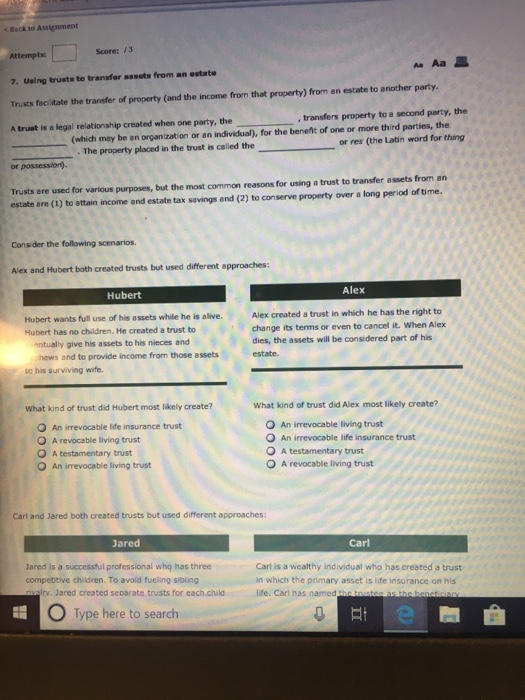

Question: Back to Assicnment Score: 13 Attempts: 7. Using trusts to transfer assets from an estate Trusts feci itate the transfer of property (and the income

Back to Assicnment Score: 13 Attempts: 7. Using trusts to transfer assets from an estate Trusts feci itate the transfer of property (and the income from that property) from an estate to enother party. A trust is a legal relationship created when one party, the Aa Aa , transfers property to a second party, the an organization or an individual), for the beneit of one or more third parties, the (which may be The property placed in the trust is called the or res (the Latin word for thing Trusts ere used for various purposes, but the most common reasons for using a trust to transfer assets from an estate are (1) to attain income and estate tax savings and (2) to conserve property over a long period of time. Consider the following scenarios Alex and Hubert both created trusts but used different approaches: Alex Hubert Hubert wants full use of his assets while he is alive. Hubert has no children. He created a trust to Alex created a trust in which he has the right to change its terms or even to cancel it. When Alex dies, the assets will be considered part of his estate entually give his assets to his nieces and hews and to provide income from those assets to his surviving wife. What kind of trust did Hubert most likely create? What kind of trust did Alex most likely create? O An irrevocable life insurance trust O A revocable living trust O A testamentary trust O An irrevocable living trust O An irrevocable living trust O An irrevocable life insurance trust O A testamentary trust OA revocable living trust Carl and Jared both created trusts but used different approaches: Jared Carl Jared is a successful professional who has three competitive children. To avoid fueling sibling Carl is a wealthy individual who has created a trust in which the primary asset is life insurance on his life. Carl has named Jared created separate trusts for each child O Type here to search Back to Assicnment Score: 13 Attempts: 7. Using trusts to transfer assets from an estate Trusts feci itate the transfer of property (and the income from that property) from an estate to enother party. A trust is a legal relationship created when one party, the Aa Aa , transfers property to a second party, the an organization or an individual), for the beneit of one or more third parties, the (which may be The property placed in the trust is called the or res (the Latin word for thing Trusts ere used for various purposes, but the most common reasons for using a trust to transfer assets from an estate are (1) to attain income and estate tax savings and (2) to conserve property over a long period of time. Consider the following scenarios Alex and Hubert both created trusts but used different approaches: Alex Hubert Hubert wants full use of his assets while he is alive. Hubert has no children. He created a trust to Alex created a trust in which he has the right to change its terms or even to cancel it. When Alex dies, the assets will be considered part of his estate entually give his assets to his nieces and hews and to provide income from those assets to his surviving wife. What kind of trust did Hubert most likely create? What kind of trust did Alex most likely create? O An irrevocable life insurance trust O A revocable living trust O A testamentary trust O An irrevocable living trust O An irrevocable living trust O An irrevocable life insurance trust O A testamentary trust OA revocable living trust Carl and Jared both created trusts but used different approaches: Jared Carl Jared is a successful professional who has three competitive children. To avoid fueling sibling Carl is a wealthy individual who has created a trust in which the primary asset is life insurance on his life. Carl has named Jared created separate trusts for each child O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts