Question: Baker Construction Corp. entered into a contract with Menlo Inc. to construct a new office building, on January 1, 2019. The price of the

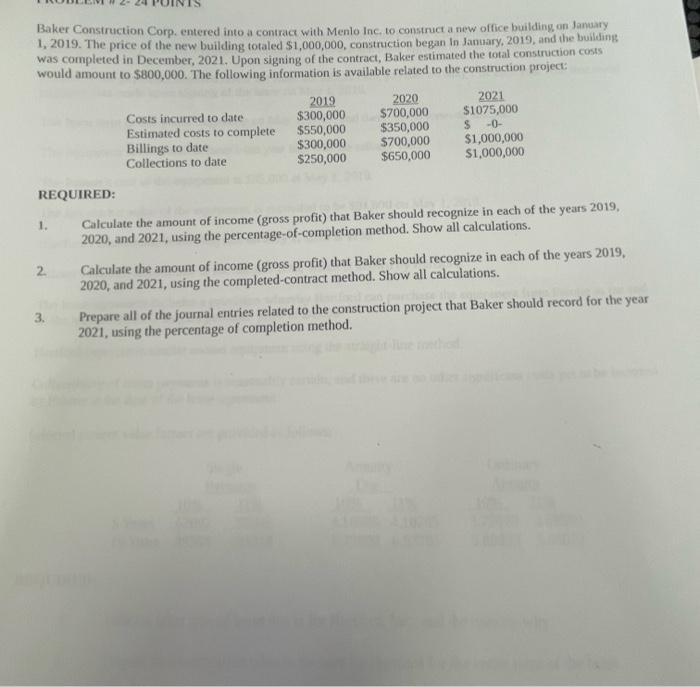

Baker Construction Corp. entered into a contract with Menlo Inc. to construct a new office building, on January 1, 2019. The price of the new building totaled $1,000,000, construction began in January, 2019, and the building was completed in December, 2021. Upon signing of the contract, Baker estimated the total construction costs would amount to $800,000. The following information is available related to the construction project: REQUIRED: 1. 2 3. Costs incurred to date Estimated costs to complete Billings to date Collections to date. 2019 $300,000 $550,000 $300,000 $250,000 2020 $700,000 $350,000 $700,000 $650,000 2021 $1075,000 S -0- $1,000,000 $1,000,000 Calculate the amount of income (gross profit) that Baker should recognize in each of the years 2019, 2020, and 2021, using the percentage-of-completion method. Show all calculations. Calculate the amount of income (gross profit) that Baker should recognize in each of the years 2019, 2020, and 2021, using the completed-contract method. Show all calculations. Prepare all of the journal entries related to the construction project that Baker should record for the year 2021, using the percentage of completion method.

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

5 6 DETAILS 7 Price of bulding 8 Costs incurred to date 9 ... View full answer

Get step-by-step solutions from verified subject matter experts