Question: < Back to Assignment Attempts: 0 Keep the Highest: 0/11 4. Problem 8.07 (Portfolio Required Return) Suppose you are the money manager of a

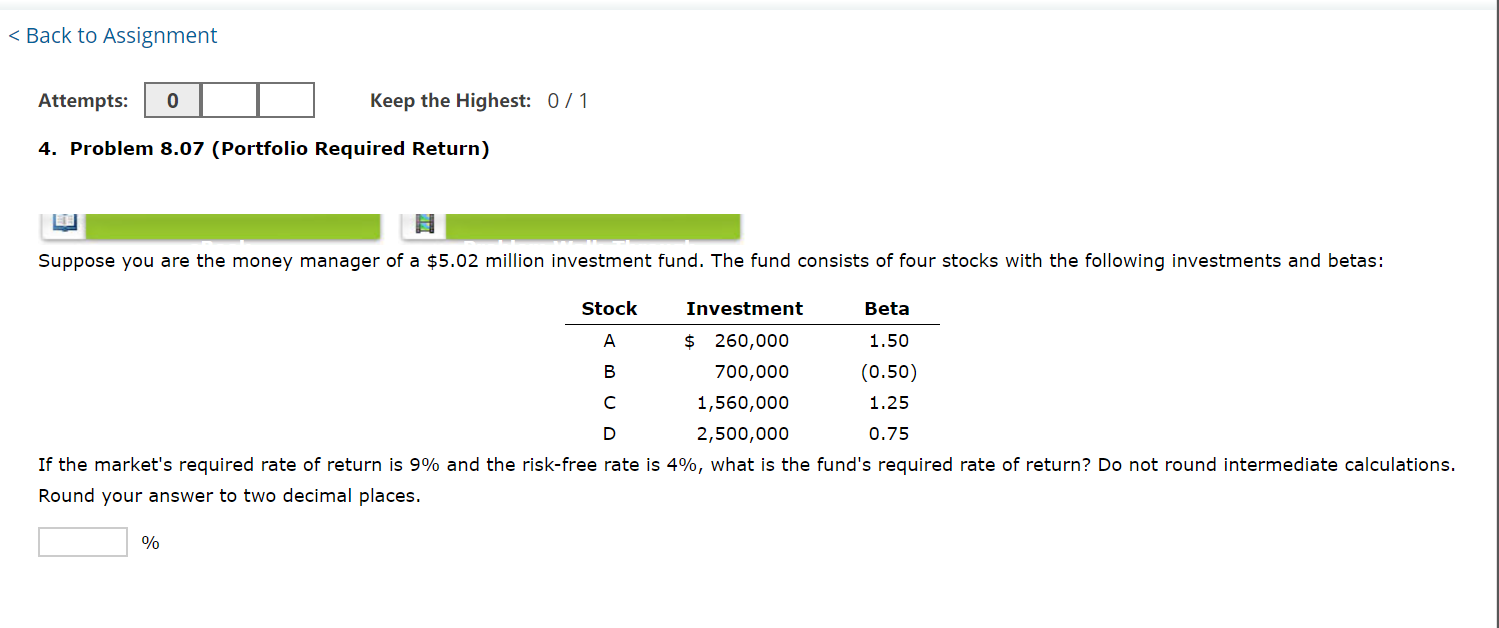

< Back to Assignment Attempts: 0 Keep the Highest: 0/11 4. Problem 8.07 (Portfolio Required Return) Suppose you are the money manager of a $5.02 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta A $ 260,000 1.50 B 700,000 (0.50) C D 1,560,000 2,500,000 1.25 0.75 If the market's required rate of return is 9% and the risk-free rate is 4%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts