Question: Background: You are a financial analyst working for the Satcom Division of Global Telecomm, Inc. ( GTI ) GTI specializes in providing ultrahigh broadband telecommunication

Background:

You are a financial analyst working for the Satcom Division of Global Telecomm, Inc. GTI GTI specializes in providing ultrahigh broadband telecommunication service infrastructure to a variety of commercial and private companies. GTI provides these services in the Americas as well as Europe and the Far East. Key to its services is a network of servers, relay nodes and towers, and access to certain commercial satellite service providers. The latter is required to enable transatlantic and transpacific near real time communication services using ultrahigh frequency transceivers. GTI home offices are in Petaluma, California. GTI has other operating divisions: Telecomm and GTI Properties.

The Satcom Division handles the transocean satellite services for GTI. GTI Properties is responsible for acquisition and management of the various properties owned and leased by GTI. The Telecomm Division is responsible for system servers and accessdistribution equipment for landbased services.

GTI has an ongoing business relationship with Morgan Stanley for investment banking services, Bank of America and Citi Corp for its banking and lines of credit. In addition, GTI does business with Barclays London and Sumitomo Bank, LTDTokyo The last two facilitate the sale of intermediate term notes and longterm bonds in Europe and the Far East, respectively. GTI provides system services to its clients on a or year contract basis. A small percentage of GTIs accounts are on a yeartoyear contract basis.

The Numbers:

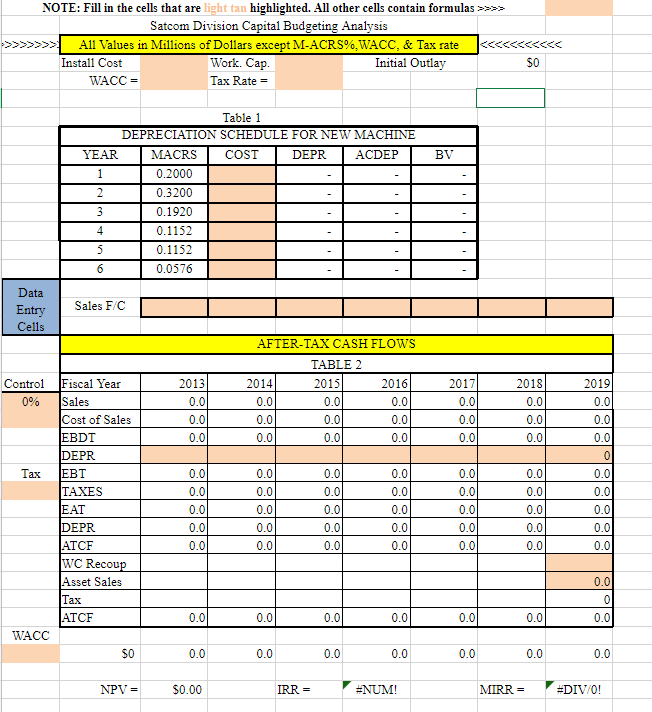

Satcoms fiscal year ends December The Satcom Division predicts it will generate $ Billion in sales and $ million in profits in FY The divisional cost of capital is and its average tax rate is The cost of sales for the Satcom Division has historically run about

Planning to add additional capacity began in The corporate economist provided a forecast of the incremental sales and the expected cost of sales for Fiscal Years through The additional new equipment will cost $ Million installed and will require a $ Million investment in working capital primarily cash and technical support contracts. We expect to recoup $ million of the $ million at the end of year Working Capital Cash

Sales Forecasts for Years through

The timeline for this project was as follows: Investment Analysis JanMar Equipment acquisition JulyOctober, Site Preparation and Installation AugustOctober, System Calibration and Testing NovemberDecember, Start of contract services January FY

Project #: Reminder: points maximum added to your final point count.

Complete the base case Depreciation and AfterTax Cash Flow tables.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock