Question: Back to Assignment Attempts Keep the Highest / 3 3. Portfolio expected return and risk A collection of financial assets and securities is referred to

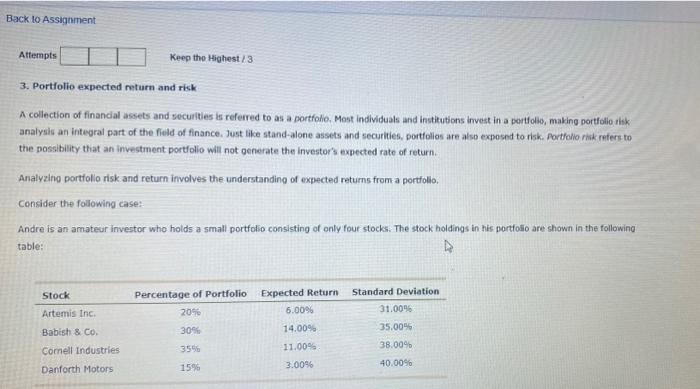

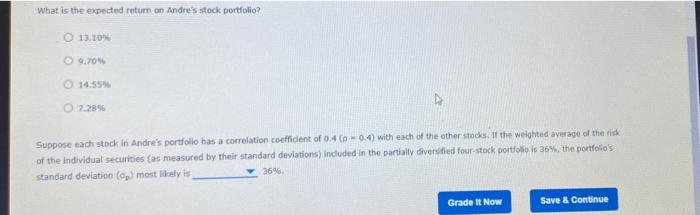

Back to Assignment Attempts Keep the Highest / 3 3. Portfolio expected return and risk A collection of financial assets and securities is referred to as a portfolio, Most individuals and institutions invest in a portfolio, making portfolio vlak analysis an integral part of the field of finance. Just like stand-alone assets and securities, portfolios are also exposed to risk. Portfolio risk refers to the possibility that an investment portfolio will not generate the Investor's expected rate of return. Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio, Consider the following case: Andre is an amateur investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the following table: Stock Percentage of Portfolio 20% Expected Return 6.00% Artemis Inc 30% Babish & Co. Comell Industries 14.00% 11.00% Standard Deviation 31.00% 35.00% 38.00% 40.00% 3596 Danforth Motors 1596 3.00% What is the expected return on Andres stock portfolio? 13.10 O 9.70 14.55 0.72896 Suppose each stock in Andre's portfolio has a correlation coefficient of 0.4-0.4) with each of the other stocks of the weighted average of the risk of the individual securities (as measured by their standard deviations included in the partially diversified four-stock portfolio is 36%, the portfolio's standard deviation () most likely is 36% Grade It Now Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts