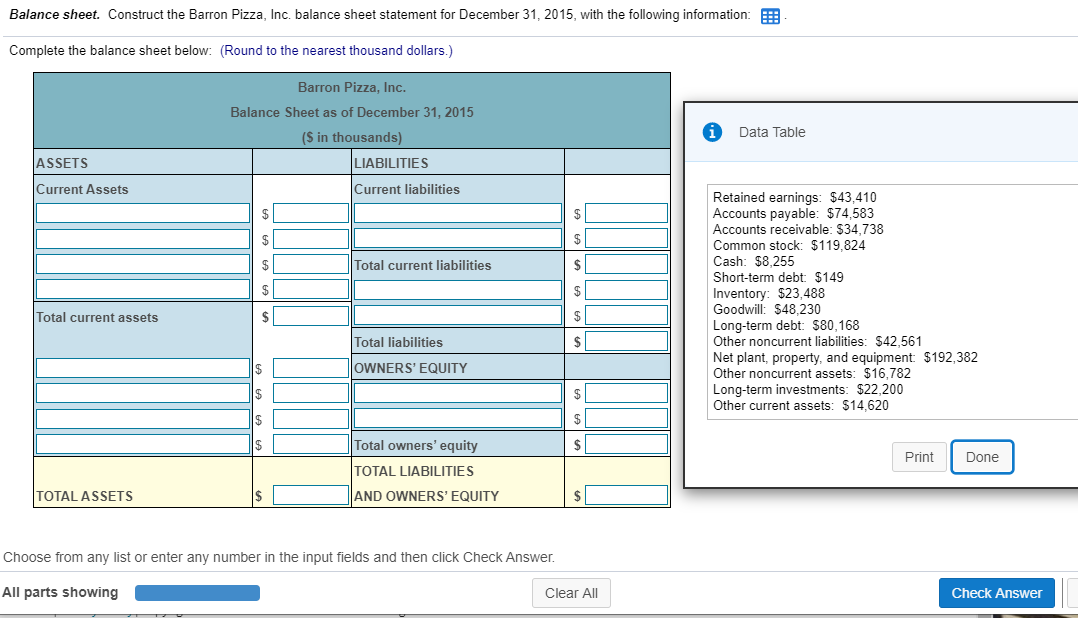

Question: Balance sheet. Construct the Barron Pizza, Inc. balance sheet statement for December 31, 2015, with the following information: 3: Complete the balance sheet below: (Round

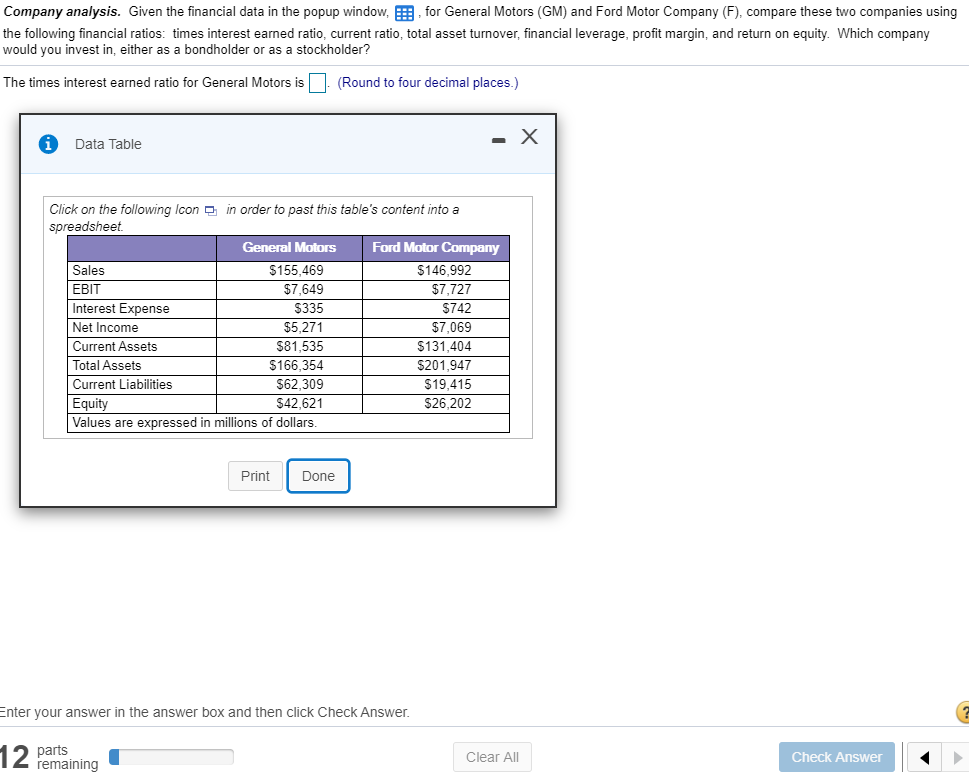

Balance sheet. Construct the Barron Pizza, Inc. balance sheet statement for December 31, 2015, with the following information: 3: Complete the balance sheet below: (Round to the nearest thousand dollars.) Barron Pizza, Inc. Balance Sheet as of December 31, 2015 ($ in thousands) LIABILITIES Current liabilities Data Table ASSETS Current Assets $ $ $ Total current liabilities $ $ $ $ $ Retained earnings: $43,410 Accounts payable: $74,583 Accounts receivable: $34,738 Common stock: $119,824 Cash: $8,255 Short-term debt: $149 Inventory: $23,488 Goodwill: $48,230 Long-term debt: $80,168 Other noncurrent liabilities: $42,561 Net plant, property, and equipment $192,382 Other noncurrent assets: $16,782 Long-term investments: $22,200 Other current assets: $14,620 Total current assets $ Total liabilities $ OWNERS' EQUITY $ $ $ $ $ Total owners' equity TOTAL LIABILITIES Print Done TOTAL ASSETS AND OWNERS' EQUITY $ Choose from any list or enter any number in the input fields and then click Check Answer. All parts showing Clear All Check Answer Company analysis. Given the financial data in the popup window, for General Motors (GM) and Ford Motor Company (F), compare these two companies using the following financial ratios: times interest earned ratio, current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? The times interest earned ratio for General Motors is I (Round to four decimal places.) Data Table Click on the following Icon 2 in order to past this table's content into a spreadsheet General Motors Ford Motor Company Sales $155,469 $146,992 | EBIT $7,649 $7,727 Interest Expense $335 $742 Net Income $5,271 $7,069 Current Assets $81,535 $131,404 Total Assets $166.354 $201.947 Current Liabilities $62.309 $19,415 Equity $42.621 $26,202 Values are expressed in millions of dollars. Print Done Enter your answer in the answer box and then click Check Answer. 12 parts Clear All remaining Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts