Question: B4 (i) Donna Donovan, CFA, has a client who believes the share price of TRT Materials (currently S58 per share) could move substantially in either

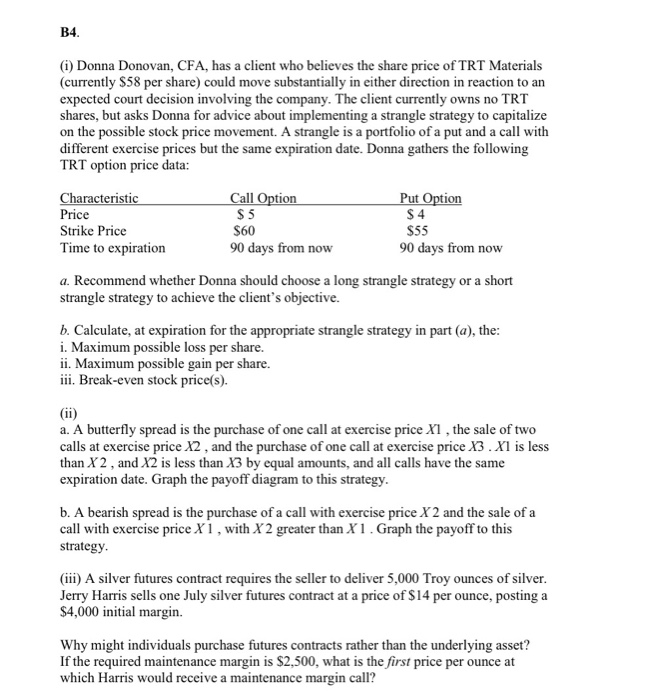

B4 (i) Donna Donovan, CFA, has a client who believes the share price of TRT Materials (currently S58 per share) could move substantially in either direction in reaction to an expected court decision involving the company. The client currently owns no TRT shares, but asks Donna for advice about implementing a strangle strategy to capitalize on the possible stock price movement. A strangle is a portfolio of a put and a call with different exercise prices but the same expiration date. Donna gathers the following TRT option price data: Call Option aracteristi Price Strike Price Time to expiration ion S5 S60 90 days from now S 4 $55 90 days from now a. Recommend whether Donna should choose a long strangle strategy or a short strangle strategy to achieve the client's objective. b. Calculate, at expiration for the appropriate strangle strategy in part (a), the: i. Maximum possible loss per share. mum possible gain per share iii. Break-even stock price(s). a. A butterfly spread is the purchase of one call at exercise price Xi, the sale of two calls at exercise price X2, and the purchase of one call at exercise price X3 .Xl is less than X2, and X2 is less than X3 by equal amounts, and all calls have the same expiration date. Graph the payoff diagram to this strategy b. A bearish spread is the purchase of a call with exercise price X2 and the sale of a call with exercise price X1, with X2 greater than X1. Graph the payoff to this strategy (iii) A silver futures contract requires the seller to deliver 5,000 Troy ounces of silver Jerry Harris sells one July silver futures contract at a price of $14 per ounce, posting a $4,000 initial margin. Why might individuals purchase futures contracts rather than the underlying asset? If the required maintenance margin is $2,500, what is the first price per ounce at which Harris would receive a maintenance margin call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts