Question: Back to Assignment Attempts: Average: 3 9. Days sales outstanding Western Gas & Electric Co.'s CFO has decided to take a closer look at the

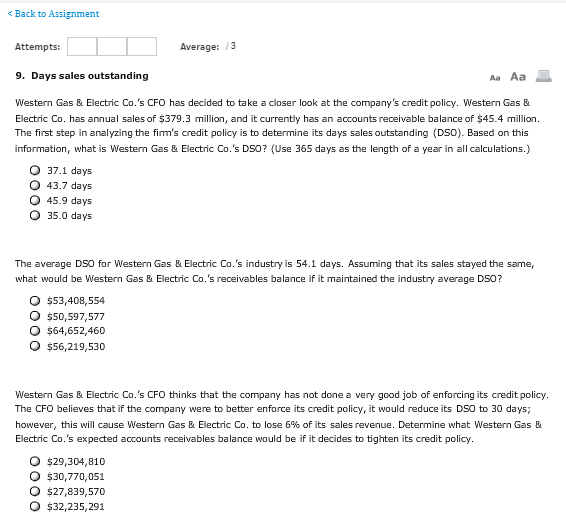

Back to Assignment Attempts: Average: 3 9. Days sales outstanding Western Gas & Electric Co.'s CFO has decided to take a closer look at the company's credit policy. Western Gas & Electric Co. has annual sales of $379.3 million, and it currently has an accounts receivable balance of $45.4 million. The first step in analyzing the firm's credit policy is to determine its days sales outstanding (DSO). Based on this information, what is Western Gas & Electric Co.'s DSO? (Use 365 days as the length of a year in all calculations.) O 37.1 days O 43.7 days O 45.9 days O 35.0 days The average DSO for Western Gas & Electric Co.'s industry is 54.1 days. Assuming that its sales stayed the same, what would be Western Gas & Electric Co.'s receivables balance if it maintained the industry average DS0? O $53,408,554 $50,597,577 O $64,652,460 O $56,219,530 Western Gas & Electric Co.'s CFO thinks that the company has not done a very good job of enforcing its credit policy The CFO believes that if the company were to better enforce its credit policy, it would reduce its DSO to 30 days however, this will cause western Gas & Electric Co. to lose 6% of its sales revenue. Determine what western Gas & Electric Co.'s expected accounts receivables balance would be if it decides to tighten its credit policy O $29,304,810 O $30,770,051 O $27,839,570 O $32,235,291

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts