Question: BACC Assignment 2 Notes receivable( LO5) On December 31, 2018, white Company sold goods and accepted in exchange a promissory note with a face value

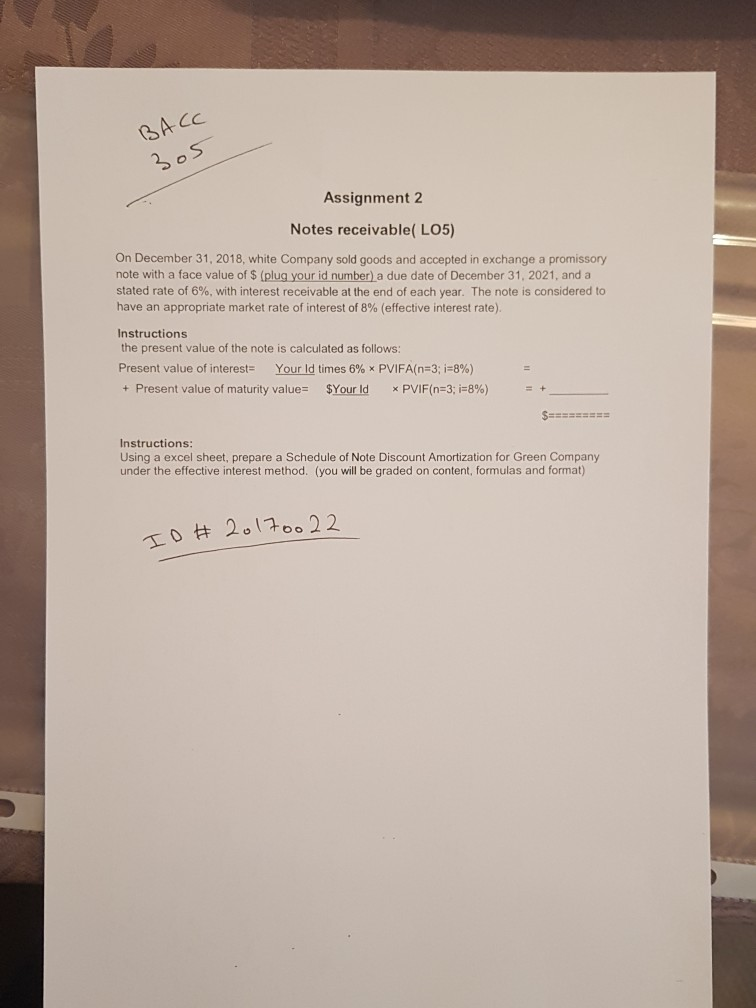

BACC Assignment 2 Notes receivable( LO5) On December 31, 2018, white Company sold goods and accepted in exchange a promissory note with a face value of $ (plug your id numberl a due date of December 31, 2021, and a stated rate of 6%, with interest receivable at the end of each year. The note is considered to have an appropriate market rate of interest of 8% (effective interest rate). Instructions the present value of the note is calculated as follows Present value of interest: Your ld times 6% , pVIFA(n-3-8%) + Present value of maturity value: $Yourld x PVIF(n-3 i-8%) Instructions Using a excel sheet, prepare a Schedule of Note Discount Amortization for Green Company under the effective interest method. (you will be graded on content, formulas and format)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts