Question: Back to Assignment Attempts: Keep the Highest: 75 3. Debt safety ratio - How much credit can you stand? To maintain financial stability, people should

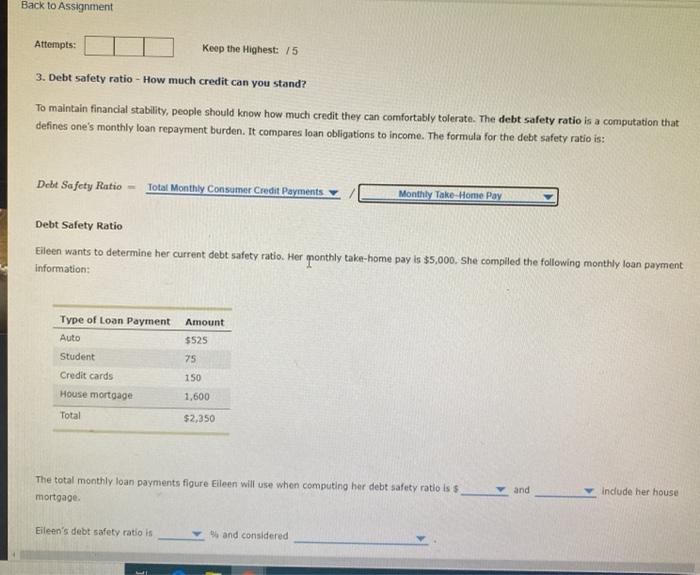

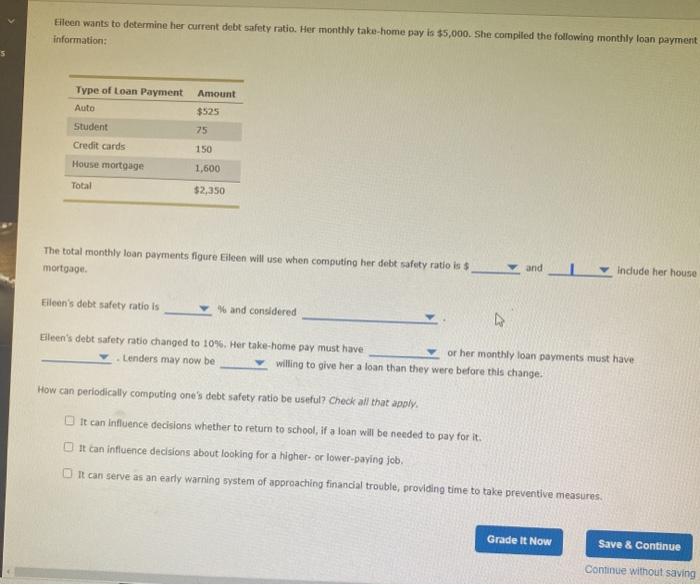

Back to Assignment Attempts: Keep the Highest: 75 3. Debt safety ratio - How much credit can you stand? To maintain financial stability, people should know how much credit they can comfortably tolerate. The debt safety ratio is a computation that defines one's monthly loan repayment burden. It compares loan obligations to income. The formula for the debt safety ratio is: Debt Safety Ratio - Total Monthly Consumer Credit Payments Monthly Take Home Pay Debt Safety Ratio Eileen wants to determine her current debt safety ratio. Her monthly take-home pay is $5,000. She compiled the following monthly loan payment Information: Type of Loan Payment Auto Student Credit cards House mortgage Amount $525 75 150 1,600 Total $2,350 The total monthly loan payments figure Eileen will use when computing her debt safety ratio is $ mortgage Y and include her house Eileen's debt safety ratio is and considered Eileen wants to determine her current debt safety ratio. Her monthly take-home pay is $5,000. She compiled the following monthly loan payment information: 5 Type of Loan Payment Auto Amount $525 Student 75 150 Credit cards House mortgage 1,600 Total $2,350 The total monthly loan payments figure Eileen will use when computing her debt safety ratio is $ mortgage andL Indude her house Eileen's debt safety ratio is % and considered Elleen's debt safety ratio changed to 10%. Her take-home pay must have or her monthly loan payments must have Lenders may now be willing to give her a loan than they were before this change. How can periodically computing one's debe safety ratio be useful? Check all that apply. It can influence decisions whether to return to school, if a loan will be needed to pay for it. It can influence decisions about looking for a higher or lower-paying job. Ont can serve as an early warning system of approaching financial trouble, providing time to take preventive measures Grade It Now Save & Continue Continue without saving Back to Assignment Attempts: Keep the Highest: 75 3. Debt safety ratio - How much credit can you stand? To maintain financial stability, people should know how much credit they can comfortably tolerate. The debt safety ratio is a computation that defines one's monthly loan repayment burden. It compares loan obligations to income. The formula for the debt safety ratio is: Debt Safety Ratio - Total Monthly Consumer Credit Payments Monthly Take Home Pay Debt Safety Ratio Eileen wants to determine her current debt safety ratio. Her monthly take-home pay is $5,000. She compiled the following monthly loan payment Information: Type of Loan Payment Auto Student Credit cards House mortgage Amount $525 75 150 1,600 Total $2,350 The total monthly loan payments figure Eileen will use when computing her debt safety ratio is $ mortgage Y and include her house Eileen's debt safety ratio is and considered Eileen wants to determine her current debt safety ratio. Her monthly take-home pay is $5,000. She compiled the following monthly loan payment information: 5 Type of Loan Payment Auto Amount $525 Student 75 150 Credit cards House mortgage 1,600 Total $2,350 The total monthly loan payments figure Eileen will use when computing her debt safety ratio is $ mortgage andL Indude her house Eileen's debt safety ratio is % and considered Elleen's debt safety ratio changed to 10%. Her take-home pay must have or her monthly loan payments must have Lenders may now be willing to give her a loan than they were before this change. How can periodically computing one's debe safety ratio be useful? Check all that apply. It can influence decisions whether to return to school, if a loan will be needed to pay for it. It can influence decisions about looking for a higher or lower-paying job. Ont can serve as an early warning system of approaching financial trouble, providing time to take preventive measures Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts