Question: Bailey Traders has been experiencing cash flow problems and has decided to prepare cash budgets so that it may anticipate cash surplus and cash shortages

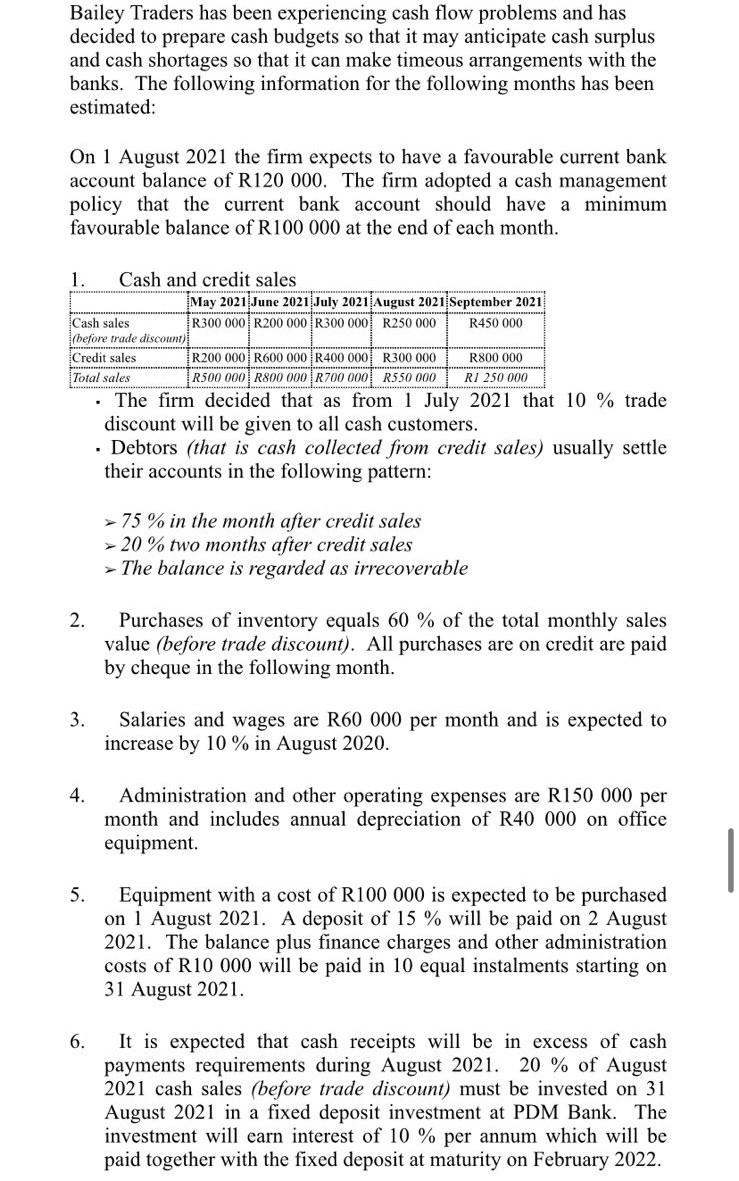

Bailey Traders has been experiencing cash flow problems and has decided to prepare cash budgets so that it may anticipate cash surplus and cash shortages so that it can make timeous arrangements with the banks. The following information for the following months has been estimated: On 1 August 2021 the firm expects to have a favourable current bank account balance of R120 000. The firm adopted a cash management policy that the current bank account should have a minimum favourable balance of R100 000 at the end of each month. 1. Cash and credit sales May 2021 June 2021 July 2021 August 2021 September 2021 Cash sales R300 000 R200 000 R300 000 R250 000 R450 000 (before trade discount) Credit sales R200 000 R600 000 R400 000 R300 000 R800 000 Total sales R500 000 R800 000 R 700 000 R550 000 RI 250 000 The firm decided that as from 1 July 2021 that 10 % trade discount will be given to all cash customers. Debtors (that is cash collected from credit sales) usually settle their accounts in the following pattern: 75 % in the month after credit sales > 20% two months after credit sales > The balance is regarded as irrecoverable 2. Purchases of inventory equals 60 % of the total monthly sales value (before trade discount). All purchases are on credit are paid by cheque in the following month. 3. Salaries and wages are R60 000 per month and is expected to increase by 10% in August 2020. 4. Administration and other operating expenses are R150 000 per month and includes annual depreciation of R40 000 on office equipment 5. Equipment with a cost of R100 000 is expected to be purchased on 1 August 2021. A deposit of 15 % will be paid on 2 August 2021. The balance plus finance charges and other administration costs of R10 000 will be paid in 10 equal instalments starting on 31 August 2021. 6. It is expected that cash receipts will be in excess of cash payments requirements during August 2021. 20 % of August 2021 cash sales (before trade discount) must be invested on 31 August 2021 in a fixed deposit investment at PDM Bank. The investment will earn interest of 10 % per annum which will be paid together with the fixed deposit at maturity on February 2022. YOU ARE REQUIRED TO: 1. Name and briefly discuss the two most important purposes (goals) of budgeting. (maximum 40 words) (3 marks) Prepare the Cash budget of Bailey Traders ONLY for August 2021. Mark will be awarded for presentation (16 marks) 2. Bailey Traders has been experiencing cash flow problems and has decided to prepare cash budgets so that it may anticipate cash surplus and cash shortages so that it can make timeous arrangements with the banks. The following information for the following months has been estimated: On 1 August 2021 the firm expects to have a favourable current bank account balance of R120 000. The firm adopted a cash management policy that the current bank account should have a minimum favourable balance of R100 000 at the end of each month. 1. Cash and credit sales May 2021 June 2021 July 2021 August 2021 September 2021 Cash sales R300 000 R200 000 R300 000 R250 000 R450 000 (before trade discount) Credit sales R200 000 R600 000 R400 000 R300 000 R800 000 Total sales R500 000 R800 000 R 700 000 R550 000 RI 250 000 The firm decided that as from 1 July 2021 that 10 % trade discount will be given to all cash customers. Debtors (that is cash collected from credit sales) usually settle their accounts in the following pattern: 75 % in the month after credit sales > 20% two months after credit sales > The balance is regarded as irrecoverable 2. Purchases of inventory equals 60 % of the total monthly sales value (before trade discount). All purchases are on credit are paid by cheque in the following month. 3. Salaries and wages are R60 000 per month and is expected to increase by 10% in August 2020. 4. Administration and other operating expenses are R150 000 per month and includes annual depreciation of R40 000 on office equipment 5. Equipment with a cost of R100 000 is expected to be purchased on 1 August 2021. A deposit of 15 % will be paid on 2 August 2021. The balance plus finance charges and other administration costs of R10 000 will be paid in 10 equal instalments starting on 31 August 2021. 6. It is expected that cash receipts will be in excess of cash payments requirements during August 2021. 20 % of August 2021 cash sales (before trade discount) must be invested on 31 August 2021 in a fixed deposit investment at PDM Bank. The investment will earn interest of 10 % per annum which will be paid together with the fixed deposit at maturity on February 2022. YOU ARE REQUIRED TO: 1. Name and briefly discuss the two most important purposes (goals) of budgeting. (maximum 40 words) (3 marks) Prepare the Cash budget of Bailey Traders ONLY for August 2021. Mark will be awarded for presentation (16 marks) 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts