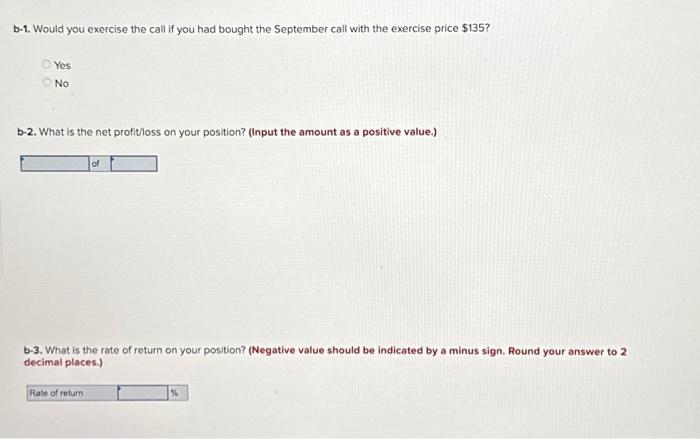

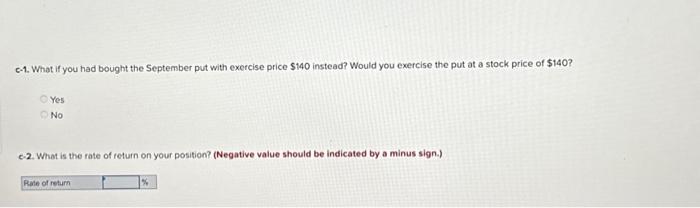

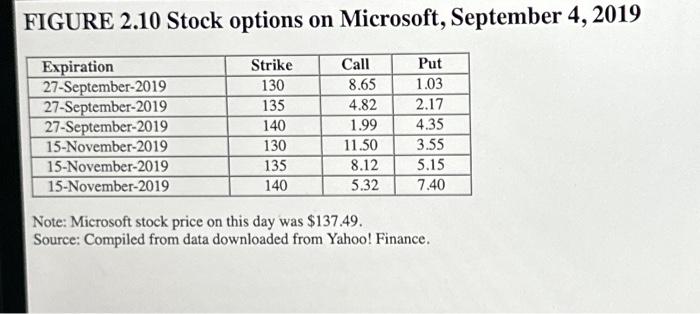

b-1. Would you exercise the call if you had bought the September call with the exercise price $135 ? Yes No b-2. What is the net profit/loss on your position? (Input the amount as a positive value.) of b-3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) 0-1. What if you had bought the September put with exercise price $140 instead? Would you exercise the put at a stock price of $140 ? Yes No -2. What is the rate of return on your position? (Negative value should be indicated by a minus sign.) Refer to the stock options on Microsoft in the Figure 210. Suppose you buy a September expiration call option on 400 shares with the excise price of $140. Required: a-1. If the stock price at option expiration is $141, will you exercise your call? Yes No a-2. What is the net profit/oss on your position? (Input the amount as a positive value.) of a.3. What is the rate of return on your position? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) FIGURE 2.10 Stock options on Microsoft, September 4, 2019 Note: Microsoft stock price on this day was $137.49. Source: Compiled from data downloaded from Yahoo! Finance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts