Question: BACKGROUND An investor is interested in purchasing a multi - tenant industrial building in Portland, OR which has an asking price of (

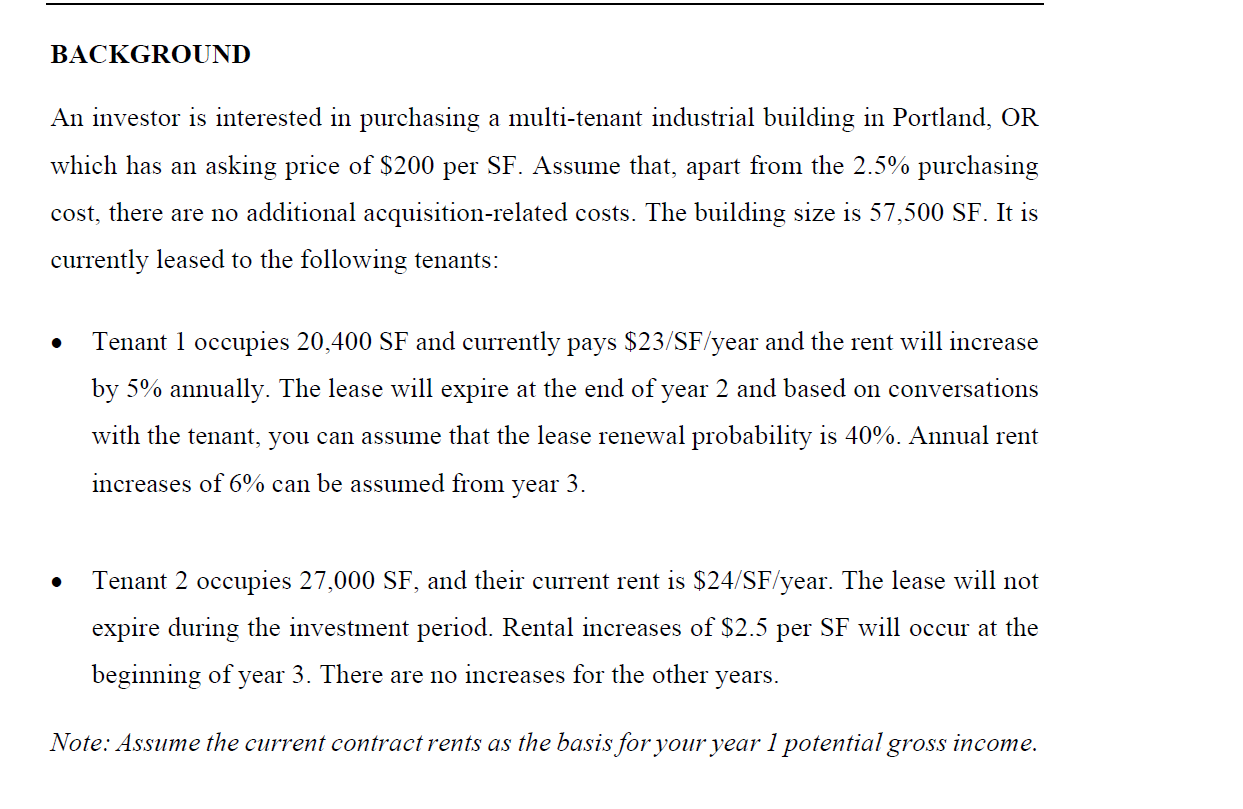

BACKGROUND

An investor is interested in purchasing a multitenant industrial building in Portland, OR which has an asking price of $ per SF Assume that, apart from the purchasing cost, there are no additional acquisitionrelated costs. The building size is mathrmSF It is currently leased to the following tenants:

Tenant occupies mathrmSF and currently pays $ mathrmSF year and the rent will increase by annually. The lease will expire at the end of year and based on conversations with the tenant, you can assume that the lease renewal probability is Annual rent increases of can be assumed from year

Tenant occupies mathrmSF and their current rent is $ mathrmSF year. The lease will not expire during the investment period. Rental increases of $ per SF will occur at the beginning of year There are no increases for the other years.

Note: Assume the current contract rents as the basis for your year potential gross income.

Real Estate Investment

The vacancy and collection losses for all the years are assumed to be of the potential gross income each year. The average market rent for industrial is currently $ mathrmSFmathrmyear and it is forecasted to increase at each year for the subsequent years. Renewing tenants receive a $ mathrmSF discount to the market rental rate.

The landlord covers of the operating expenses. Operating expenses are $ mathrmSF year in year and are expected to increase by each year expense inflation No capital expenses are assumed, and no tenant improvements and leasing commissions are incurred for new or renewing tenants.

Assume that the building is bought in January and sold in December ie the investor expects to hold the building for years. The building is depreciated over years and the value of improvements building is considered to be of the purchasing price.

The property is financed with a year mortgage at compounded monthly with a loantovalue ratio LTV of No financing costs eg origination fees or discount points occur. Assume a goingout cap rate of and an income tax of

Real Estate Investment

The potential gross income and rent calculations for all years; the implied market rent calculation; The vacancy and collection losses for years and ; the effective gross income for years and ; the operating expenses for years and ; the net operating income for years and ; the debt service in years and ; the before tax cash flow in year ; the depreciation for all the years; the interest calculation for all the years; the taxable income and tax for years and ; the aftertax cash flow for year ; the sales price and the mortgage balance after three years.

Use the Excel investment proforma outline provided for this project. You only have to explain and show the calculations for the amounts in the cells that are not blue.

The project will be graded using the grading guidelines for this project. Upload the Zoom link to your presentation. Do not use Google Drive or YouTube. Your camera should be on for the presentation. You do not have to submit your Excel file, only the link to your presentation in Zoom.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock