Question: BA 2 1 5 Financial Accounting Chapter 8 Exercises Record the following transactions for Turnbull Company. On August 4 , Turnbull sold merchandise on account

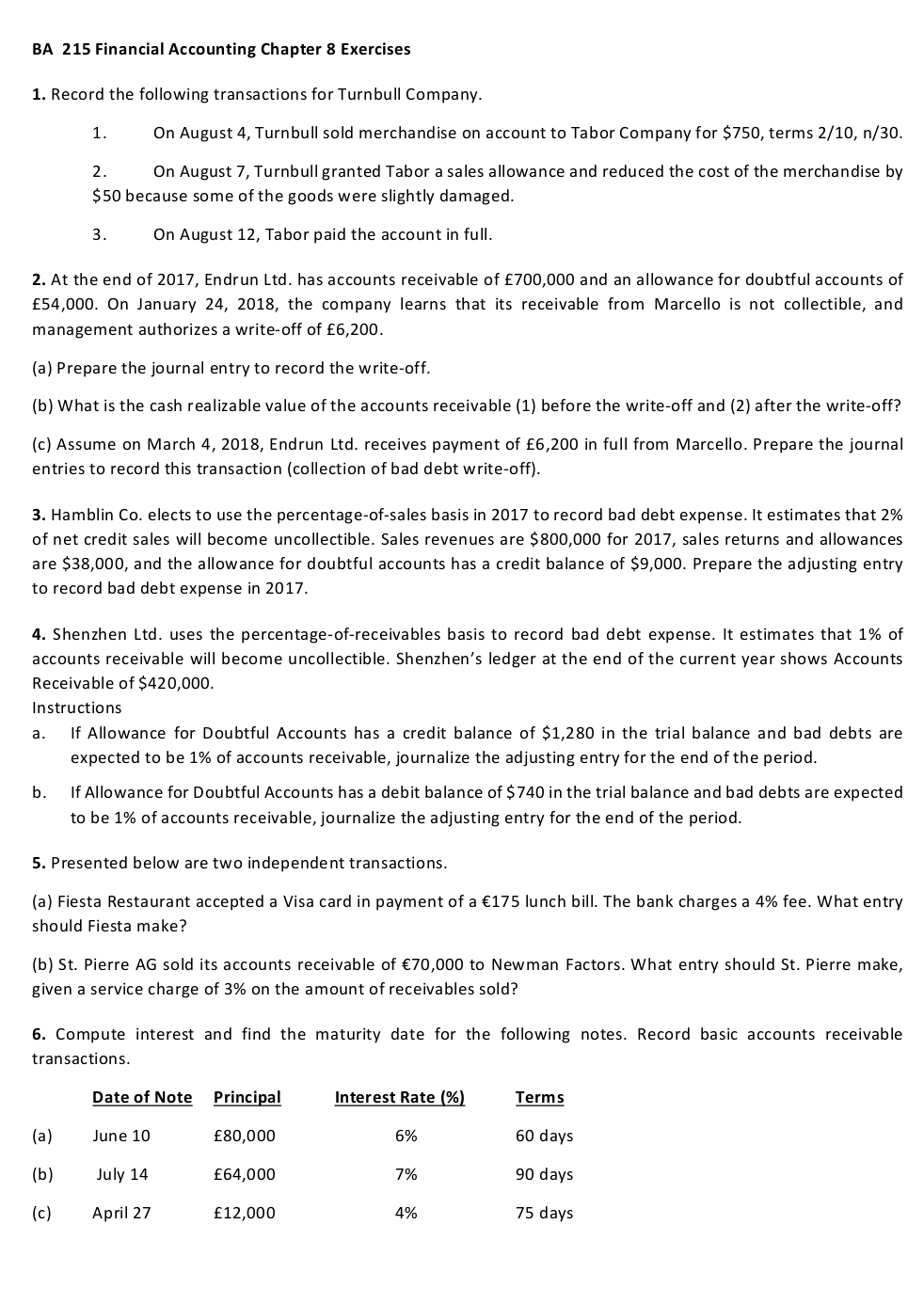

BA Financial Accounting Chapter Exercises

Record the following transactions for Turnbull Company.

On August Turnbull sold merchandise on account to Tabor Company for $ terms

On August Turnbull granted Tabor a sales allowance and reduced the cost of the merchandise by $ because some of the goods were slightly damaged.

On August Tabor paid the account in full.

At the end of Endrun Ltd has accounts receivable of and an allowance for doubtful accounts of On January the company learns that its receivable from Marcello is not collectible, and management authorizes a writeoff of

a Prepare the journal entry to record the writeoff.

b What is the cash realizable value of the accounts receivable before the writeoff and after the writeoff?

c Assume on March Endrun Ltd receives payment of in full from Marcello. Prepare the journal entries to record this transaction collection of bad debt writeoff

Hamblin Co elects to use the percentageofsales basis in to record bad debt expense. It estimates that of net credit sales will become uncollectible. Sales revenues are $ for sales returns and allowances are $ and the allowance for doubtful accounts has a credit balance of $ Prepare the adjusting entry to record bad debt expense in

Shenzhen Ltd uses the percentageofreceivables basis to record bad debt expense. It estimates that of accounts receivable will become uncollectible. Shenzhen's ledger at the end of the current year shows Accounts Receivable of $

Instructions

a If Allowance for Doubtful Accounts has a credit balance of $ in the trial balance and bad debts are expected to be of accounts receivable, journalize the adjusting entry for the end of the period.

b If Allowance for Doubtful Accounts has a debit balance of $ in the trial balance and bad debts are expected to be of accounts receivable, journalize the adjusting entry for the end of the period.

Presented below are two independent transactions.

a Fiesta Restaurant accepted a Visa card in payment of a lunch bill. The bank charges a fee. What entry should Fiesta make?

b St Pierre AG sold its accounts receivable of to Newman Factors. What entry should St Pierre make, given a service charge of on the amount of receivables sold?

Compute interest and find the maturity date for the following notes. Record basic accounts receivable transactions.

tableDate of Note,Principal,,Interest Rate TermsaJune daysbJuly dayscApril days,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock