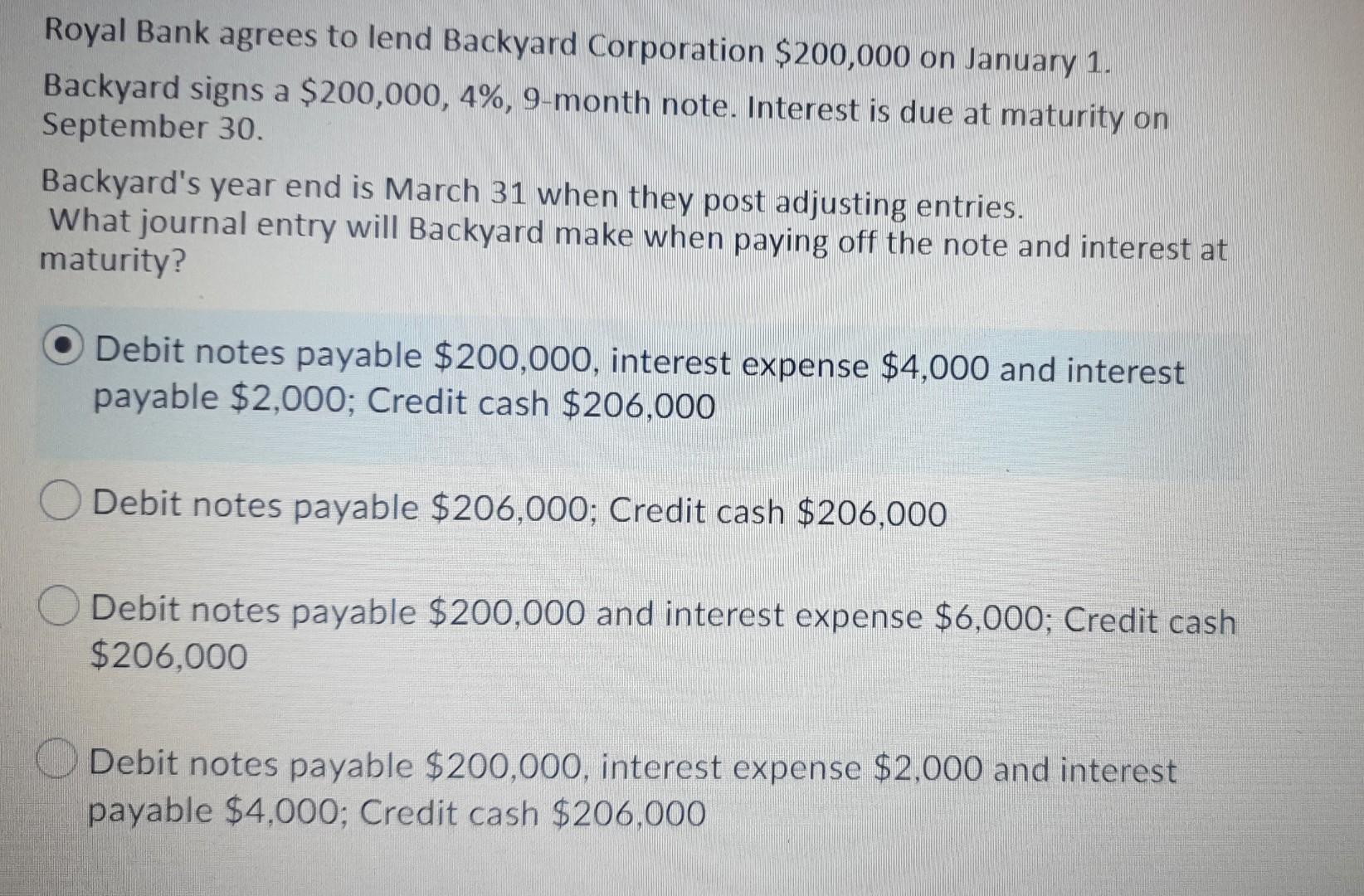

Question: Backyard signs a $200,000,4%,9-month note. Interest is due at maturity on September 30. Backyard's year end is March 31 when they post adjusting entries. What

Backyard signs a $200,000,4%,9-month note. Interest is due at maturity on September 30. Backyard's year end is March 31 when they post adjusting entries. What journal entry will Backyard make when paying off the note and interest at maturity? Debit notes payable $200,000, interest expense $4,000 and interest payable $2,000; Credit cash $206,000 Debit notes payable $206,000; Credit cash $206,000 Debit notes payable $200,000 and interest expense $6,000; Credit cash $206,000 Debit notes payable $200,000, interest expense $2,000 and interest payable $4,000; Credit cash $206,000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock