Question: Bailey Computers Inc. needs to raise $35 million to begin producing a new micro-computer. Bailey's straight, nonconvertible debentures currently yield 12%.Its stock sells for $38.00

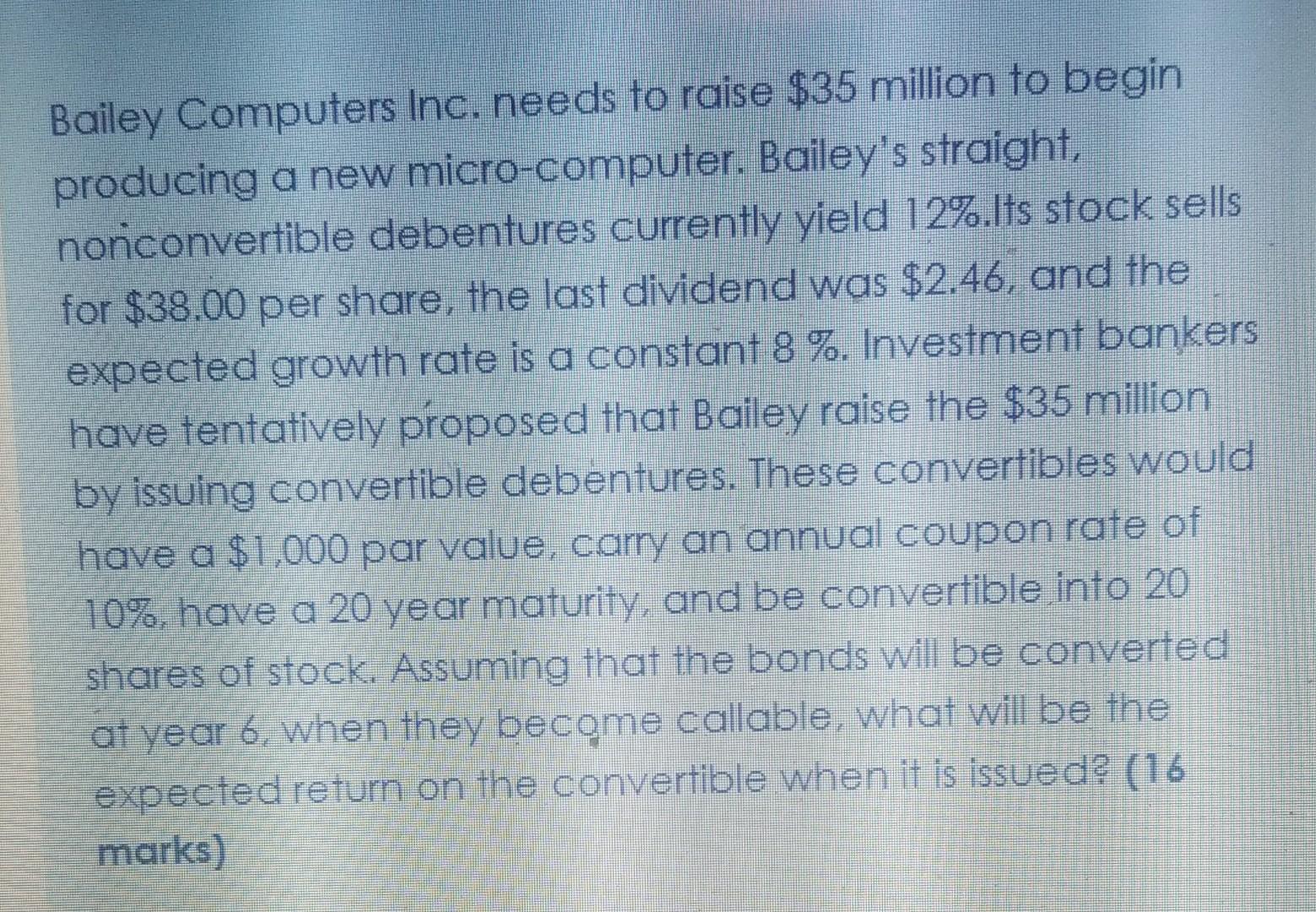

Bailey Computers Inc. needs to raise $35 million to begin producing a new micro-computer. Bailey's straight, nonconvertible debentures currently yield 12%.Its stock sells for $38.00 per share, the last dividend was $2.46, and the expected growth rate is a constant 8 %. Investment bankers have tentatively proposed that Bailey raise the $35 million by issuing convertible debentures. These convertibles would have a $1,000 par value, carry an annual coupon rate of 10%, have a 20 year maturity, and be convertible into 20 shares of stock. Assuming that the bonds will be converted at year 6. when they become callable, what will be the expected return on the convertible when it is issued? (16 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts