Question: Balance Sheet and Income statement has been mentioned Required Question: Compute all the ratios for the company (Balance Sheet and Income statement has been mentioned)

Balance Sheet and Income statement has been mentioned

Required Question:

Compute all the ratios for the company (Balance Sheet and Income statement has been mentioned) also include each ratio short analysis.

1. Current Ratio

2. Quick Ratio

3. Networking capital

4. Debt to Equity Ratio

5. Equity ratio

6. Debt Ratio

7. Gross profit Margin

8. Operating profit Margin

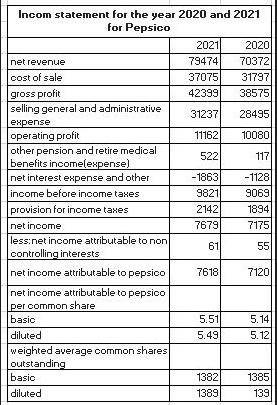

Incom statement for the year 2020 and 2021 for Pepsico net revenue cost of sale gross profit selling general and administrative expense operating profit other pension and retire medical benefits income(expense) net interest expense and other income before income taxes provision for income taxes net income less:net income attributable to non controlling interests net income attributable to pepsico net income attributable to pepsico per common share basic diluted weighted average common shares outstanding basic diluted 2021 79474 37075 42399 31237 11162 522 -1863 9821 2142 7679 61 7618 5.51 5.49 1382 1389 2020 70372 31797 38575 28495 10080 117 -1128 9069 1894 7175 55 7120 5.14 5.12 1385 139

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

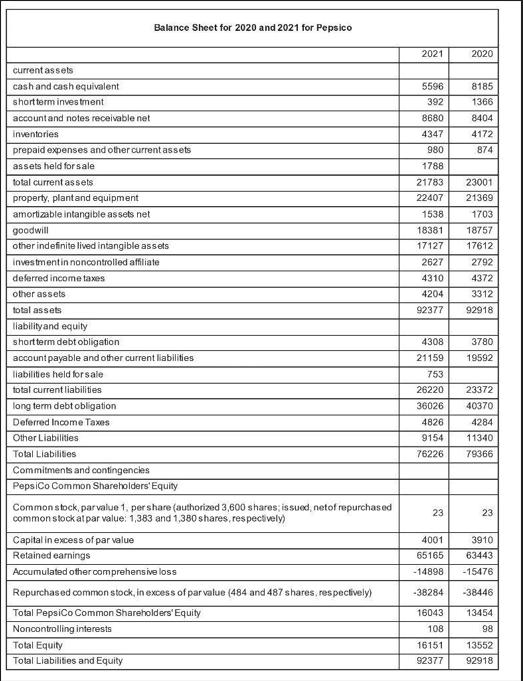

Current Ratio Current Ratio Current Assets Current Liabilities For 2021 Current Assets 21783 million Current Liabilities 26220 million Current Ratio 2021 21783 26220 083 For 2020 Current Assets 23001 ... View full answer

Get step-by-step solutions from verified subject matter experts