Question: Back to Assignment Atrompts 2 . 4 Keep the Hikhest 2 . 4 / 6 4 . The multi - stage valuation model Consider the

Back to Assignment

Atrompts

Keep the Hikhest

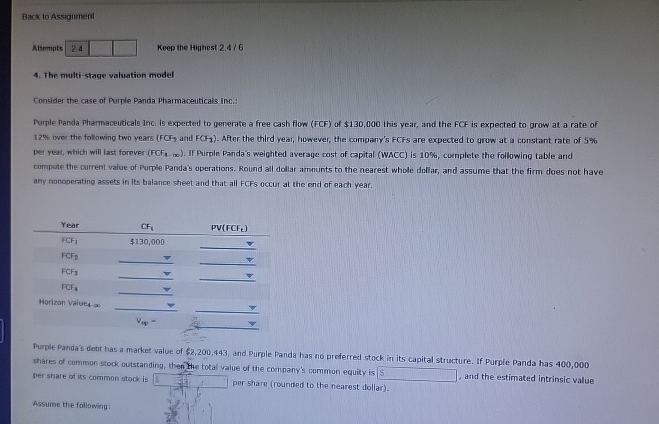

The multistage valuation model

Consider the case of Purple Panda Pharmaceuticals inc.:

Purple Panda phamaceuticals Inc is expected to generate a free cash flow FCF of $ this year, and the FCF is expected to orow at a rate of over the following two years FCF and FCF After the third year, however, the company's FCFs are expected to grow at a constant rate of per vear, which will last forpver FCF If Purple Panda's weighted average cost of capital WACC is complete the following table and compute the current value of Purple Panda's operations. Round all dollar armounts to the nearest whole dollar, and assume that the firm does not have any nonoperating assets in its balance sheet and that all FCFs occur at the end of each year.

tableYear

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock