Question: B5 For this question assume that the default event for a company follows a hazard rate model in the risk neutral world with inhomogeneous hazard

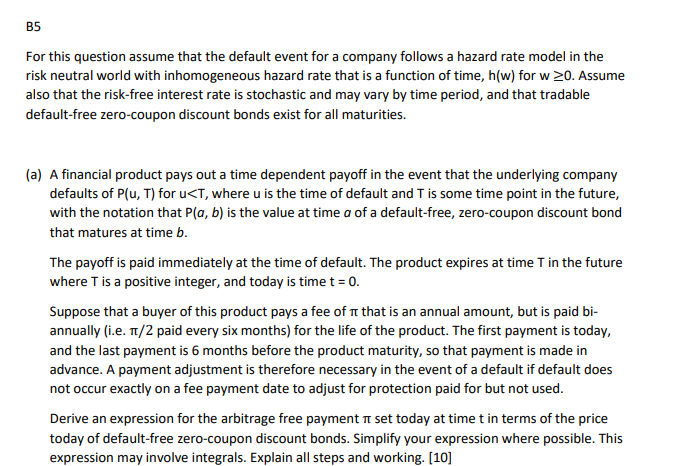

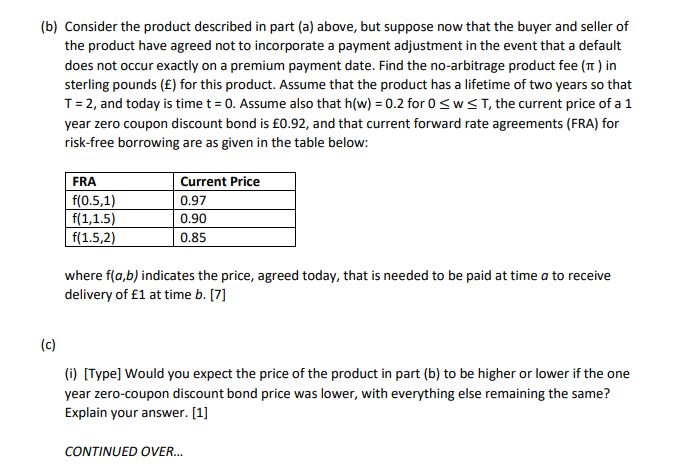

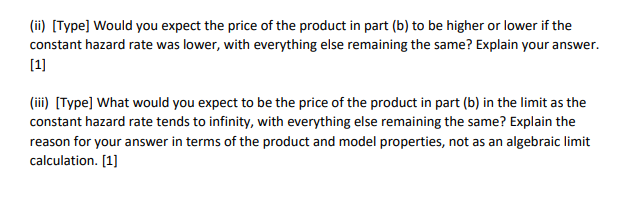

B5 For this question assume that the default event for a company follows a hazard rate model in the risk neutral world with inhomogeneous hazard rate that is a function of time, h(w) for w 20. Assume also that the risk-free interest rate is stochastic and may vary by time period, and that tradable default-free zero-coupon discount bonds exist for all maturities. (a) A financial product pays out a time dependent payoff in the event that the underlying company defaults of Plu, T) for u

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts