Question: Background Stella Strummer started a company that sells hand-crafted guitars made from carefully curated woods, offering musicians a rich sound that's highly valued. The business

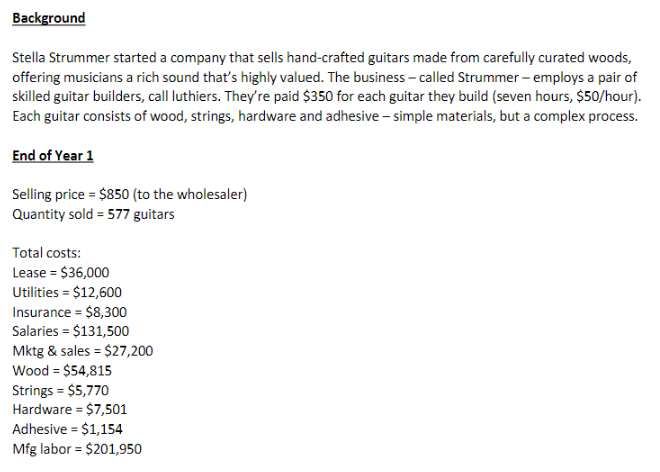

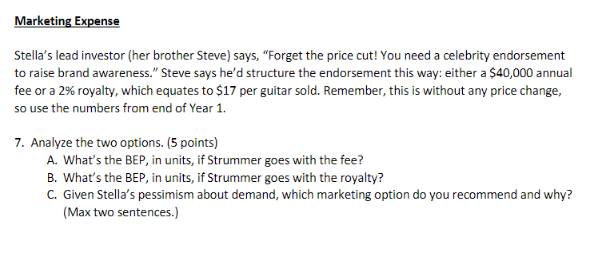

Background Stella Strummer started a company that sells hand-crafted guitars made from carefully curated woods, offering musicians a rich sound that's highly valued. The business - called Strummer - employs a pair of skilled guitar builders, call luthiers. They're paid $350 for each guitar they build (seven hours, $50/hour). Each guitar consists of wood, strings, hardware and adhesive - simple materials, but a complex process. End of Year 1 Selling price = $850 (to the wholesaler) Quantity sold = 577 guitars Total costs: Lease = $36,000 Utilities = $12,600 Insurance = $8,300 Salaries = $131,500 Mktg & sales = $27,200 Wood = $54,815 Strings = $5,770 Hardware = $7,501 Adhesive = $1,154 Mfg labor = $201,950 Marketing Expense Stella's lead investor (her brother Steve) says, "Forget the price cut! You need a celebrity endorsement to raise brand awareness." Steve says he'd structure the endorsement this way: either a $40,000 annual fee or a 2% royalty, which equates to $17 per guitar sold. Remember, this is without any price change, so use the numbers from end of Year 1. 7. Analyze the two options. (5 points) A. What's the BEP, in units, if Strummer goes with the fee? B. What's the BEP, in units, if Strummer goes with the royalty? C. Given Stella's pessimism about demand, which marketing option do you recommend and why? (Max two sentences.) Background Stella Strummer started a company that sells hand-crafted guitars made from carefully curated woods, offering musicians a rich sound that's highly valued. The business - called Strummer - employs a pair of skilled guitar builders, call luthiers. They're paid $350 for each guitar they build (seven hours, $50/hour). Each guitar consists of wood, strings, hardware and adhesive - simple materials, but a complex process. End of Year 1 Selling price = $850 (to the wholesaler) Quantity sold = 577 guitars Total costs: Lease = $36,000 Utilities = $12,600 Insurance = $8,300 Salaries = $131,500 Mktg & sales = $27,200 Wood = $54,815 Strings = $5,770 Hardware = $7,501 Adhesive = $1,154 Mfg labor = $201,950 Marketing Expense Stella's lead investor (her brother Steve) says, "Forget the price cut! You need a celebrity endorsement to raise brand awareness." Steve says he'd structure the endorsement this way: either a $40,000 annual fee or a 2% royalty, which equates to $17 per guitar sold. Remember, this is without any price change, so use the numbers from end of Year 1. 7. Analyze the two options. (5 points) A. What's the BEP, in units, if Strummer goes with the fee? B. What's the BEP, in units, if Strummer goes with the royalty? C. Given Stella's pessimism about demand, which marketing option do you recommend and why? (Max two sentences.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts