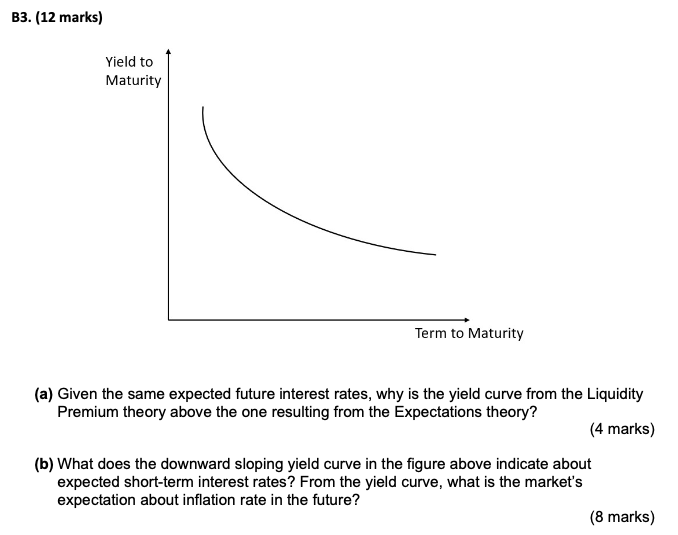

Question: B3. (12 marks) Yield to Maturity Term to Maturity (a) Given the same expected future interest rates, why is the yield curve from the Liquidity

B3. (12 marks) Yield to Maturity Term to Maturity (a) Given the same expected future interest rates, why is the yield curve from the Liquidity Premium theory above the one resulting from the Expectations theory? (4 marks) (b) What does the downward sloping yield curve in the figure above indicate about expected short-term interest rates? From the yield curve, what is the market's expectation about inflation rate in the future? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock