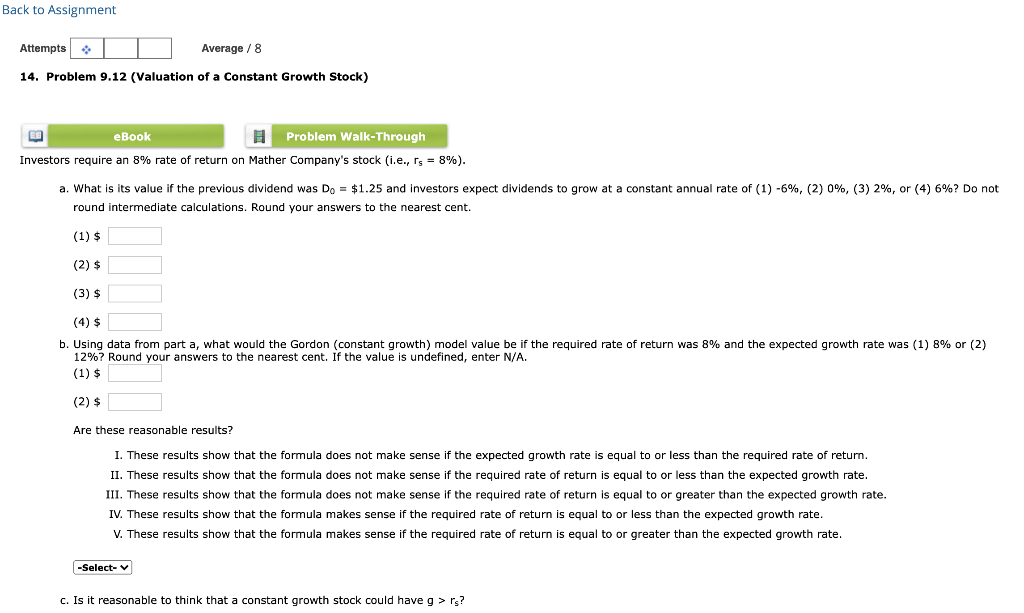

Question: Back to Assignment Attempts Average / 8 14. Problem 9.12 (Valuation of a Constant Growth Stock) eBook Problem Walk-Through Investors require an 8% rate of

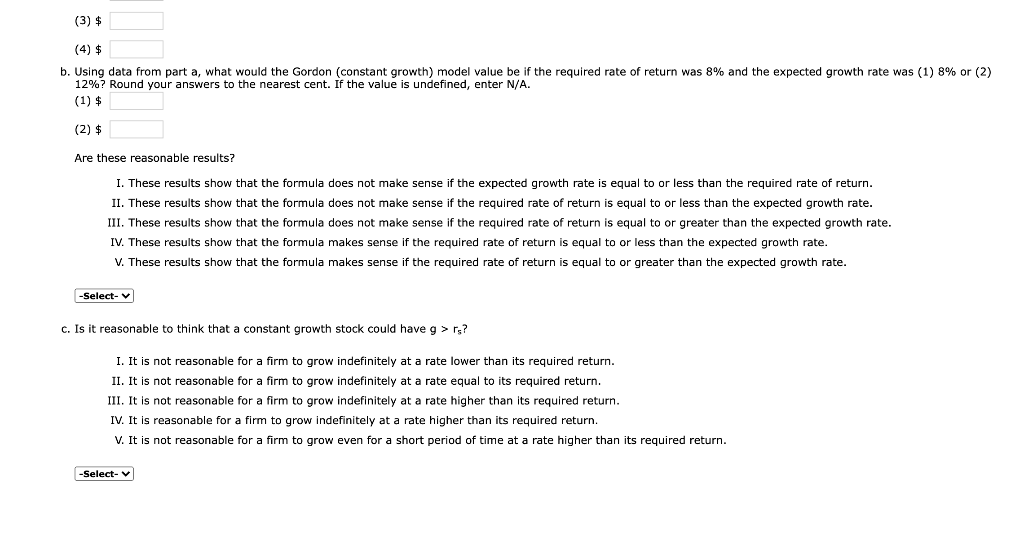

Back to Assignment Attempts Average / 8 14. Problem 9.12 (Valuation of a Constant Growth Stock) eBook Problem Walk-Through Investors require an 8% rate of return on Mather Company's stock (i.e., rs = 8%). a. What is its value if the previous dividend was Do = $1.25 and investors expect dividends to grow at a constant annual rate of (1) -6%, (2) 0%, (3) 2%, or (4) 6%? Do not round intermediate calculations. Round your answers to the nearest cent. (1) $ (2) $ (3) $ (4) $ b. Using data from part a, what would the Gordon (constant growth) model value be if the required rate of return was 8% and the expected growth rate was (1) 8% or (2) 12%? Round your answers to the nearest cent. If the value is undefined, enter N/A. (1) $ (2) $ Are these reasonable results? I. These results show that the formula does not make sense if t expected growth rate is equal to or less than the required rate of return. II. These results show that the formula does not make sense if the required rate of return is equal to or less than the expected growth rate. III. These results show that the formula does not make sense if the required rate of return is equal to or greater than the expected growth rate. IV. These results show that the formula makes sense if the required rate of return is equal to or less than the expected growth rate. V. These results show that the formula makes sense if the required rate of return is equal to or greater than the expected growth rate. -Select- c. Is it reasonable to think that a constant growth stock could have g > rs? (3) $ b. Using data from part a, what would the Gordon (constant growth) model value be if the required rate of return was 8% and the expected growth rate was (1) 8% or (2) 12%? Round your answers to the nearest cent. If the value is undefined, enter N/A. (1) $ (2) $ Are these reasonable results? I. These results show that the formula does not make sense if the expected growth rate is equal to or less than the required rate of return. II. These results show that the formula does not make sense if the required rate of return is equal to or less than the expected growth rate. III. These results show that the formula does not make sense if the required rate of return is equal to or greater than the expected growth rate. IV. These results show that the formula makes sense if the required rate of return is equal to or less than the expected growth rate. V. These results show that the formula makes sense if the required rate of return is equal to or greater than the expected growth rate. -Select- c. Is it reasonable to think that a constant growth stock could have g > rs? I. It is not reasonable for a firm to grow indefinitely at a rate lower than its required return. II. It is not reasonable for a firm to grow indefinitely at a rate equal to its required return. III. It is not reasonable for a firm to grow indefinitely at a rate higher than its required return. IV. It is reasonable for a firm to grow indefinitely at a rate higher than its required return. V. It is not reasonable for a firm to grow even for a short period of time at a rate higher than its required return. -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts