Question: Back to Assignment Attempts: 0 Keep the Highest: 12 7. The cost of new common stock A firm will never have to take flotation costs

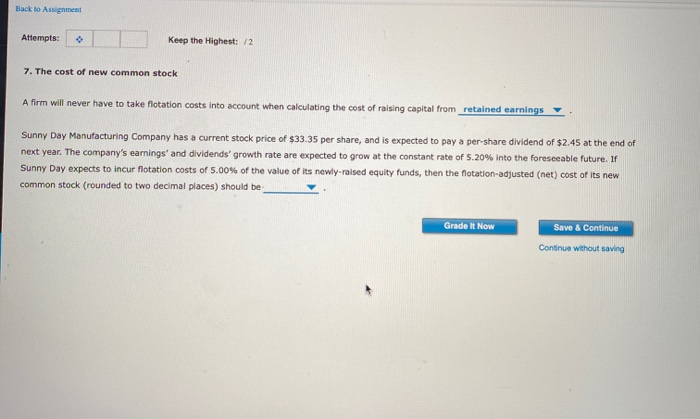

Back to Assignment Attempts: 0 Keep the Highest: 12 7. The cost of new common stock A firm will never have to take flotation costs into account when calculating the cost of raising capital from retained earnings Sunny Day Manufacturing Company has a current stock price of $33.35 per share, and is expected to pay a per-share dividend of $2.45 at the end of next year. The company's earnings and dividends' growth rate are expected to grow at the constant rate of 5.20% into the foreseeable future. If Sunny Day expects to incur flotation costs of 5.00% of the value of its newly-raised equity funds, then the notation-adjusted (net) cost of its new common stock (rounded to two decimal places) should be Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts