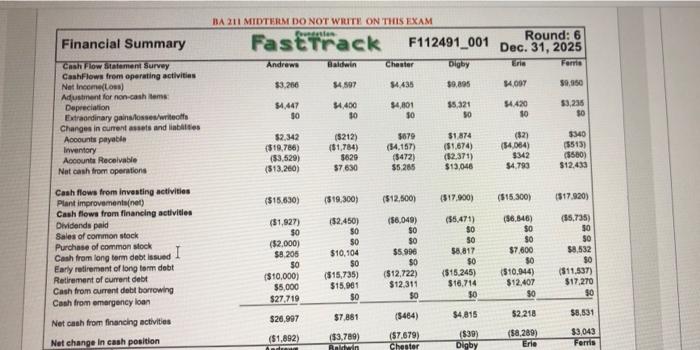

Question: BA 11 MIDTERM DO NOT WRITE ON THIS EXAM Financial Summary FastTrack F112491_001 Chester Digby Round: 6 Dec. 31, 2025 Andrews Baldwin Eria Forria $3.266

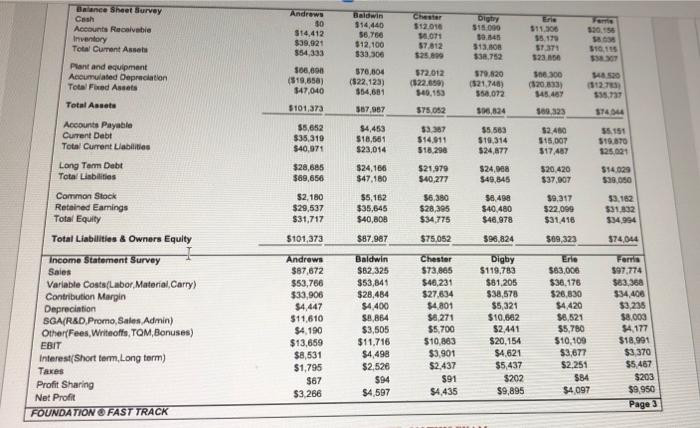

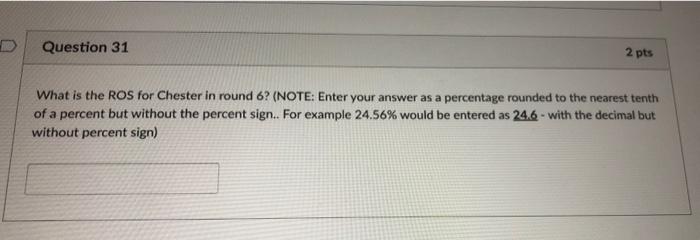

BA 11 MIDTERM DO NOT WRITE ON THIS EXAM Financial Summary FastTrack F112491_001 Chester Digby Round: 6 Dec. 31, 2025 Andrews Baldwin Eria Forria $3.266 4597 1435 $9.895 HOOT $9.950 Cash Flow Statement Survey Cashflows from operating activities Net Income Los) Adustment for non-cashtems: Depreciation Extraordinary gain ossewitt Changes in current assets and liabilities Accounts payable Inventory Accounts Receivable Net cash from operations $4,447 50 $4,400 10 $4801 10 $5.321 50 H420 50 53,235 50 52.342 ($19.786) (53,529) (513.260) (5212) ($1,784) 5629 $7630 5679 (14,157) (5472) $5.265 $1.874 (31.674) (52.371) $13,046 (327 (54.054) $342 $4.793 3340 (5515) (5560) $12.433 ($15.630) ($19.300) (512.5001 (517.000) (515.300) $17.920) Cash flows from investing activities Plant improvements(net) Cash flows from financing activities Olvidends paid Sales of common stock Purchase of common stock Cash from long term debt issued I Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan ($1,927) $0 ($2,000) $8.205 $0 ($10,000) $5,000 $27.719 ($2,450) 50 50 $10,104 SO ($15.735) $15.981 $0 ($6,040) SO SO $5.998 SO ($12,722) $12.311 $0 (55,471) $0 SO 58.817 $0 ($15.245) $18,714 50 (56.546) $0 $0 $7,600 50 (510,944) $12.407 $0 ($5.735) 30 50 $8,532 $0 ($11,537) $17,270 30 $7.881 $8,531 $26.997 $4,815 $2218 Net cash from financing activities Net change in cash position (5464) (57.679) Chester ($1,892) ($3,789) niin $39 Digby ($8,269) Eria $3,043 Ferris Ch Balance Sheet Survey Cash Accounts Receivable Inventory Total Current Assets Andrews 30 $14,412 $39,921 354,333 Baldwin 314,440 56.766 $12,100 $33,306 Fone 52016 $12.010 11.071 57,812 525.99 Digley 18.000 0.84 313. OB 338.752 Ere $11.00 15.170 S7371 523.50 10,115 Plant and equipment Accumulated Depreciation Total Fixed Assets 50 506,690 ($19,658) $47,040 5101,373 370,804 (522,123) $54,681 367.967 572,012 (1.22.650) 140,153 $75,052 579,820 (521,748) 558,072 112 56.300 120.833) 145.45 Total Assets 590,824 369 323 5744 Accounts Payable Current Debt Total Current Liabilities $5,652 $35,319 $40,071 $4,453 $18,561 $23,014 53.387 $14911 518.298 $5563 $19,314 $24,877 52.480 $15.007 317 487 55.151 $19.BTO 125.621 Long Term Debt Total Liabilities $28,685 $69,656 $24.166 $47,180 521,970 $40.277 $24,068 $49,845 $20.420 $37,907 $14.029 $39.050 Common Stock Retained Earings Total Equity $2,180 $29,537 $31,717 5101,373 $5,162 $35,545 $40,808 56,380 $28,395 $34.775 38.498 340.480 $46,978 39,317 $22.099 $31416 $3,162 $31.832 $34.994 Total Liabilities & Owners Equity $87.987 $75,052 396,824 $69,323 374044 Income Statement Survey Sales Variable costs(Labor Material Carry) Contribution Marpin Depreciation SGA(R&D Promo, Sales Admin) Other Fees, Writeoffs TOM, Bonuses) EBIT Interest(Short term. Long term) Taxes Profit Sharing Net Profit FOUNDATION FAST TRACK Andrews $87,672 $53,766 $33,906 $4,447 $11.610 $4,190 $13,659 $8,531 $1,795 $67 $3266 Baldwin $52.325 $53,841 $28,484 $4,400 $8,864 $3,505 $11,716 $4,498 $2,528 $94 $4,597 Chester $73,866 $46,231 $27.634 $4.801 $8,271 $5,700 $10,863 $3,901 $2.437 $91 $4,435 Digby $119.783 $61,205 $38,578 $5,321 $10.662 $2,441 $20,154 $4,621 $5,437 $202 $9,895 Erle $63.006 $38,178 $26.830 $4,420 $6,521 $5,780 $10,100 $3,677 $2.251 $84 $4.097 Forris 597,774 $83,368 $34.400 $3235 $8.000 34 177 $18.991 $3.370 $5.467 $203 $9.950 Page 3 Question 31 2 pts What is the ROS for Chester in round 6? (NOTE: Enter your answer as a percentage rounded to the nearest tenth of a percent but without the percent sign. For example 24.56% would be entered as 24.6 - with the decimal but without percent sign)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts