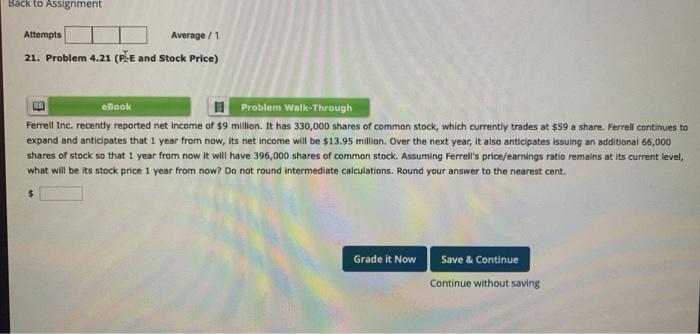

Question: Back to Assignment Attempts Average/1 21. Problem 4.21 (PL-E and Stock Price) eBook Problem Walk-Through Ferrell Inc. recently reported net income of $9 million. It

Back to Assignment Attempts Average/1 21. Problem 4.21 (PL-E and Stock Price) eBook Problem Walk-Through Ferrell Inc. recently reported net income of $9 million. It has 330,000 shares of common stock, which currently trades at $59 a share. Ferrell continues to expand and anticipates that 1 year from now, its net income will be $13.95 million. Over the next year, it also anticipates issuing an additional 66,000 shares of stock so that 1 year from now it will have 396,000 shares of common stock. Assuming Ferrell's price/earnings ratio remains at its current level, what will be its stock price 1 year from now? Do not round intermediate calculations. Round your answer to the nearest cent. $ Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts