Question: B2. No math is needed, please write the intuition for the answer. Suppose the economy has 2- factors, a market factor and a separate profitability

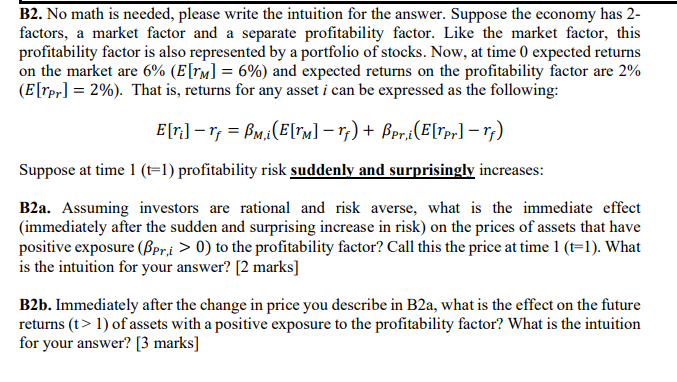

B2. No math is needed, please write the intuition for the answer. Suppose the economy has 2- factors, a market factor and a separate profitability factor. Like the market factor, this profitability factor is also represented by a portfolio of stocks. Now, at time 0 expected returns on the market are 6% (E[TM] = 6%) and expected returns on the profitability factor are 2% (E[rpr] = 2%). That is, returns for any asset i can be expressed as the following: E[ri] r; = Bm,i(E[ru] r7) + Bpr,i(E[rpr] r;) Suppose at time 1 (t=1) profitability risk suddenly and surprisingly increases: B2a. Assuming investors are rational and risk averse, what is the immediate effect (immediately after the sudden and surprising increase in risk) on the prices of assets that have positive exposure (Bpri > 0) to the profitability factor? Call this the price at time 1 (t=1). What is the intuition for your answer? [2 marks] B2b. Immediately after the change in price you describe in B2a, what is the effect on the future returns (t> 1) of assets with a positive exposure to the profitability factor? What is the intuition for your answer? [3 marks] B2. No math is needed, please write the intuition for the answer. Suppose the economy has 2- factors, a market factor and a separate profitability factor. Like the market factor, this profitability factor is also represented by a portfolio of stocks. Now, at time 0 expected returns on the market are 6% (E[TM] = 6%) and expected returns on the profitability factor are 2% (E[rpr] = 2%). That is, returns for any asset i can be expressed as the following: E[ri] r; = Bm,i(E[ru] r7) + Bpr,i(E[rpr] r;) Suppose at time 1 (t=1) profitability risk suddenly and surprisingly increases: B2a. Assuming investors are rational and risk averse, what is the immediate effect (immediately after the sudden and surprising increase in risk) on the prices of assets that have positive exposure (Bpri > 0) to the profitability factor? Call this the price at time 1 (t=1). What is the intuition for your answer? [2 marks] B2b. Immediately after the change in price you describe in B2a, what is the effect on the future returns (t> 1) of assets with a positive exposure to the profitability factor? What is the intuition for your answer? [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts