Question: B3. We consider a two-period binomial model with discrete interest rate i = 5% where the risky asset increases each step by either b =

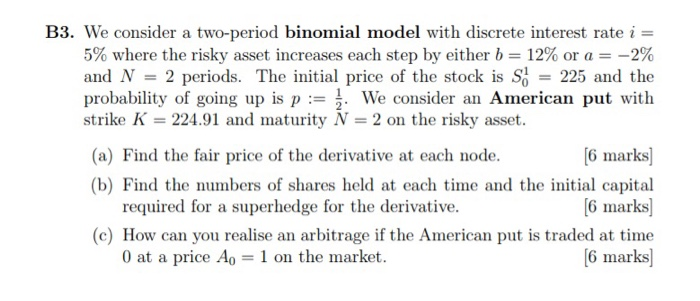

B3. We consider a two-period binomial model with discrete interest rate i = 5% where the risky asset increases each step by either b = 12% or a = -2% and N = 2 periods. The initial price of the stock is so = 225 and the probability of going up is p := {. We consider an American put with strike K = 224.91 and maturity N = 2 on the risky asset. (a) Find the fair price of the derivative at each node. [6 marks] (b) Find the numbers of shares held at each time and the initial capital required for a superhedge for the derivative. [6 marks) (c) How can you realise an arbitrage if the American put is traded at time 0 at a price Ao = 1 on the market. [6 marks] B3. We consider a two-period binomial model with discrete interest rate i = 5% where the risky asset increases each step by either b = 12% or a = -2% and N = 2 periods. The initial price of the stock is so = 225 and the probability of going up is p := {. We consider an American put with strike K = 224.91 and maturity N = 2 on the risky asset. (a) Find the fair price of the derivative at each node. [6 marks] (b) Find the numbers of shares held at each time and the initial capital required for a superhedge for the derivative. [6 marks) (c) How can you realise an arbitrage if the American put is traded at time 0 at a price Ao = 1 on the market. [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts