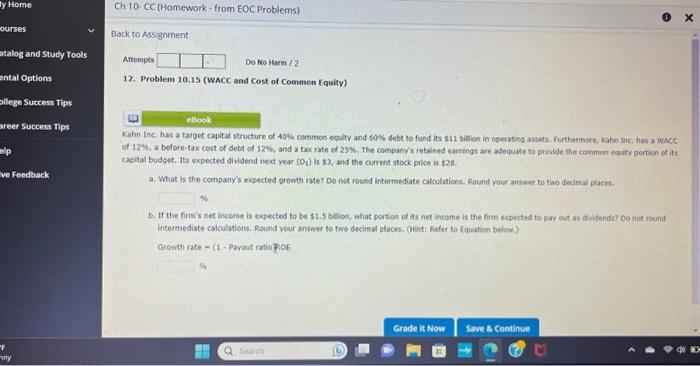

Question: Back to Assignment Attempt: 00 No Harm /2 12. Problem 10.1s (WACC and Cost of Commen Equity) allege success Tips areer Success Tips Kahn Inc.

Back to Assignment Attempt: 00 No Harm /2 12. Problem 10.1s (WACC and Cost of Commen Equity) allege success Tips areer Success Tips Kahn Inc. has a tarpet capital structure of 40% common ecuity and 60% debe to fund its sat bilion in operatieg assets. furthermore, kakn Inc. has a wace of 12\%, a before-tax cost of debt of 12%; and a tax rate of 25%. The company's retained eamings are adequate to provide the common nguty portion af its capital budget. Its expected dividend next year (D1) is 23 , and the current stock crice is 52l. a. What is the company's expected orowth ratet Do not round intermediate caloutations. Raund your answer to tino decimal places. b. If the fim's net income is expexted to be 51.5 bimion, shat portion of its net income is the firm expected to gay out as dividendi? bo not round Intermediate calculations. Round your ansmer to tho decimal elsces. (ient: Refer to Equation below.) Growth rate =1 - Pavout ratio RoE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts