Question: Back to Assignment Attempts Average: /4 7. Estimates, extensions, and amendments When are items due? Part of tax preparation and filing involves understanding when various

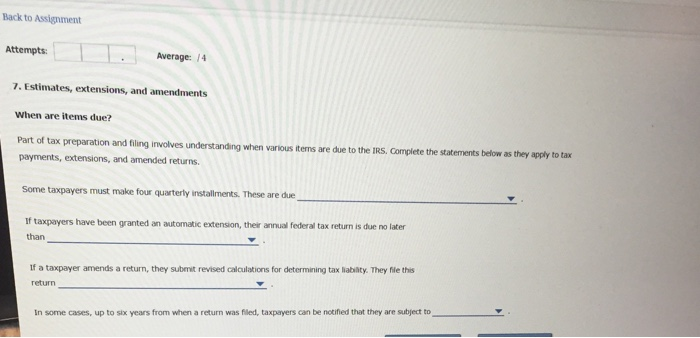

Back to Assignment Attempts Average: /4 7. Estimates, extensions, and amendments When are items due? Part of tax preparation and filing involves understanding when various items are due to the IRS. Complete the statements below as they apply to tax payments, extensions, and amended returns. Some taxpayers must make four quarterly installments. These are due If taxpayers have been granted an automatic extension, their annual federal tax return is due no later than If a taxpayer amends a return, they submit revised calculations for determining tax liabilty. They file this return In some cases, up to six years from when a return was filed, taxpayers can be notified that they are subject to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts