Question: BA II plus calculation help. How would you do these problems on a BA II plus financial calculator? I can work them out long ways

BA II plus calculation help. How would you do these problems on a BA II plus financial calculator? I can work them out long ways but would prefer to save time on my exam.

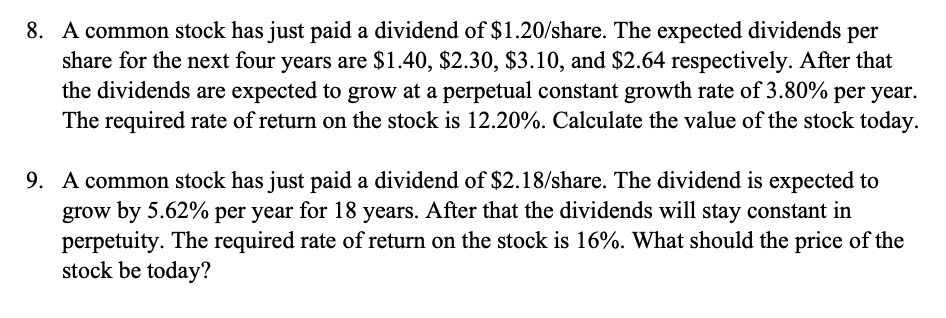

8. A common stock has just paid a dividend of $1.20/share. The expected dividends per share for the next four years are $1.40, $2.30, $3.10, and $2.64 respectively. After that the dividends are expected to grow at a perpetual constant growth rate of 3.80% per year. The required rate of return on the stock is 12.20%. Calculate the value of the stock today. 9. A common stock has just paid a dividend of $2.18/share. The dividend is expected to grow by 5.62% per year for 18 years. After that the dividends will stay constant in perpetuity. The required rate of return on the stock is 16%. What should the price of the stock be today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts