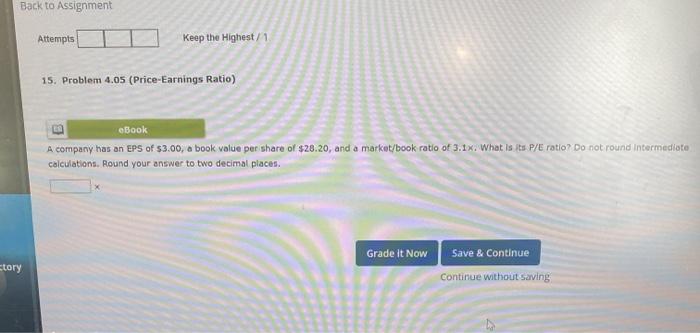

Question: Back to Assignment Attempts Keep the Highest / 1 15. Problem 4.05 (Price-Earnings Ratio) eBook A company has an EPS of 3.00, a book value

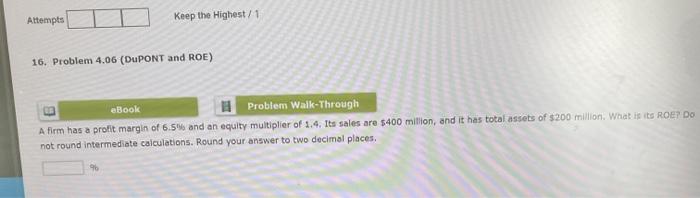

Back to Assignment Attempts Keep the Highest / 1 15. Problem 4.05 (Price-Earnings Ratio) eBook A company has an EPS of 3.00, a book value per share of $28.20, and a market/book ratio of 3.1%. What is its P/E ratlo? Do not round Intermediate calculations. Round your answer to two decimal places. Grade It Now Save & Continue story Continue without saving Attempts Keep the Highest / 1 16. Problem 4.06 (DUPONT and ROE) eBook Problem Walk-Through A firm has a profit margin of 6.5% and an equity multiplier of 1.4. Its sales are $400 million, and it has total assets of $200 million. What is its ROET DO not round intermediate calculations. Round your answer to two decimal places 90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts