Question: BACKGROUND: Improperly counting or recording inventory transactions can result in material financial statement errors. REQUIRED: Barnett Manufacturing uses the periodic method to account for its

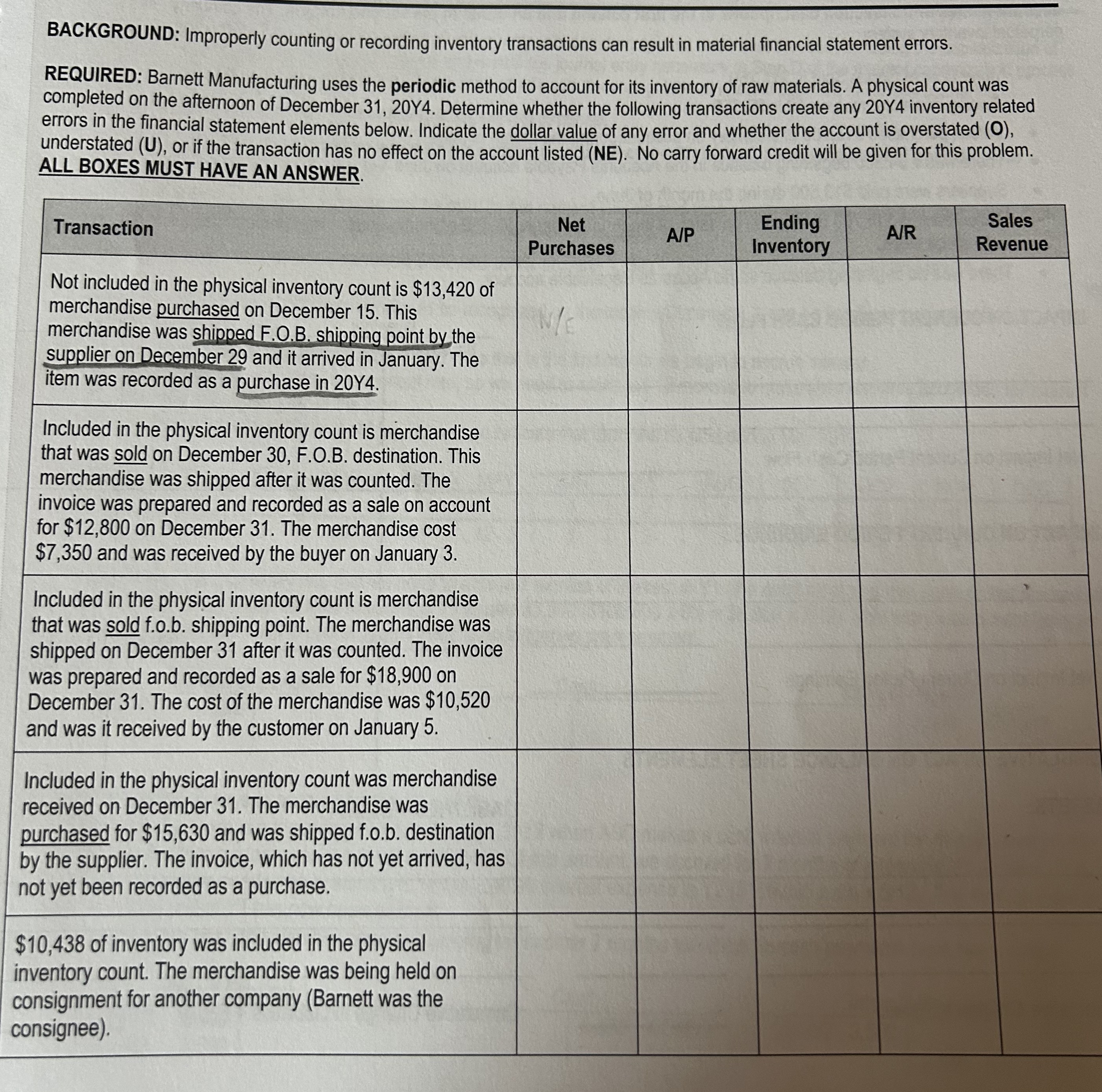

BACKGROUND: Improperly counting or recording inventory transactions can result in material financial statement errors.

REQUIRED: Barnett Manufacturing uses the periodic method to account for its inventory of raw materials. A physical count was completed on the afternoon of December Y Determine whether the following transactions create any Y inventory related errors in the financial statement elements below. Indicate the dollar value of any error and whether the account is overstated O understated U or if the transaction has no effect on the account listed NE No carry forward credit will be given for this problem.

ALL BOXES MUST HAVE AN ANSWER.

tableTransactiontableNetPurchasesAPEnding Inventory,ARSales RevenueNot included in the physical inventory count is $ of merchandise purchased on December This merchandise was shipped FOB shipping point by the supplier on December and it arrived in January. The item was recorded as a purchase in Y Included in the physical inventory count is merchandise that was sold on December FOB destination. This merchandise was shipped after it was counted. The invoice was prepared and recorded as a sale on account for $ on December The merchandise cost $ and was received by the buyer on January Included in the physical inventory count is merchandise that was sold fob shipping point. The merchandise was shipped on December after it was counted. The invoice was prepared and recorded as a sale for $ on December The cost of the merchandise was $ and was it received by the customer on January Included in the physical inventory count was merchandise received on December The merchandise was purchased for $ and was shipped fob destination by the supplier. The invoice, which has not yet arrived, has not yet been recorded as a purchase.,,,,,$ of inventory was included in the physical inventory count. The merchandise was being held on consignment for another company Barnett was the consignee

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock