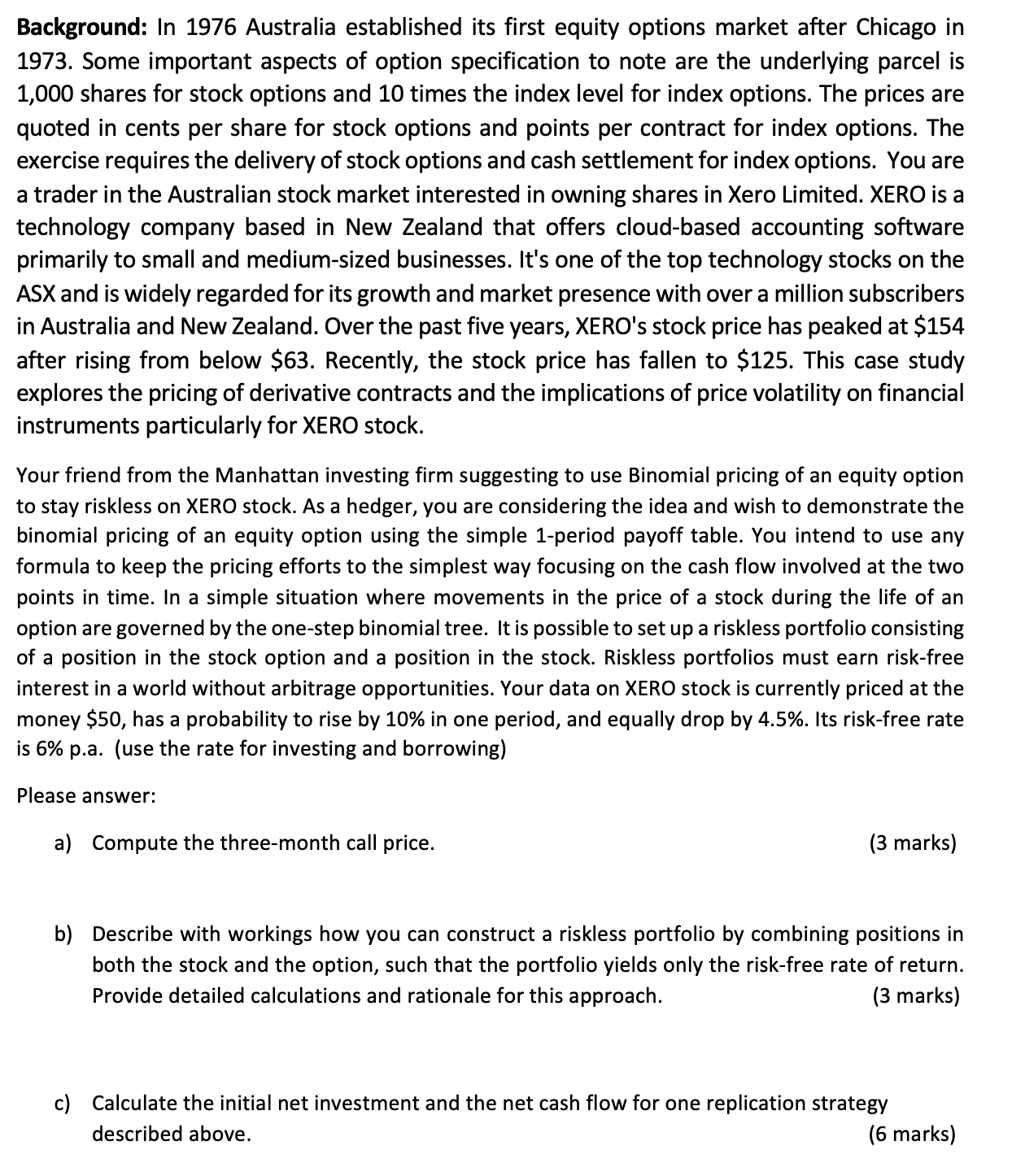

Question: Background: In 1 9 7 6 Australia established its first equity options market after Chicago in Some important aspects of option specification to note are

Background: In Australia established its first equity options market after Chicago in

Some important aspects of option specification to note are the underlying parcel is

shares for stock options and times the index level for index options. The prices are

quoted in cents per share for stock options and points per contract for index options. The

exercise requires the delivery of stock options and cash settlement for index options. You are

a trader in the Australian stock market interested in owning shares in Xero Limited. XERO is a

technology company based in New Zealand that offers cloudbased accounting software

primarily to small and mediumsized businesses. It's one of the top technology stocks on the

ASX and is widely regarded for its growth and market presence with over a million subscribers

in Australia and New Zealand. Over the past five years, XERO's stock price has peaked at $

after rising from below $ Recently, the stock price has fallen to $ This case study

explores the pricing of derivative contracts and the implications of price volatility on financial

instruments particularly for XERO stock.

Your friend from the Manhattan investing firm suggesting to use Binomial pricing of an equity option

to stay riskless on XERO stock. As a hedger, you are considering the idea and wish to demonstrate the

binomial pricing of an equity option using the simple period payoff table. You intend to use any

formula to keep the pricing efforts to the simplest way focusing on the cash flow involved at the two

points in time. In a simple situation where movements in the price of a stock during the life of an

option are governed by the onestep binomial tree. It is possible to set up a riskless portfolio consisting

of a position in the stock option and a position in the stock. Riskless portfolios must earn riskfree

interest in a world without arbitrage opportunities. Your data on XERO stock is currently priced at the

money $ has a probability to rise by in one period, and equally drop by Its riskfree rate

is pause the rate for investing and borrowing

Please answer:

a Compute the threemonth call price.

b Describe with workings how you can construct a riskless portfolio by combining positions in

both the stock and the option, such that the portfolio yields only the riskfree rate of return.

Provide detailed calculations and rationale for this approach.

marks

c Calculate the initial net investment and the net cash flow for one replication strategy

described above.

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock