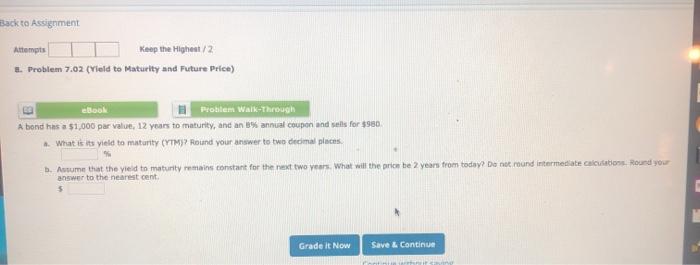

Question: Back to Assignment Attempts Keep the Highest /2 3. Problem 7.02 (Yield to Maturity and Future Price) eBook Problem Walk-Through A bond has a $1,000

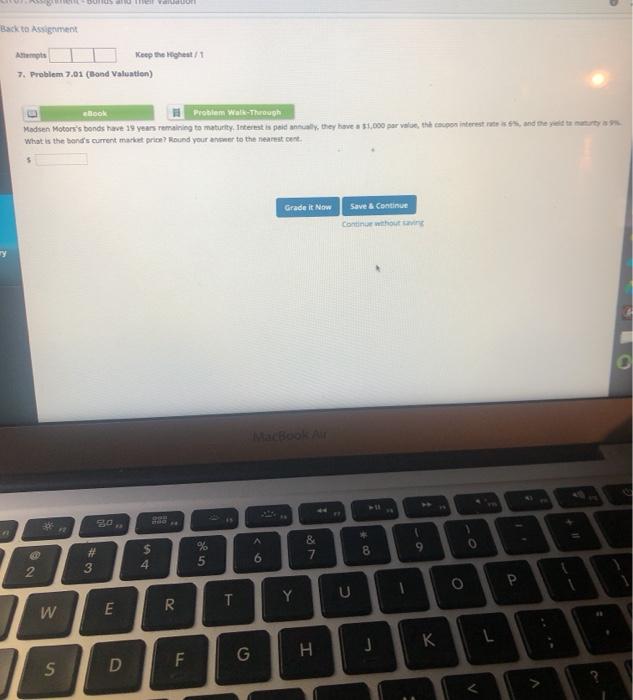

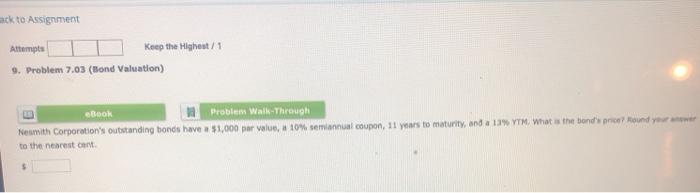

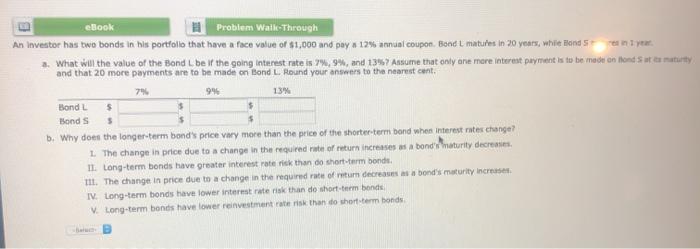

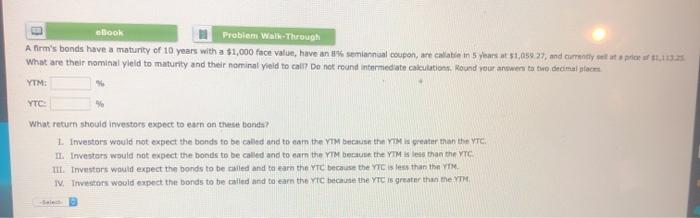

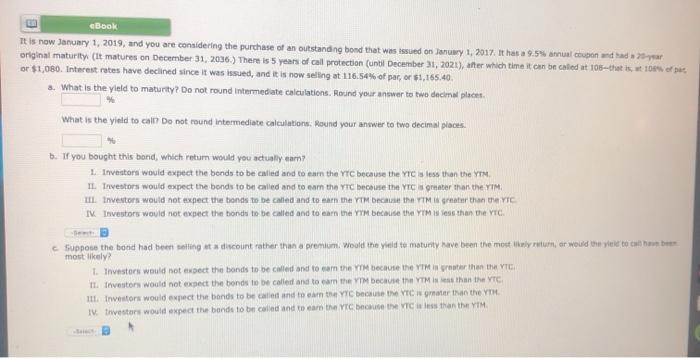

Back to Assignment Attempts Keep the Highest /2 3. Problem 7.02 (Yield to Maturity and Future Price) eBook Problem Walk-Through A bond has a $1,000 par value, 12 years to maturity, and an 8% annual coupon and sells for $980. What is its yield to maturity (YTM)? Round your answer to two decimal places b. Anume that the yield to maturity remains constant for the next two years. What will the price be 2 years from today? Dentround intermediate calcio Round you answer to the nearest cent Grade it Now Save Continue ack to Assignment Attempts Keep the Highest / 1 9. Problem 7.03 (Bond Valuation) BOOK Problem Walk Through Nesmith Corporation's outstanding bonds have a $1,000 par value, a 10% semiannual coupon, 11 years to maturity, and a 13% YM. What is the band's price? Round your to the nearestat eBook Problem Wall-Through An Investor has two bonds in his portfolio that have a face value of $1,000 and pay 12% annual coupon Bond L maturins in 20 years, while Fonds 2. What will the value of the Bond be if the going interest rate is 7%, 9% and 13% Assume that only one more interest payment is to be made on Honda maturity and that 20 more payments are to be made on Bond L. Round your answers to the nearest cent 996 13% Bond L $ Bonds b. Why does the longer term bond price vary more than the price of the shorter term bond when interest rates change? L The change in price due to a change in the required rate of return increases as a bond maturity decreases II. Long-term bonds have greater interest rate risk than do short-term bonde TII. The change in price due to a change in the required rate of turn decreases as a bond maturity increase IV. Long-term bonds have lower interest rate risk than do short-term bonds V. Long-term bonds have lower reinvestment rate risk than do short-term bonds E B ebook Problem Walk-Through A firm's bonds have a maturity of 10 years with a $1,000 face value, have an 8% semiannual coupon, are collabe in 5 years at $1,050.27, and currently pro 12,113 What are their nominal yield to maturity and their nominal yield to call? Do not round intermediate calculations. Round your answer to two decimal places YTM YTC What return should investors expect to earn on these bonds? Investors would not expect the bonds to be called and to eam the YTM because they greater than the YTC. IL Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the VTC TIL Investors would expect the bonds to be called and to earn the YC because the YC is less than the YTM 1. Investors would expect the bonds to be called and to earn the YTchecause the YTC is greater than the YTM eBook It is now January 1, 2019, and you are considering the purchase of an outstanding bond that was issued on January 1, 2017. It has 9.5% anual cupon and had a 20- original maturity (It matures on December 31, 2036) There is 5 years of all protection (until December 31, 2021), after which time it can be called at 10--that is, of or $1,080. Interest rates have declined since it was issued, and it is now seling at 116.54% of par, or $1,165.40. 2. What is the yield to maturity? Do not round Intermediate calculations. Round your answer to two decimal places What is the yield to call Do not round Intermediate calculations, Round your answer to two decimal places. b. If you bought this bond, which retum would you adually cam? 1. Investors would expect the bonds to be called and to earn the YTC because they less than the YTM IL Investors would expect the bonds to be called and to earn the YTC because the YCrater than the YTM TIL Investors would not expect the bonds to be called and to earn the YTM Because this greater than the IC IV Investors would not expect the hands to be called and to earn the YTM because the YTM Sess than the YC Suppose the hond had been selling at a discount rather than a premium. Wool the yield to maturity have been the mostly rum, or would the yield to cha most likely L Investors would not expect the bonds to be called and to earn the YTH because the Year than the YC 1. Investors would not expect the bonds to be called and to the VTM because theYTM than the VTC Investors would expect the bonds to be called and to the YTC De VC mater in theYTH IV. Investors would expect the bands to be called and to earn the YCbce VTC than the YTM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts