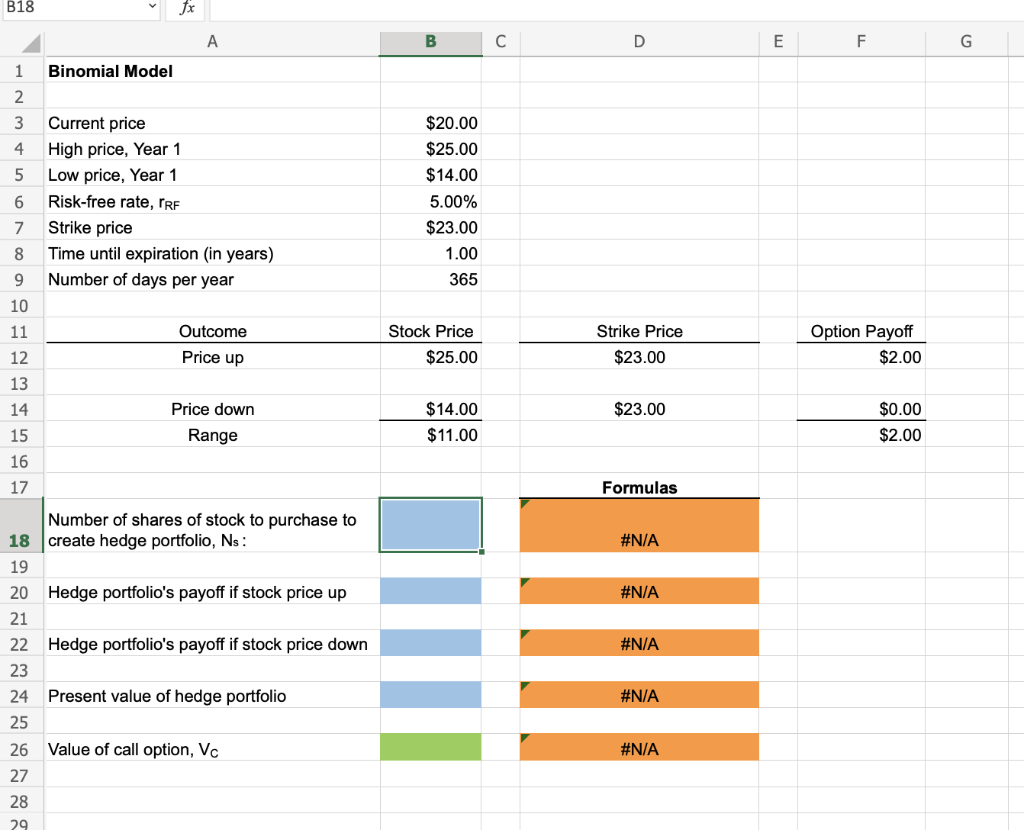

Question: B18 Jx A B D E F G 1 Binomial Model 2 3 4 5 6 Current price High price, Year 1 Low price, Year

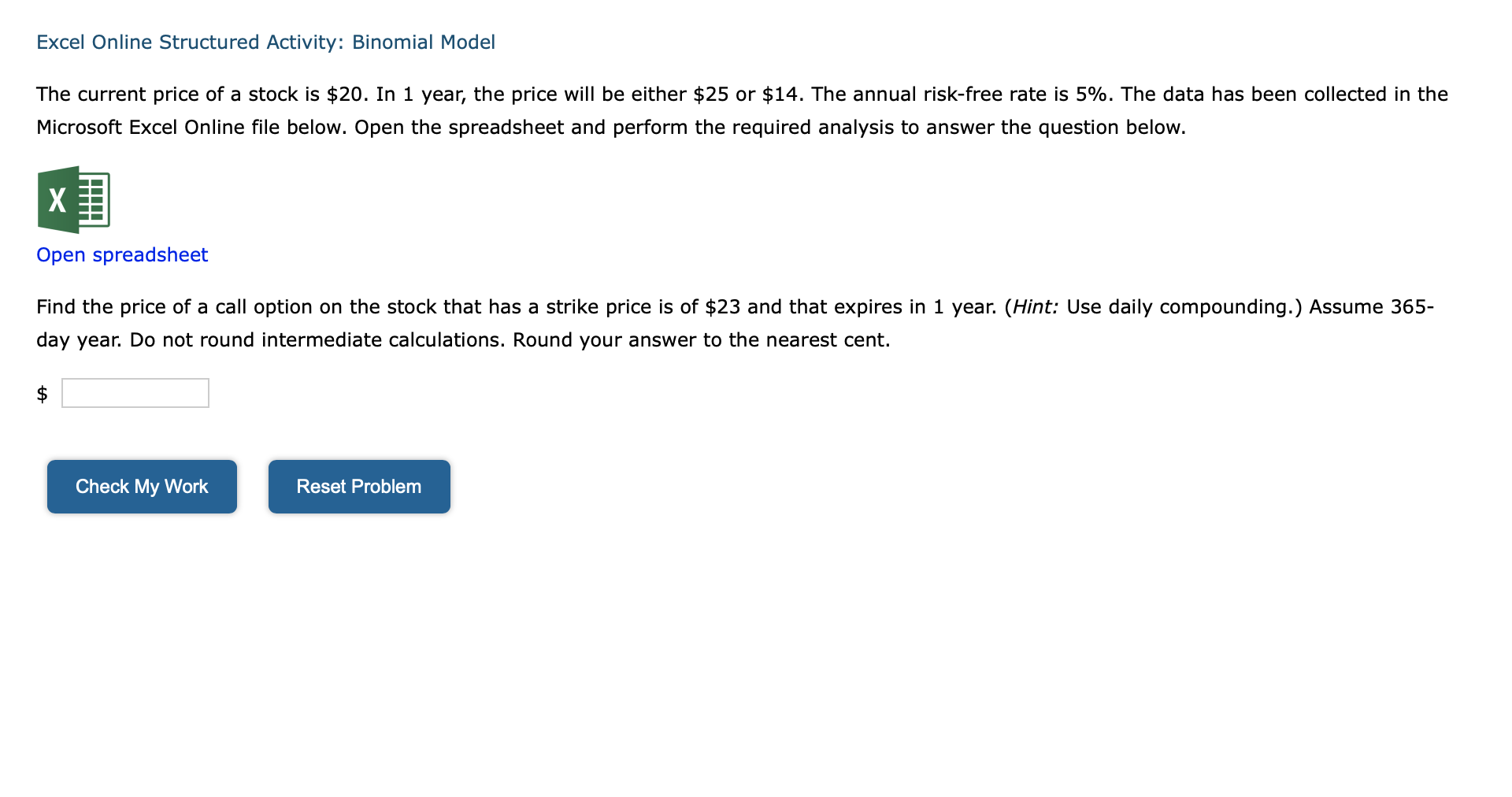

B18 Jx A B D E F G 1 Binomial Model 2 3 4 5 6 Current price High price, Year 1 Low price, Year 1 Risk-free rate, IRF Strike price Time until expiration (in years) Number of days per year $20.00 $25.00 $14.00 5.00% $23.00 1.00 365 7 8 9 10 11 Outcome Stock Price $25.00 Strike Price $23.00 Option Payoff $2.00 12 Price up 13 14 $23.00 Price down Range $14.00 $11.00 $0.00 $2.00 15 16 17 Formulas #N/A #N/A Number of shares of stock to purchase to 18 create hedge portfolio, Ns: 19 20 Hedge portfolio's payoff if stock price up 21 22 Hedge portfolio's payoff if stock price down 23 24 Present value of hedge portfolio 25 26 Value of call option, Vc 27 #N/A #N/A #N/A 28 29 Excel Online Structured Activity: Binomial Model The current price of a stock is $20. In 1 year, the price will be either $25 or $14. The annual risk-free rate is 5%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Find the price of a call option on the stock that has a strike price is of $23 and that expires in 1 year. (Hint: Use daily compounding.) Assume 365- day year. Do not round intermediate calculations. Round your answer to the nearest cent. Check My Work Reset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts