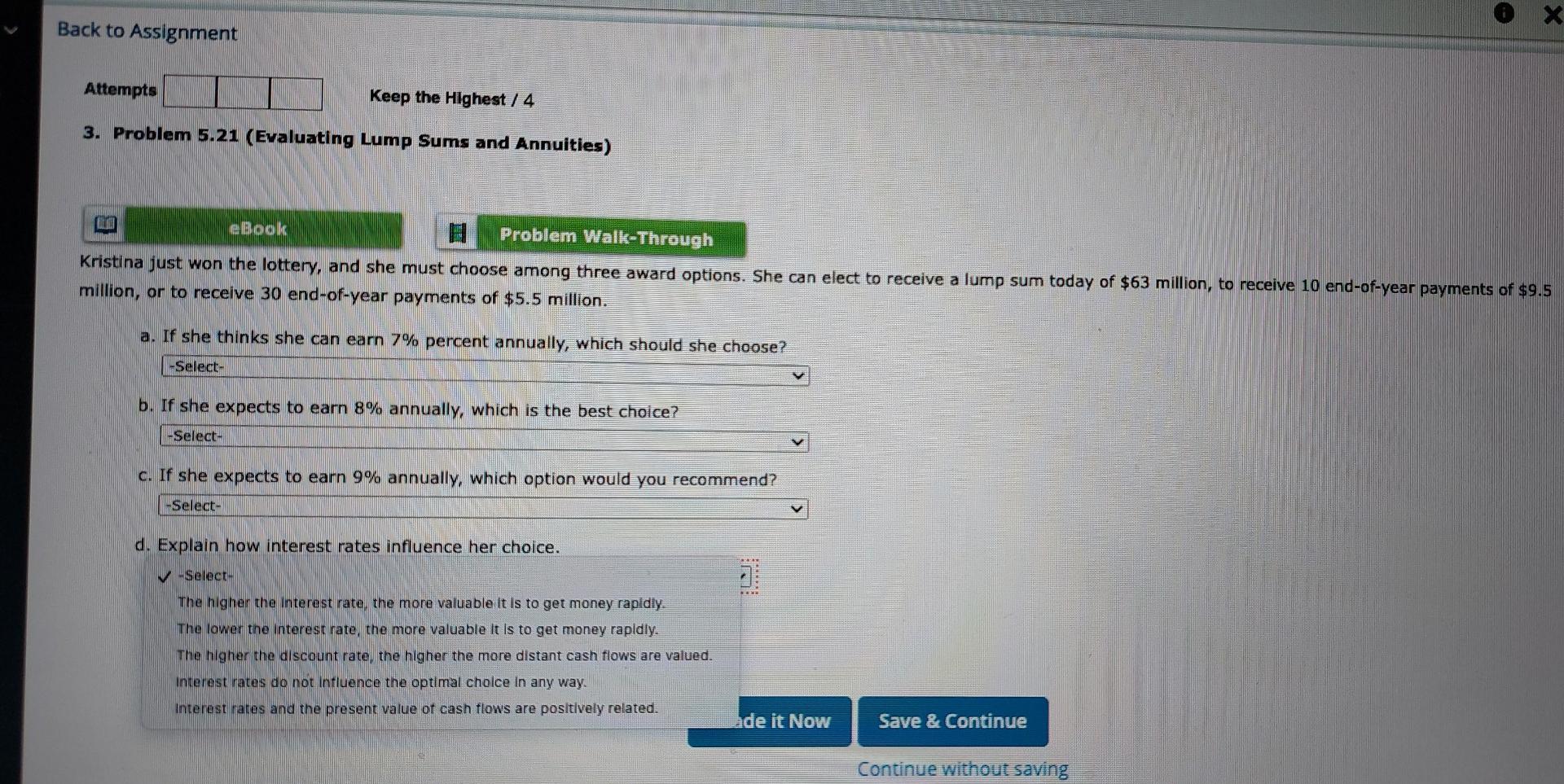

Question: Back to Assignment Attempts Keep the Highest 1 4 3. Problem 5.21 (Evaluating Lump Sums and Annuities) eBOOK Problem Walk-Through Kristina just won the lottery,

Back to Assignment Attempts Keep the Highest 1 4 3. Problem 5.21 (Evaluating Lump Sums and Annuities) eBOOK Problem Walk-Through Kristina just won the lottery, and she must choose among three award options. She can elect to receive a lump sum today of $63 million, to receive 10 end-of-year payments of $9.5 million, or to receive 30 end-of-year payments of $5.5 million. a. If she thinks she can earn 7% percent annually, which should she choose? -Select- b. If she expects to earn 8% annually, which is the best choice? -Select- c. If she expects to earn 9% annually, which option would you recommend? -Select- d. Explain how interest rates influence her choice. -Select- The higher the interest rate, the more valuable it is to get money rapidly. The lower the interest rate, the more valuable it is to get money rapidly. The higher the discount rate, the higher the more distant cash flows are valued. Interest rates do not influence the optimal choice in any way. Interest rates and the present value of cash flows are positively related. ade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts