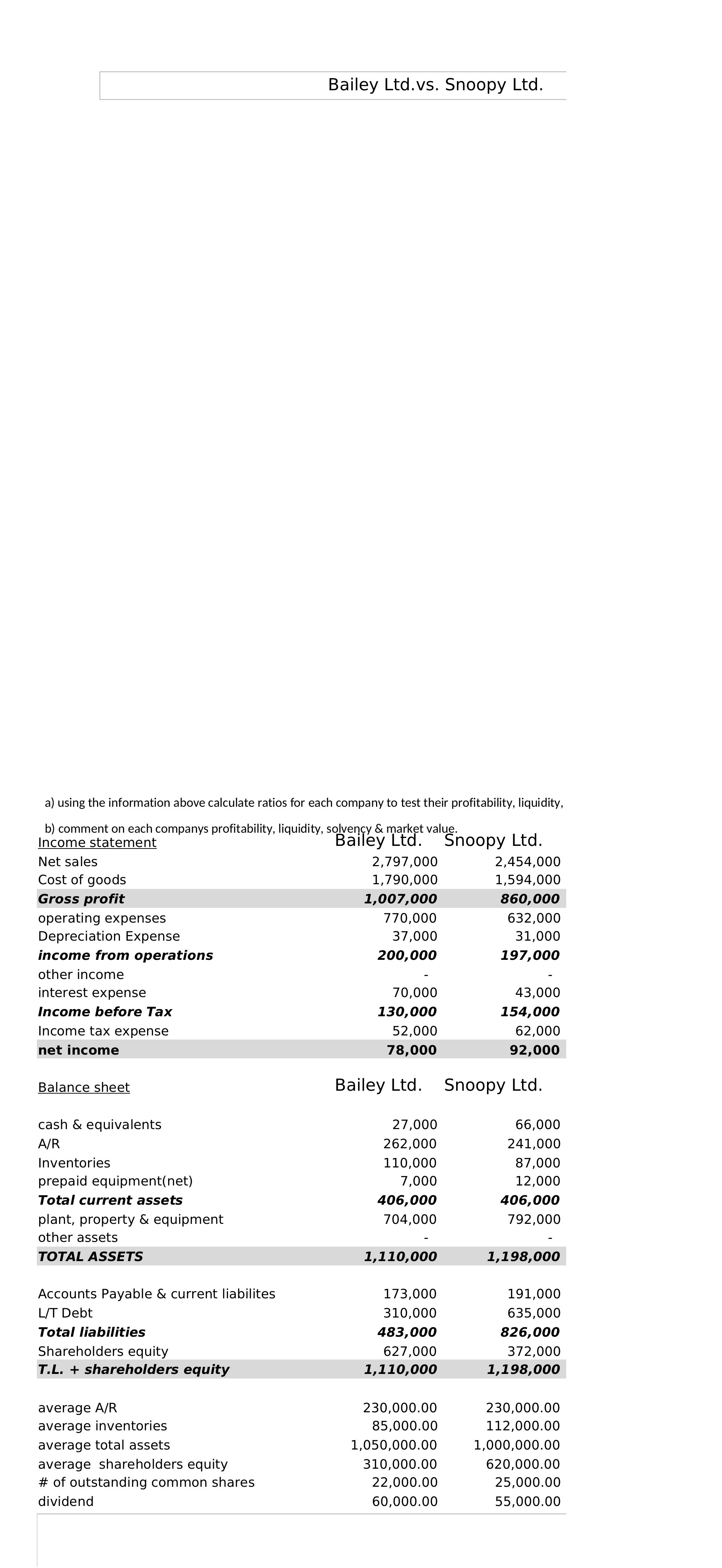

Question: Bailey Ltd.vs. Snoopy Ltd. a) using the information above calculate ratios for each company to test their profitability, liquidity, b) comment on each companys profitability,

Bailey Ltd.vs. Snoopy Ltd. a) using the information above calculate ratios for each company to test their profitability, liquidity, b) comment on each companys profitability, liquidity, solvency & market value. W Bailey Ltd. Snoopy Ltd. Net sales 2,797,000 2,454,000 Cost of goods 1,790,000 1,594,000 Gross profit 1,007,000 860, 000 operating expenses 770,000 632,000 Depreciation Expense 37,000 31,000 income from operations 200,000 197,000 other income - interest expense 70,000 43,000 income before Tax 130,000 154,000 Income tax expense 52,000 62,000 net income 78,000 92,000 M Bailey Ltd. Snoopy Ltd. cash & equivalents 27,000 66,000 A/R 262,000 241,000 Inventories 110,000 87,000 prepaid equipment(net) 7.000 12,000 Total current assets 406,000 406,000 plant, property & equipment 704,000 792,000 other assets - - TOTAL ASSETS 1,110,000 1,198,000 Accounts Payable & current liabilites 173,000 191,000 LIT Debt 310,000 635,000 Total liabilities 483, 000 826, 000 Shareholders equity 627,000 372,000 T.L. + shareholders equity 1,110,000 1,198,000 average A/R 230,000.00 230,000.00 average inventories 85,000.00 112,000.00 average total assets 1,050,000.00 1,000,000.00 average shareholders equity 310,000.00 620,000.00 # of outstanding common shares 22,000.00 25,000.00 dividend 60,000.00 55,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts