Question: Back to Assignment Attemats: Average: 12 7. Calculating interest rates Tha real risk-free rate (ra) is 2.80% and is expected to remain constant into the

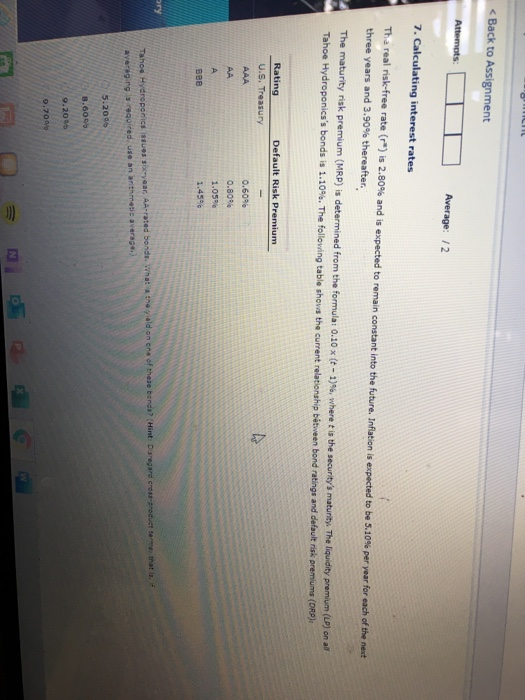

Back to Assignment Attemats: Average: 12 7. Calculating interest rates Tha real risk-free rate (ra) is 2.80% and is expected to remain constant into the future. Inflation is expected to be 5.10% per year for each of the next three years and 3.90% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.10 x (t-1)", where is the security's maturity. The liquidity premium (LP) on all Tahoe Hydroponics's bonds is 1.10%. The following table shows the current relationship between bond ratings and default risk premiums (DRD) Default Risk Premium Rating U.S. Treasury AAA 0.60% 0.80 AA A 1.05% 1.45 BBB sry Tahoe Hydroponics Issues byear. AA-rated bonds. What the yield on one of these bonda? (Hint: regard crostproduet tem that is averaging sired, use an arithmeticaverage) 5.2006 8.609 9.2016 0.709

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts