Background. The International Integrated Reporting Framework ( Framework) was developed by the International Integrated Reporting Council (IIRC) to assist organisations prepare an integrated report. The Framework was first released in 2013 and updated in 2021 to include feedback (but not limited to) from users and preparers of an integrated report.

The Framework is a principles-based framework which establishes Guiding Principles and Content Elements that govern the overall content of an integrated report, and it explains the fundamental concepts that underpin them including value creation, the six capitals and the value creation process (business model).

The primary purpose of an integrated report is to explain to providers of financial capital how an organisation utilizes its resources to create value over time. An integrated report could also benefit other stakeholders interested in an organisations ability to create value over time, including employees, customers, suppliers, business partners, local communities, legislators, regulators, and policymakers.

Although Integrated Reporting is still voluntary in Australia, the business reporting landscape has changed in recent years with the formation of the International Sustainability Standards Board (ISSB) by IFRS Foundation in 2021. As a result, the IIRC became part of the Value Reporting Foundation, which was then consolidated into the IFRS Foundation in August 2022. Integrated Reporting is expected to play a pivotal role in bridging financial information with sustainability information in providing relevant information to investors.

There is a growing number of listed companies in Australia, such as Lendlease, Stockland, National Australia Bank, Transurban, CPA Australia, among others, who choose to release reports prepared with reference to the Framework. For many Australian companies the idea of preparing an Integrated Report may be overwhelming and most dont know where to begin but practices are changing in a fastmoving world and integrated reporting may become the corporate reporting norm in the not-so-distant future.

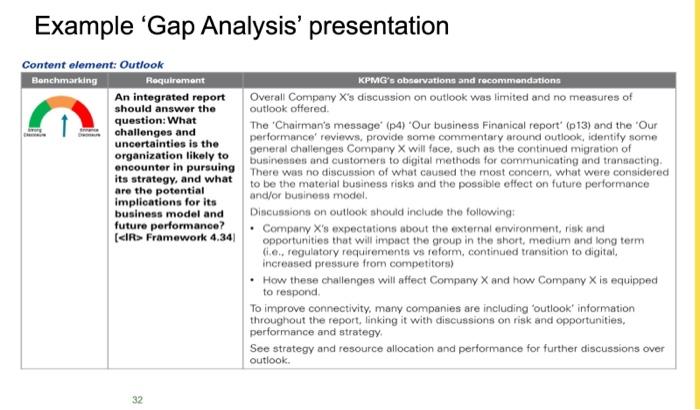

Over the years KPMG has worked with a number of Australian listed companies looking to start this journey and prepare an Integrated Report. The first step of this process typically involves preparing a gap analysis, a report for the Senior Executives identifying how the information they are currently communicating across their reports portfolio (such as the Annual Report, Annual Review, Sustainability Report, Investor Presentation and corporate website) compares to the type of information required to be communicated in an Integrated Report. The gap analysis identifies information gaps between what and how the company is currently reporting and the Fundamental Concepts, Guiding Principles and Content Elements of the Framework. Where gaps are noted, KPMG will provide a number of recommendations of how the company could improve their corporate reporting, accompanied by examples from other Australian and International Annual and/or Integrated Reports. See lecture notes for a template.

This case study was developed in collaboration with KPMG Australia and Deakin Universitys Centre for Integrated Reporting to provide students with a hands-on experience of what it is like to work on an integrated reporting consulting engagement.

Furthermore, this case study will develop teamwork skills. Teamwork is a vital skill in a professional or business environment and a key graduate attribute that students should have.

Working effectively in a team does not happen by accident. It involves a deliberate effort by every member of the group. Employers will look to hire employees who can communicate and participate as part of a productive team, and who are able to use their initiative, organisational and selfmanagement abilities to ensure the success of the team.

Refer to Xero Limited Annual Report 2023 in preparing a gap analysis.

The Annual Report is available from the corporate website or the course website. Other documents referenced in the corporate

report may also be useful for this case study.

Required:

1. Group report Prepare a detailed report for the Senior Executives of Xero Limited summarising your findings and recommendations from your gap analysis. The report should contain the following:

a. A critical assessment of how well Xero has applied the mandatory requirements of

the Framework. All of the 19 black letter requirements of the Framework

are listed in the Appendix of the Framework. Use of score cards or star ratings

Zealandbased technology company listed in the Australian Securities Exchange (ASX).

Xero is a New

Xero provides cloud-based accounting software for small and medium-sized businesses. The

company has offices in New Zealand, Australia, the United Kingdom and the United States.

Xero accounting platform is used in over 180 countries.

may be useful in this assessment. We should assess whether Xero has 3of the IR requirements (conciseness, reliability and completness, consistency and compareability) Write in what page we find the information that support our observation

b. Recommendations specific to Xero in order for the annual report to comply with the

mandatory requirements of the Framework and so provide more meaningful

information to the report users. if the company performs well in the disclosures, just give analysis and justification (which page). make it brief, and spend more in the ones that need improvement

c. Support recommendation for improvement with examples of disclosures from other Australian and/or international companies.

attachemnt 1: example

attachment 2: details of the three IR requirement

Conciseness 3.36 An integrated report should be concise. Reliability and completeness 3.39 An integrated report should include all material matters, both positive and negative, in a balanced way and without material error. Consistency and comparability 3.54 The information in an integrated report should be presented: - On a basis that is consistent over time - In a way that enables comparison with other organizations to the extent it is material to the organization's own ability to create value over time. Example 'Gap Analysis' presentation