Question: BAAC 2203 Principles of Auditing - Case Studies Assignment Case No 2: A self-employed ACCA member prepares accounts on behalf of a small independent trader.

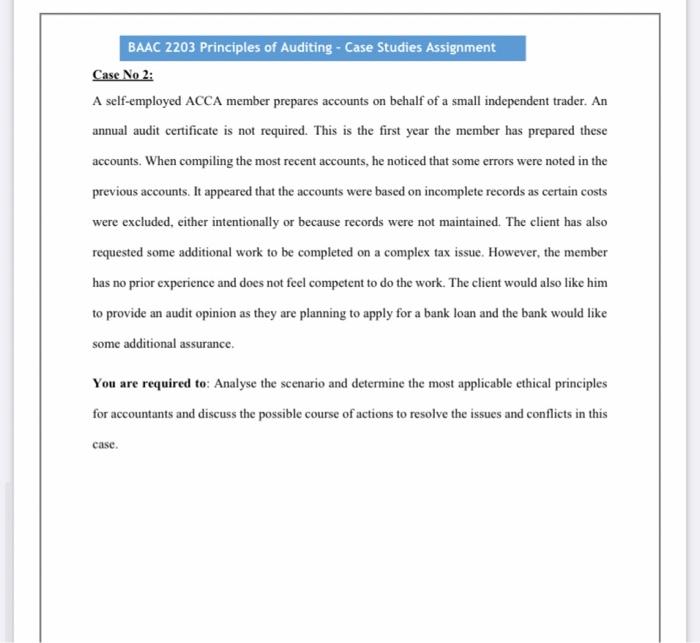

BAAC 2203 Principles of Auditing - Case Studies Assignment Case No 2: A self-employed ACCA member prepares accounts on behalf of a small independent trader. An annual audit certificate is not required. This is the first year the member has prepared these accounts. When compiling the most recent accounts, he noticed that some errors were noted in the previous accounts. It appeared that the accounts were based on incomplete records as certain costs were excluded, either intentionally or because records were not maintained. The client has also requested some additional work to be completed on a complex tax issue. However, the member has no prior experience and does not feel competent to do the work. The client would also like him to provide an audit opinion as they are planning to apply for a bank loan and the bank would like some additional assurance You are required to: Analyse the scenario and determine the most applicable ethical principles for accountants and discuss the possible course of actions to resolve the issues and conflicts in this case. BAAC 2203 Principles of Auditing - Case Studies Assignment Case No 2: A self-employed ACCA member prepares accounts on behalf of a small independent trader. An annual audit certificate is not required. This is the first year the member has prepared these accounts. When compiling the most recent accounts, he noticed that some errors were noted in the previous accounts. It appeared that the accounts were based on incomplete records as certain costs were excluded, either intentionally or because records were not maintained. The client has also requested some additional work to be completed on a complex tax issue. However, the member has no prior experience and does not feel competent to do the work. The client would also like him to provide an audit opinion as they are planning to apply for a bank loan and the bank would like some additional assurance You are required to: Analyse the scenario and determine the most applicable ethical principles for accountants and discuss the possible course of actions to resolve the issues and conflicts in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts