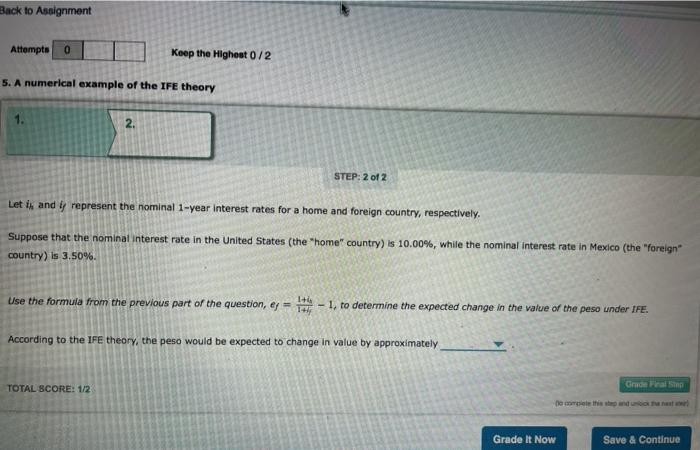

Question: Back to Assignment Attempts o Keep the Highest 0/2 5. A numerical example of the IFE theory 1. 2. STEP: 2 of 2 Let is

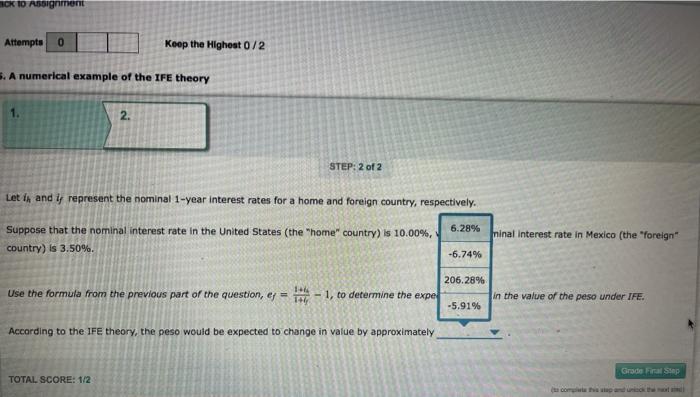

Back to Assignment Attempts o Keep the Highest 0/2 5. A numerical example of the IFE theory 1. 2. STEP: 2 of 2 Let is and y represent the nominal 1-year interest rates for a home and foreign country, respectively. Suppose that the nominal interest rate in the United States (the "home" country) is 10.00%, while the nominal interest rate in Mexico (the "foreign country) is 3.50%. Use the formula from the previous part of the question, ey - - 1. to determine the expected change in the value of the peso under IFE. According to the IFE theory, the peso would be expected to change in value by approximately TOTAL SCORE: 1/2 Grade Firal Step Demet Grade It Now Save & Continue 1 1 Assignment Attempts 0 Keep the Highest 0/2 s. A numerical example of the IFE theory 1. 2. STEP: 2 of 2 Let I. and ly represent the nominal 1-year interest rates for a home and foreign country, respectively. the United States (the "home" country) is 10.00%, 6.28% Suppose that the nominal Interest rate country) is 3.50%. minal Interest rate in Mexico (the "foreign -6.74% 206.28% Use the formula from the previous part of the question, e = 1 - 1, to determine the expel in the value of the peso under IFE. -5.91% According to the IFE theory, the peso would be expected to change in value by approximately Grade First Step TOTAL SCORE: 1/2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts