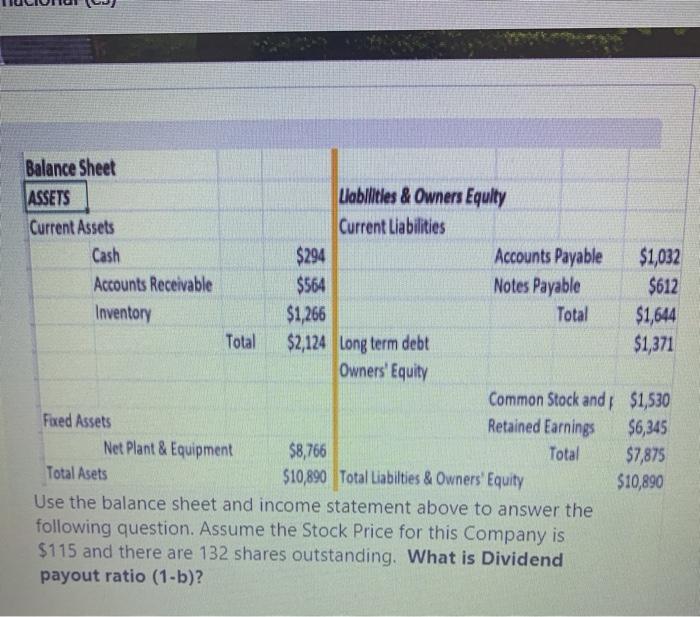

Question: Balance Sheet ASSETS Llabilities & Owners Equlty Current Assets Current Liabilities Cash $294 Accounts Payable $1,032 Accounts Receivable $564 Notes Payable $612 Inventory $1,266 Total

Balance Sheet ASSETS Llabilities & Owners Equlty Current Assets Current Liabilities Cash $294 Accounts Payable $1,032 Accounts Receivable $564 Notes Payable $612 Inventory $1,266 Total $1,644 Total $2,124 long term debt $1,371 Owners' Equity Common Stock and $1,530 Fixed Assets Retained Earnings $6,345 Net Plant & Equipment $8,766 Total $7,875 Total Asets $10,890 Total Liabilties & Owners' Equity $10,890 Use the balance sheet and income statement above to answer the following question. Assume the Stock Price for this Company is $115 and there are 132 shares outstanding. What is Dividend payout ratio (1-b)? Balance Sheet ASSETS Llabilities & Owners Equlty Current Assets Current Liabilities Cash $294 Accounts Payable $1,032 Accounts Receivable $564 Notes Payable $612 Inventory $1,266 Total $1,644 Total $2,124 long term debt $1,371 Owners' Equity Common Stock and $1,530 Fixed Assets Retained Earnings $6,345 Net Plant & Equipment $8,766 Total $7,875 Total Asets $10,890 Total Liabilties & Owners' Equity $10,890 Use the balance sheet and income statement above to answer the following question. Assume the Stock Price for this Company is $115 and there are 132 shares outstanding. What is Dividend payout ratio (1-b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts