Question: Bad Debts Expense 2. D'Costa Company uses the allowance method of handling credit losses. It estimates losses at 2% of credit sales, which were $1,800,000

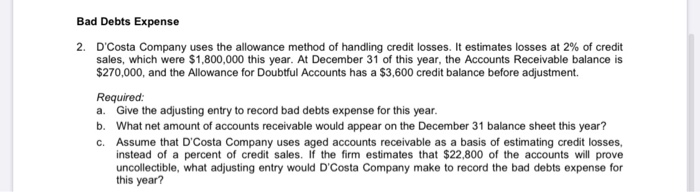

Bad Debts Expense 2. D'Costa Company uses the allowance method of handling credit losses. It estimates losses at 2% of credit sales, which were $1,800,000 this year. At December 31 of this year, the Accounts Receivable balance is $270,000, and the Allowance for Doubtful Accounts has a $3,600 credit balance before adjustment. Required: a. Give the adjusting entry to record bad debts expense for this year. b. What net amount of accounts receivable would appear on the December 31 balance sheet this year? C. Assume that D'Costa Company uses aged accounts receivable as a basis of estimating credit losses, instead of a percent of credit sales. If the firm estimates that $22,800 of the accounts will prove uncollectible, what adjusting entry would D'Costa Company make to record the bad debts expense for this year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts