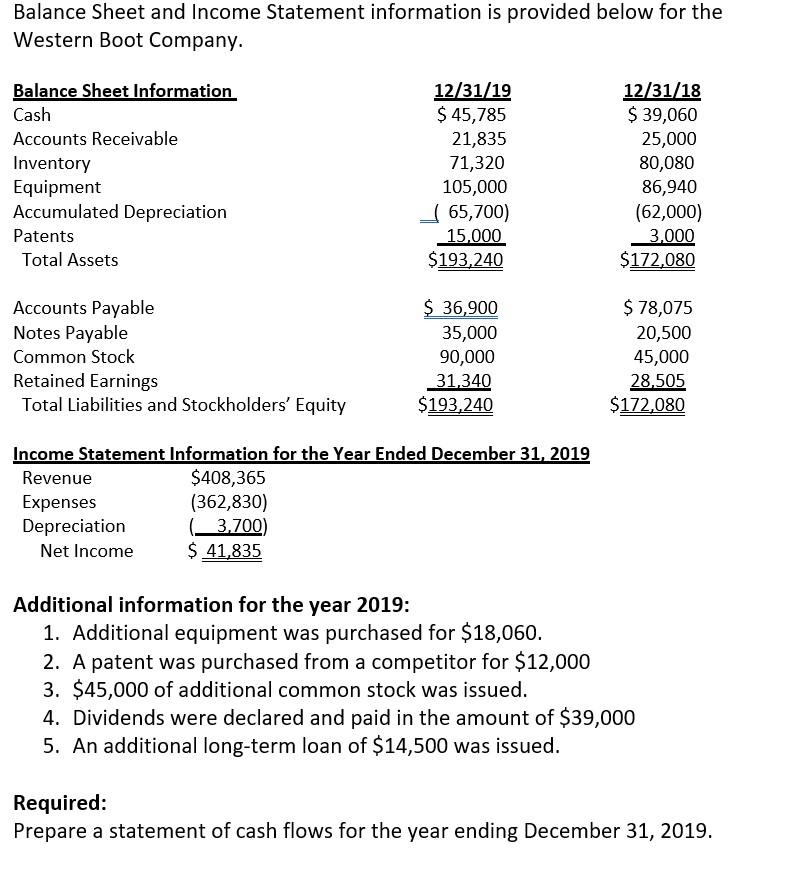

Question: Balance Sheet and Income Statement information is provided below for the Western Boot Company. Balance Sheet Information 12/31/19 12/31/18 Cash $ 45,785 $ 39,060 Accounts

Balance Sheet and Income Statement information is provided below for the Western Boot Company. Balance Sheet Information 12/31/19 12/31/18 Cash $ 45,785 $ 39,060 Accounts Receivable 21,835 25,000 Inventory 71,320 80,080 Equipment 105,000 86,940 Accumulated Depreciation ( 65,700) (62,000) Patents 15,000 3,000 Total Assets $193,240 $172,080 Accounts Payable $ 36,900 $ 78,075 Notes Payable 35,000 20,500 Common Stock 90,000 45,000 Retained Earnings 31,340 28,505 Total Liabilities and Stockholders Equity $193,240 $172,080 Income Statement Information for the Year Ended December 31, 2019 Revenue $408,365 Expenses (362,830) Depreciation ( 3,700) Net Income $ 41,835 Additional information for the year 2019: 1. Additional equipment was purchased for $18,060. 2. A patent was purchased from a competitor for $12,000 3. $45,000 of additional common stock was issued. 4. Dividends were declared and paid in the amount of $39,000 5. An additional long-term loan of $14,500 was issued. Required: Prepare a statement of cash flows for the year ending December 31, 2019.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts