A). Bagus Bhd sold goods with a cost of RM200,000 to Cekap Bhd at an invoice...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

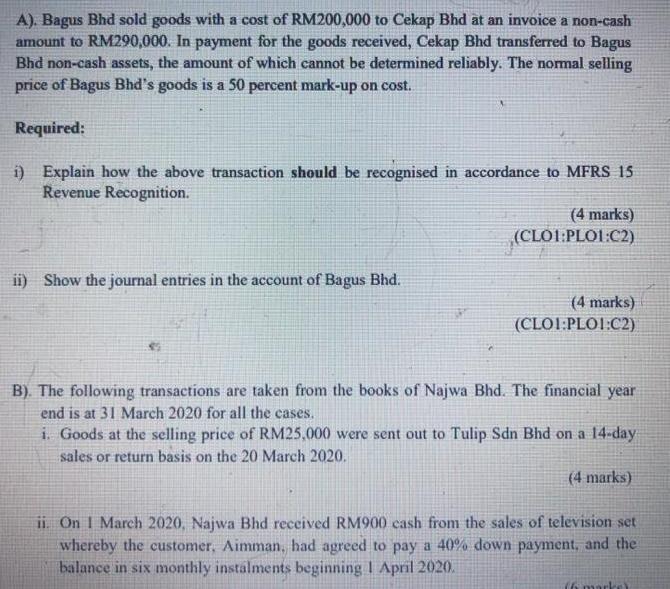

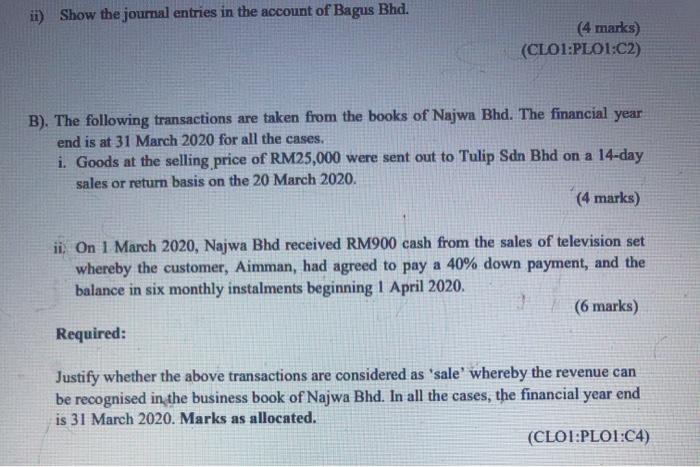

A). Bagus Bhd sold goods with a cost of RM200,000 to Cekap Bhd at an invoice a non-cash amount to RM290,000. In payment for the goods received, Cekap Bhd transferred to Bagus Bhd non-cash assets, the amount of which cannot be determined reliably. The nomal selling price of Bagus Bhd's goods is a 50 percent mark-up on cost. Required: i) Explain how the above transaction should be recognised in accordance to MFRS 15 Revenue Recognition. (4 marks) (CLO1:PLO1:C2) ii) Show the journal entries in the account of Bagus Bhd. (4 marks) (CLO1:PLO1:C2) B). The following transactions are taken from the books of Najwa Bhd. The financial year end is at 31 March 2020 for all the cases. i. Goods at the selling price of RM25,000 were sent out to Tulip Sdn Bhd on a 14-day sales or return basis on the 20 March 2020. (4 marks) ii On I March 2020, Najwa Bhd received RM900 cash from the sales of television set whereby the customer, Aimman, had agreed to pay a 40% down payment, and the balance in six monthly instalments beginning I April 2020. 16 ke) ii) Show the jounal entries in the account of Bagus Bhd. (4 marks) (CLO1:PLO1:C2) B). The following transactions are taken from the books of Najwa Bhd. The financial year end is at 31 March 2020 for all the cases. i. Goods at the selling price of RM25,000 were sent out to Tulip Sdn Bhd on a 14-day sales or return basis on the 20 March 2020. (4 marks) ii. On 1 March 2020, Najwa Bhd received RM900 cash from the sales of television set whereby the customer, Aimman, had agreed to pay a 40% down payment, and the balance in six monthly instalments beginning 1 April 2020. (6 marks) Required: Justify whether the above transactions are considered as 'sale whereby the revenue can be recognised in the business book of Najwa Bhd. In all the cases, the financial year end is 31 March 2020. Marks as allocated. (CLO1:PLO1:C4) A). Bagus Bhd sold goods with a cost of RM200,000 to Cekap Bhd at an invoice a non-cash amount to RM290,000. In payment for the goods received, Cekap Bhd transferred to Bagus Bhd non-cash assets, the amount of which cannot be determined reliably. The nomal selling price of Bagus Bhd's goods is a 50 percent mark-up on cost. Required: i) Explain how the above transaction should be recognised in accordance to MFRS 15 Revenue Recognition. (4 marks) (CLO1:PLO1:C2) ii) Show the journal entries in the account of Bagus Bhd. (4 marks) (CLO1:PLO1:C2) B). The following transactions are taken from the books of Najwa Bhd. The financial year end is at 31 March 2020 for all the cases. i. Goods at the selling price of RM25,000 were sent out to Tulip Sdn Bhd on a 14-day sales or return basis on the 20 March 2020. (4 marks) ii On I March 2020, Najwa Bhd received RM900 cash from the sales of television set whereby the customer, Aimman, had agreed to pay a 40% down payment, and the balance in six monthly instalments beginning I April 2020. 16 ke) ii) Show the jounal entries in the account of Bagus Bhd. (4 marks) (CLO1:PLO1:C2) B). The following transactions are taken from the books of Najwa Bhd. The financial year end is at 31 March 2020 for all the cases. i. Goods at the selling price of RM25,000 were sent out to Tulip Sdn Bhd on a 14-day sales or return basis on the 20 March 2020. (4 marks) ii. On 1 March 2020, Najwa Bhd received RM900 cash from the sales of television set whereby the customer, Aimman, had agreed to pay a 40% down payment, and the balance in six monthly instalments beginning 1 April 2020. (6 marks) Required: Justify whether the above transactions are considered as 'sale whereby the revenue can be recognised in the business book of Najwa Bhd. In all the cases, the financial year end is 31 March 2020. Marks as allocated. (CLO1:PLO1:C4)

Expert Answer:

Answer rating: 100% (QA)

B 1 Goods sent to Tulip Sdn Bhd on 20 march can be considered as sale interpret... View the full answer

Related Book For

Corporate Financial Accounting

ISBN: 978-1305653535

14th edition

Authors: Carl S. Warren, James M. Reeve, Jonathan Duchac

Posted Date:

Students also viewed these accounting questions

-

On October 20, Cullumber sells merchandise at a cost of $3,840 to Blossom for $6,400 cash. On October 25, Cullumber received returned goods from Blossom and refunds the amount in cash for items that...

-

A diesel-powered tractor with a cost of $145,000 and estimated residual value of $7,000 is expected to have a useful operating life of 75,000 hours. During July, the generator was operated 150 hours....

-

A long-term investment in bonds with a cost of $60,000 was sold for $72,000 cash. (a) What was the gain or loss on the sale? (b) What was the effect of the transaction on cash flows? (c) How should...

-

Compute the least-squares regression line for predicting power (y) from wind speed (x).

-

Differentiate the following terms/concepts: a. Miscalibration and excessive optimism b. Better-than-average effect and illusion of control c. Self-attribution bias and confirmation bias d. Pros and...

-

Use the MATLAB pidtool to design a PID controller for the system of Problem 8.6-1. Start with these parameters, then try to improve the design \(\left(G_{p}=1 /\left(s^{2}+sight), T=1, H=1, P_{m}=45,...

-

At a sudden contraction in a pipe the diameter changes from \(D_{1}\) to \(D_{2}\). The pressure drop, \(\Delta p\), which develops across the contraction is a function of \(D_{1}\) and \(D_{2}\), as...

-

Gillian Shaw opened Shaws Carpet Cleaners on March 1. During March, the following transactions were completed. Mar. 1 Invested $10,000 cash in the business. 1 Purchased used truck for $6,000, paying...

-

Teapot Dome Company is in the business of manufacturing various teapots. They sell their products directly to the customer. For 2022, they have reported the following financial information. Revenue...

-

A four-bit binary number is represented as A3A2A1A0, where A3, A2, A1, and A0 represent the individual bits and A0 is equal to the LSB. Design a logic circuit that will produce a HIGH output whenever...

-

Consider an economy with two-agents, two-states of nature, and where agents live for two- periods. Agent state dependent endowments (income) and state probabilities are given in the following table:...

-

Hiro Corp. common stock is selling for $29.50 per share. The last dividend was $2.40 and dividends are expected to grow at an 8% annual rate. Flotation costs on new stock sales are 11% of the selling...

-

The movement of a share price over the next two months is to be modelled using a two-period recombining binomial model. Over each month, it is assumed that the share price will either increase or...

-

Submit the completed Marketing Math Calculations worksheet.Also, please submit a separate Word document in which you answer the following questions: If the retail price is set at $1.00, what effect...

-

Suppose you borrowed $15,000 at a rate of 8% and must repay it in 3 equal installments at the end of each year of the next 4 years. Construct a loan amortization table showing how the loan payments...

-

Your cousin knows you studied finance courses at university, and asks you for information and advice relating to his small mini-mart business. Based on your studies, identify any two (2) finance...

-

Drug Trial: A pharmaceutical company is testing a new drug with 85 patients. They recorded the following frequencies. Drugs Impact on Patient Frequency Strong side effects that resulted in 18...

-

How is use of the word consistent helpful in fraud reports?

-

The cash account for Pala Medical Co. at June 30, 20Y1, indicated a balance of $146,035. The bank statement indicated a balance of $181,965 on June 30, 20Y1. Comparing the bank statement and the...

-

On November 1, 2018, Kris Lehman established an interior decorating business, Modern Designs. During the month, Kris completed the following transactions related to the business: Nov. 1. Kris...

-

Imaging Services was organized on March 1, 2018. A summary of the revenue and expense transactions for March follows: Fees earned ........................................ $482,000 Wages expense...

-

Which of the following are boiler mountings ? (a) Economiser (b) Fusible plug (c) Super heater (d) Injector

-

Which out of the following boiler is capable of generating superheated steam without additional accessories ? (a) Cochran (b) Lancashire (c) Locomotive (d) Cornish

-

The economiser of the boiler plant is used mainly to (a) increase steam capacity (b) reduce fuel consumption (c) increase steam pressure (d) increase life of the boiler

Study smarter with the SolutionInn App