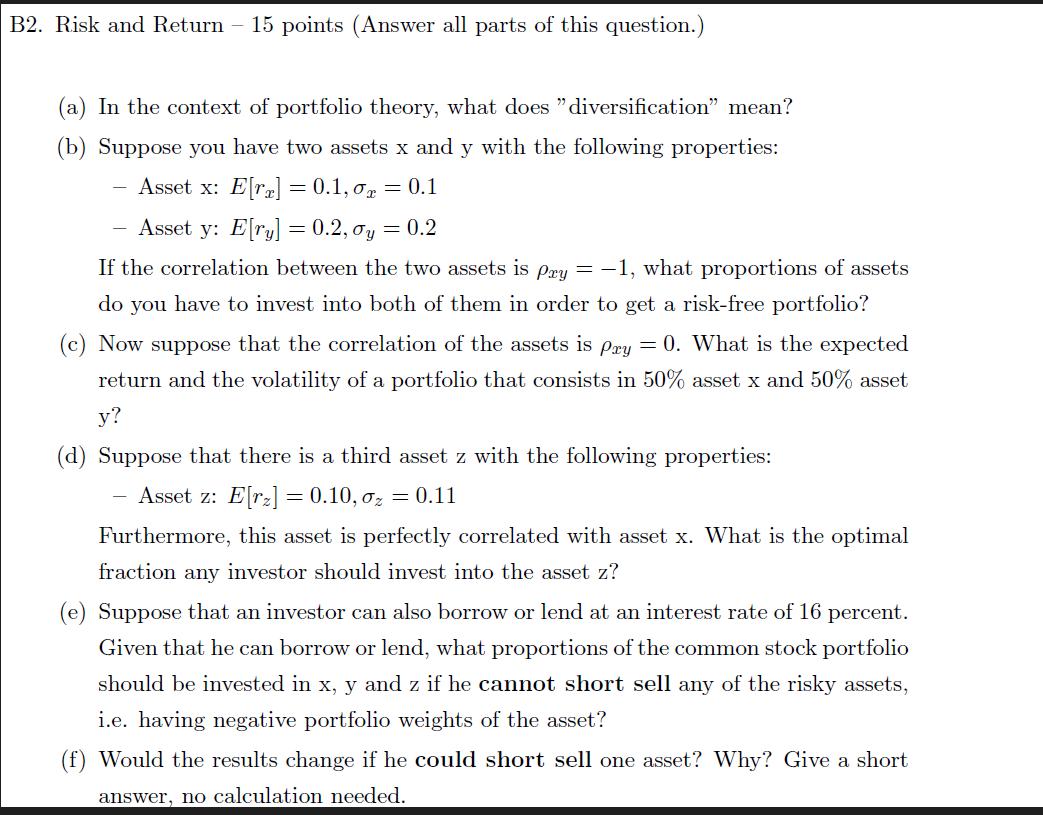

Question: B2. Risk and Return - 15 points (Answer all parts of this question.) (a) In the context of portfolio theory, what does diversification mean?

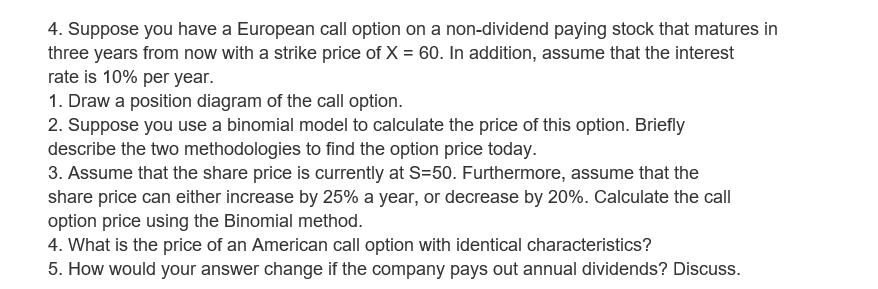

B2. Risk and Return - 15 points (Answer all parts of this question.) (a) In the context of portfolio theory, what does "diversification" mean? (b) Suppose you have two assets x and y with the following properties: Asset x: E[r]= 0.1, 0 = 0.1 Asset y: E[ry] = 0.2, 0y = 0.2 If the correlation between the two assets is pay = -1, what proportions of assets do you have to invest into both of them in order to get a risk-free portfolio? (c) Now suppose that the correlation of the assets is pay = 0. What is the expected return and the volatility of a portfolio that consists in 50% asset x and 50% asset y? (d) Suppose that there is a third asset z with the following properties: Asset z: E[r] = 0.10, z = 0.11 Furthermore, this asset is perfectly correlated with asset x. What is the optimal fraction any investor should invest into the asset z? (e) Suppose that an investor can also borrow or lend at an interest rate of 16 percent. Given that he can borrow or lend, what proportions of the common stock portfolio should be invested in x, y and z if he cannot short sell any of the risky assets, i.e. having negative portfolio weights of the asset? (f) Would the results change if he could short sell one asset? Why? Give a short answer, no calculation needed. 4. Suppose you have a European call option on a non-dividend paying stock that matures in three years from now with a strike price of X = 60. In addition, assume that the interest rate is 10% per year. 1. Draw a position diagram of the call option. 2. Suppose you use a binomial model to calculate the price of this option. Briefly describe the two methodologies to find the option price today. 3. Assume that the share price is currently at S=50. Furthermore, assume that the share price can either increase by 25% a year, or decrease by 20%. Calculate the call option price using the Binomial method. 4. What is the price of an American call option with identical characteristics? 5. How would your answer change if the company pays out annual dividends? Discuss.

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

a In the context of portfolio theory diversification means investing in a variety of different assets in order to reduce risk By diversifying a portfolio investors are able to reduce the risk associat... View full answer

Get step-by-step solutions from verified subject matter experts