Question: background information about client: their general preferences and needs for product information and support 2.1 Briefly describe the nature of your clien't business. Include the

background information about client: their general preferences and needs for product information and support

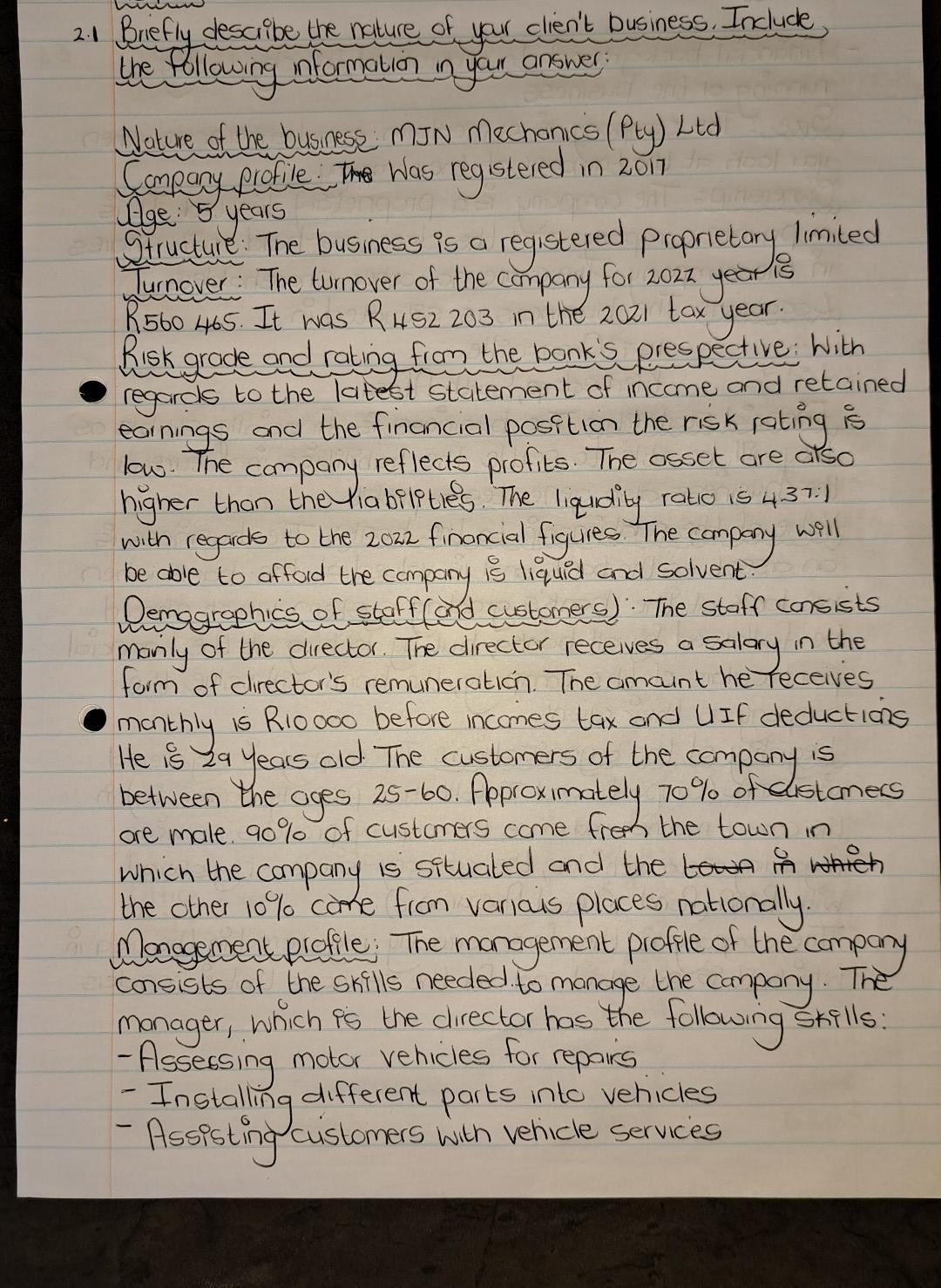

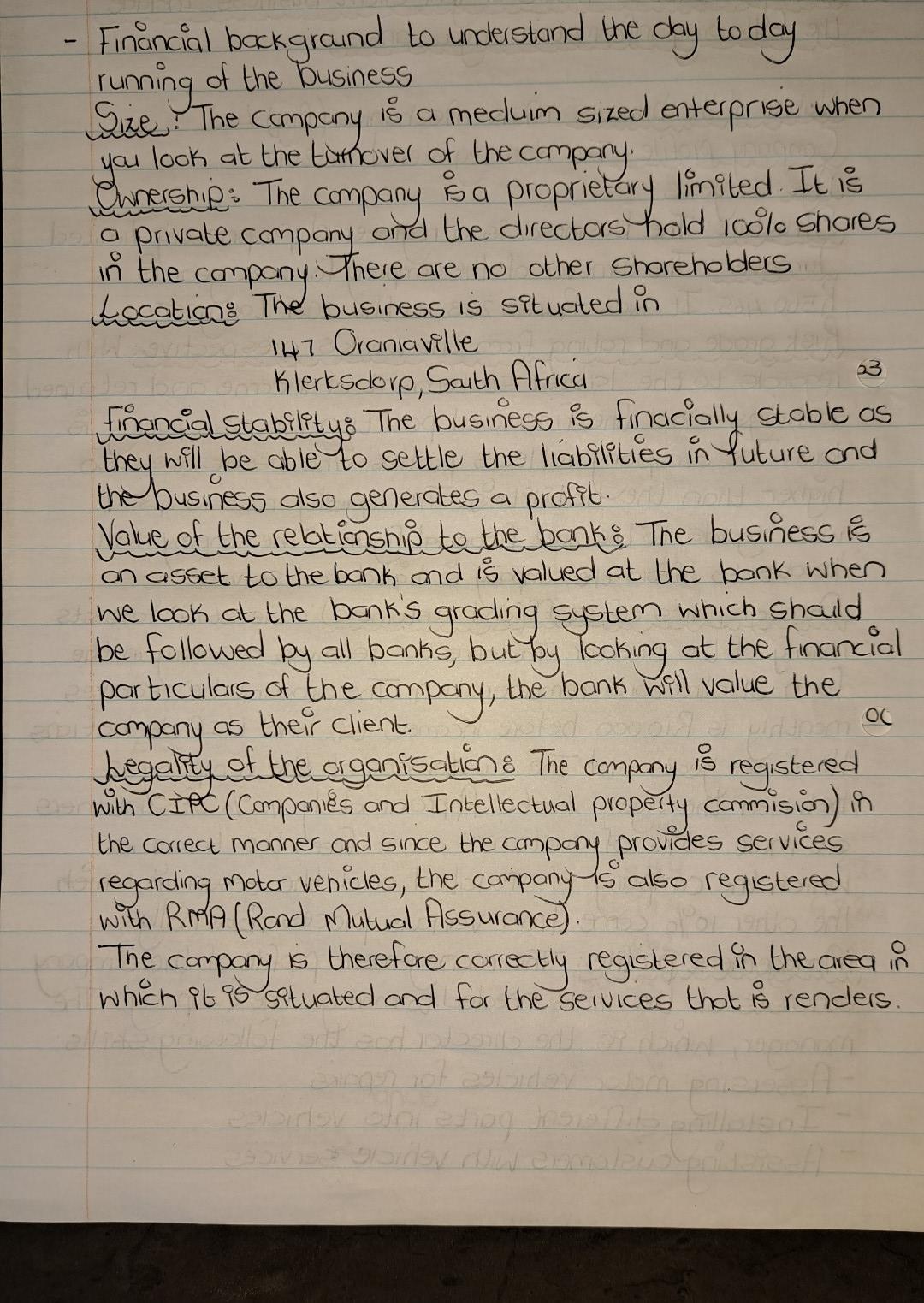

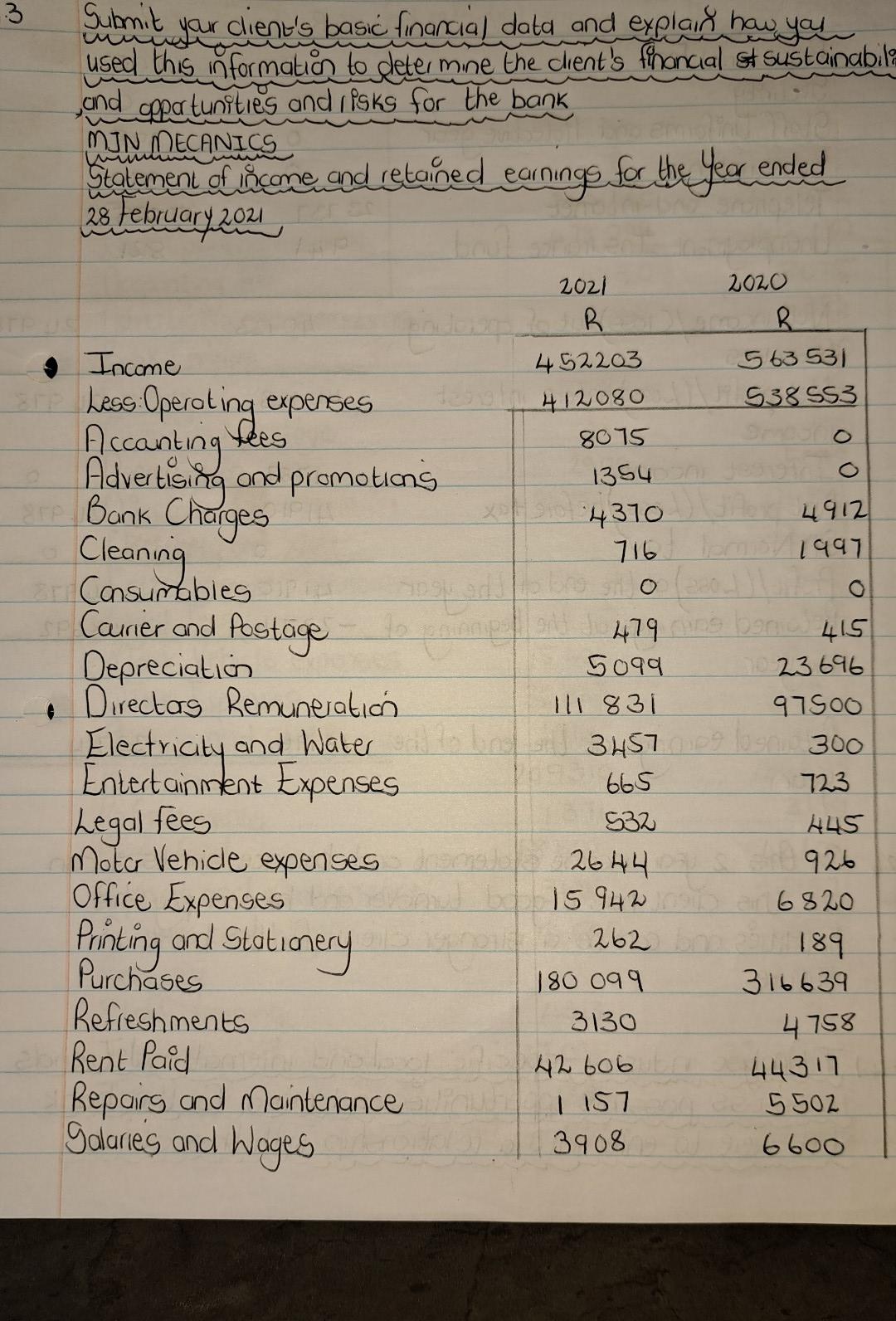

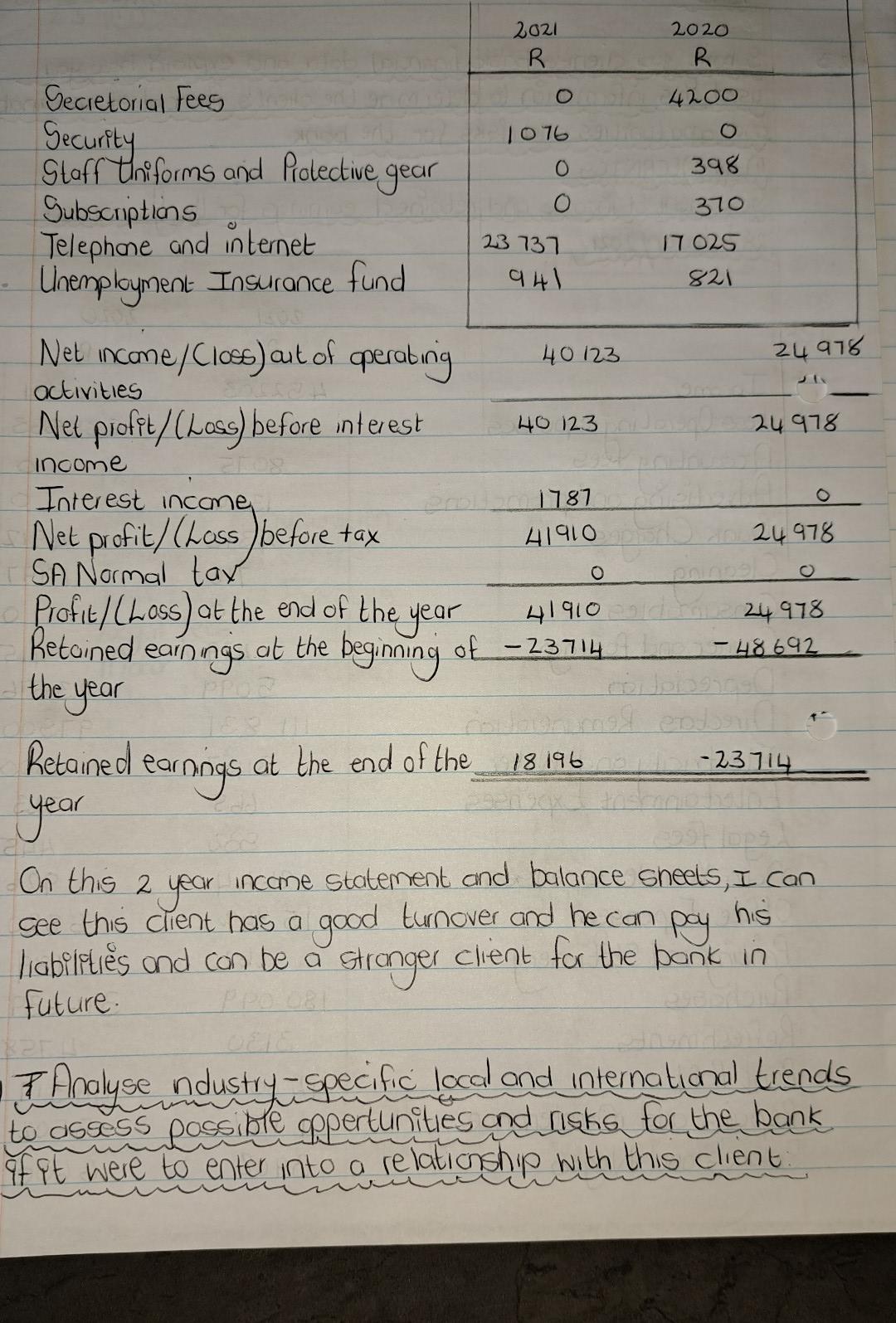

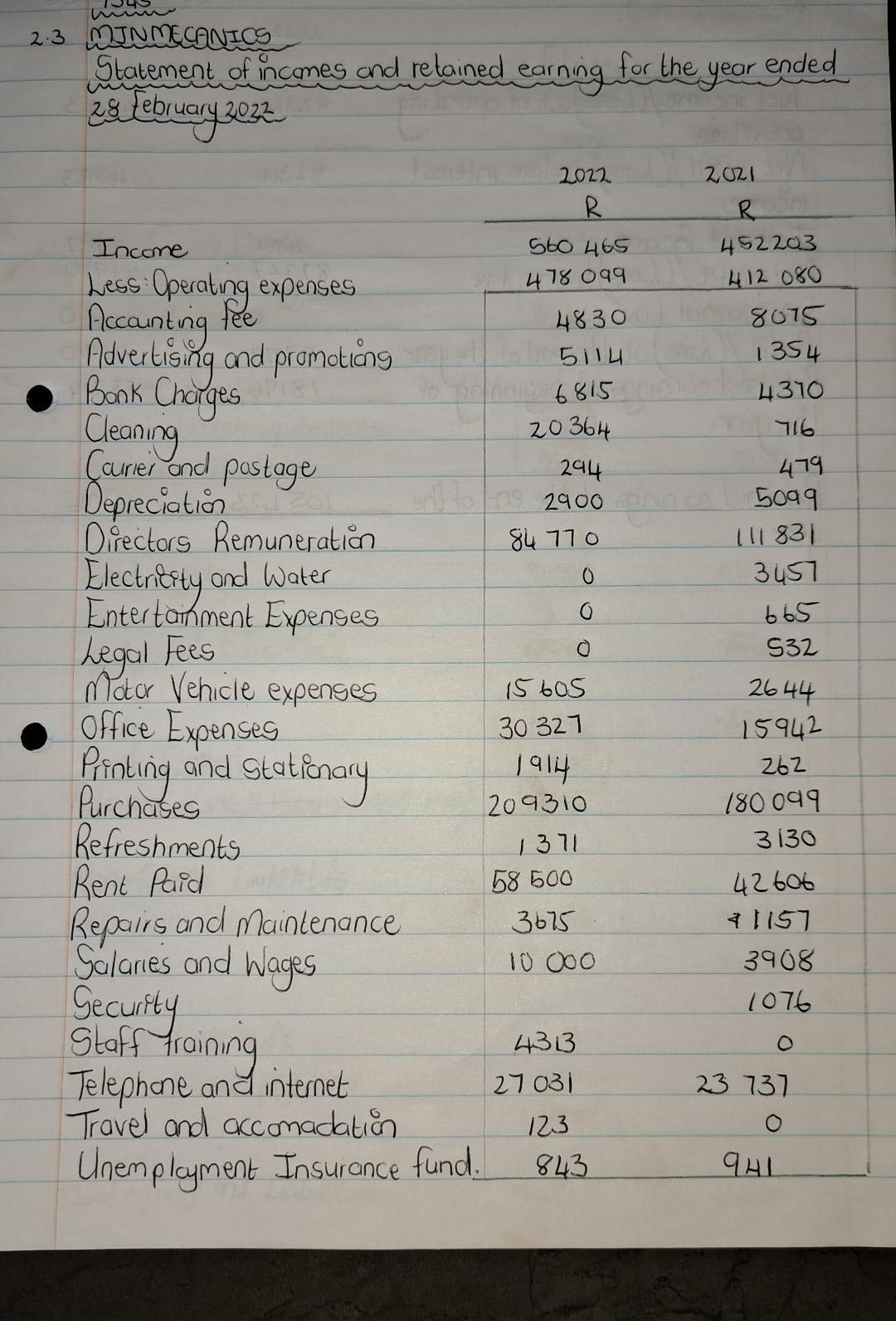

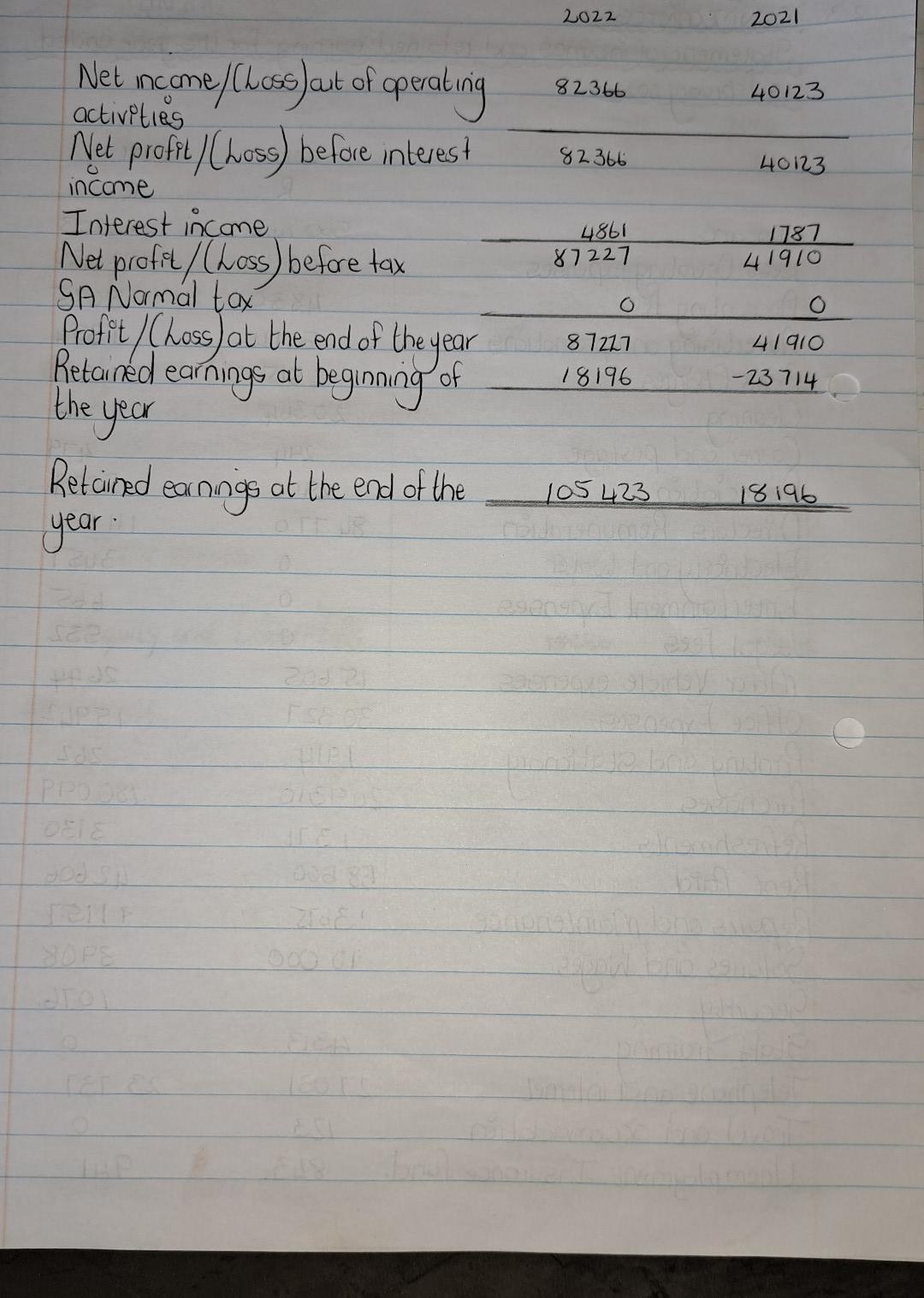

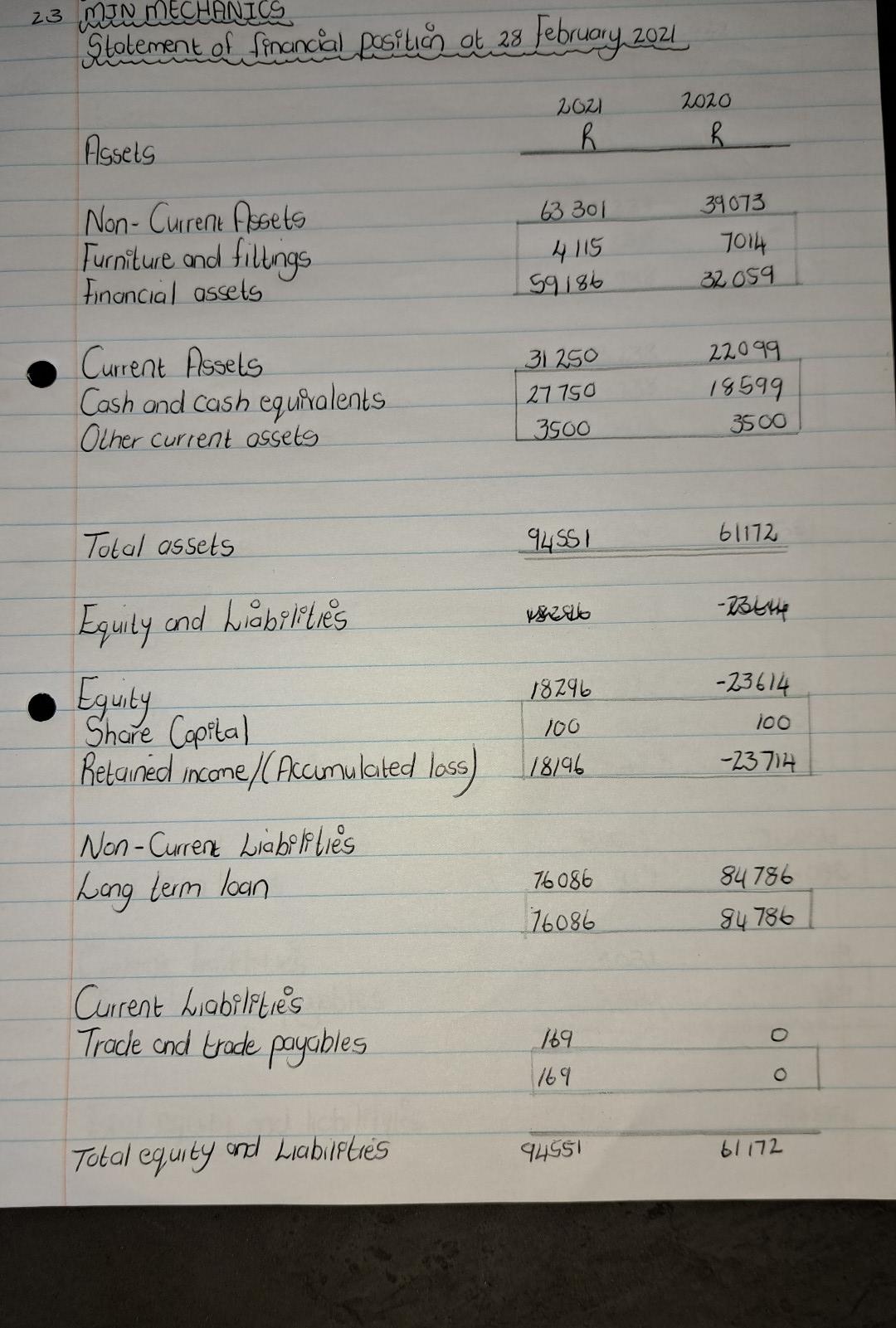

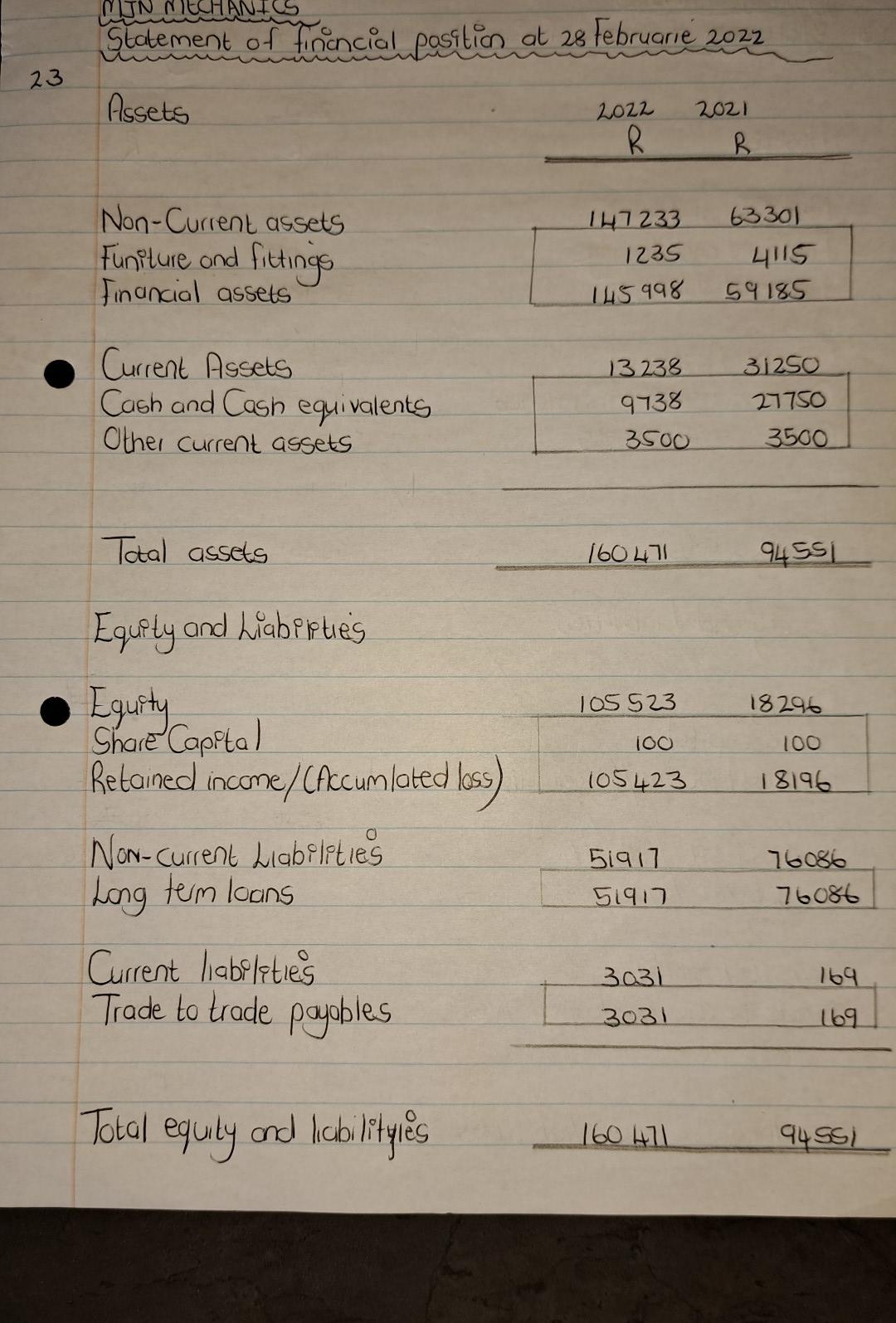

2.1 Briefly describe the nature of your clien't business. Include the following information in your answer: Nature of the business: MJN Mechanics (Pty) Ltd Company profile. The Was registered in 2017 Age: 5 years Structure: The business is a registered proprietary limited R560 465. It was R452 203 in the 2021 tax year. Risk grade and rating from the bank's prespective: With earnings and the financial position the risk rating is low. The company reflects profits. The osset are also higher than the liabilities. The liquidity ratio is 4.37:1 with regards to the 2022 financial figures. The company will be able to afford the company is liquid and solvent. Demggraphics of staff (ond customers): The staff consists marily of the director. The director receives a salary in the form of director's remuneration. The amaint he receives manthly is Rio 1000 before incomes tax and UIf deductians He is 29 Years old. The customers of the company is between the oges 2560. Approximately 70% of cuistamers are male. 90% of custamers come frem the town in Which the company is situated and the town in which the other 10% cane from variais places nationally. Monagement profile: The management profile of the campany consists of the skills needed to manage the campany. The manager, which is the director has the following skills: - Assessing motor vehicles for repairs - Installing different parts into vehicles - Assisting customers with vehicle services - Financial backgraind to understand the day to day running of the business Size. The company is a meduim sized enterprise when you look at the tathover of the compary CWnership: The company is a proprietary limited. It is a private company and the directors hold 100% shares in the company. There are no other shareholders becaticn: The business is situated in 147 Oraniaville Klerksdorp, Saith Africa Financial stability: The business is finacially stable as they will be able to settle the liabilities in future and the business also generates a profit. Value of the relationship to the bank: The business is an asset to the bank and is valued at the bank when we look at the bank's grading system which shaild be followed by all banks, but by looking at the financial particulars of the company, the bank will value the company as their client. hegality of the organisations The company is registered with CIPC (Companies and Intellectual property commision) in the correct manner and since the campony provides services regarding motar venicles, the company 15 also registered with RMA (Rond Mutual Assurance). The company is therefore correctly registered in the area in which it is situated and for the services thot is renders. Submit your dient's basic financial data and explain, how yol used this information to deter mine the chent's fhancial st sustainabila and oppartunities and risks for the bank MIN MECANICS Statement of income and retained earnings for the Year ended 28. Februaryz2021 the year Retained earnings at the end of the 1819623714 year On this 2 year incame statement and balance sheets, I can see this client has a good turnover and he can pay his liabilitis and con be a stronger client for the bank in future. FAnalyse ndustry - specific local and international trends to assess possible oppertunities and risks for the bank if ift were to enter into a relationship with this client. 2.3 MJNMECANICS Statement of incomes and retained earning for the year ended 9h 21 ainlnnarl in im 23 MIN MECHANICS Stotement of financial position at 28 February 2021 Financial assets \begin{tabular}{l|rr|} Current Assets & 31250 & 22099 \\ Cash and cash equiralents & 27750 & 18599 \\ Other current ossets & 3500 & 3500 \\ \hline \end{tabular} Total assets 94551 61172 Equity and Liabilitis wseds -2364 Eguity Share Copital 18296100181962361410023714 Retained income/(Accumulated loss) 1819623714 Non-Current Liabilities Long term loan 76086160868478684786 Current Luabilitis Tracle and trade payables Total equity and Liabilities \begin{tabular}{cc} 169 & 0 \\ 169 & 0 \\ \hline 94551 & 61172 \end{tabular} Statement of finincial pasition at 28 Februarie 2022 2.1 Briefly describe the nature of your clien't business. Include the following information in your answer: Nature of the business: MJN Mechanics (Pty) Ltd Company profile. The Was registered in 2017 Age: 5 years Structure: The business is a registered proprietary limited R560 465. It was R452 203 in the 2021 tax year. Risk grade and rating from the bank's prespective: With earnings and the financial position the risk rating is low. The company reflects profits. The osset are also higher than the liabilities. The liquidity ratio is 4.37:1 with regards to the 2022 financial figures. The company will be able to afford the company is liquid and solvent. Demggraphics of staff (ond customers): The staff consists marily of the director. The director receives a salary in the form of director's remuneration. The amaint he receives manthly is Rio 1000 before incomes tax and UIf deductians He is 29 Years old. The customers of the company is between the oges 2560. Approximately 70% of cuistamers are male. 90% of custamers come frem the town in Which the company is situated and the town in which the other 10% cane from variais places nationally. Monagement profile: The management profile of the campany consists of the skills needed to manage the campany. The manager, which is the director has the following skills: - Assessing motor vehicles for repairs - Installing different parts into vehicles - Assisting customers with vehicle services - Financial backgraind to understand the day to day running of the business Size. The company is a meduim sized enterprise when you look at the tathover of the compary CWnership: The company is a proprietary limited. It is a private company and the directors hold 100% shares in the company. There are no other shareholders becaticn: The business is situated in 147 Oraniaville Klerksdorp, Saith Africa Financial stability: The business is finacially stable as they will be able to settle the liabilities in future and the business also generates a profit. Value of the relationship to the bank: The business is an asset to the bank and is valued at the bank when we look at the bank's grading system which shaild be followed by all banks, but by looking at the financial particulars of the company, the bank will value the company as their client. hegality of the organisations The company is registered with CIPC (Companies and Intellectual property commision) in the correct manner and since the campony provides services regarding motar venicles, the company 15 also registered with RMA (Rond Mutual Assurance). The company is therefore correctly registered in the area in which it is situated and for the services thot is renders. Submit your dient's basic financial data and explain, how yol used this information to deter mine the chent's fhancial st sustainabila and oppartunities and risks for the bank MIN MECANICS Statement of income and retained earnings for the Year ended 28. Februaryz2021 the year Retained earnings at the end of the 1819623714 year On this 2 year incame statement and balance sheets, I can see this client has a good turnover and he can pay his liabilitis and con be a stronger client for the bank in future. FAnalyse ndustry - specific local and international trends to assess possible oppertunities and risks for the bank if ift were to enter into a relationship with this client. 2.3 MJNMECANICS Statement of incomes and retained earning for the year ended 9h 21 ainlnnarl in im 23 MIN MECHANICS Stotement of financial position at 28 February 2021 Financial assets \begin{tabular}{l|rr|} Current Assets & 31250 & 22099 \\ Cash and cash equiralents & 27750 & 18599 \\ Other current ossets & 3500 & 3500 \\ \hline \end{tabular} Total assets 94551 61172 Equity and Liabilitis wseds -2364 Eguity Share Copital 18296100181962361410023714 Retained income/(Accumulated loss) 1819623714 Non-Current Liabilities Long term loan 76086160868478684786 Current Luabilitis Tracle and trade payables Total equity and Liabilities \begin{tabular}{cc} 169 & 0 \\ 169 & 0 \\ \hline 94551 & 61172 \end{tabular} Statement of finincial pasition at 28 Februarie 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts