Question: Balance Sheet, Income Statement and owners equity is needed E 3-5A (L04) TRANSACTION ANALYSIS Linda Kipp started a business on May 1, 20- Analyze dab

Balance Sheet, Income Statement and owners equity is needed

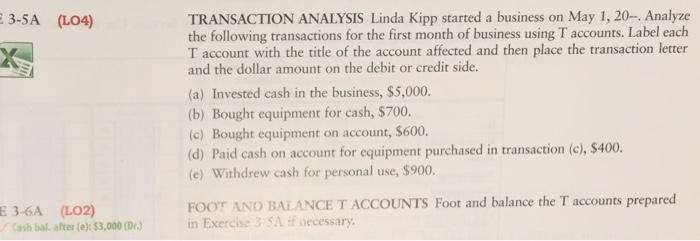

E 3-5A (L04) TRANSACTION ANALYSIS Linda Kipp started a business on May 1, 20- Analyze dab the following transactions for the first month of business using T accounts. Label each T account with the title of the account affected and then place the transaction letter and the dollar amount on the debit or credit side. (a) Invested cash in the business, $5,000. (b) Bought equipment for cash, $700. (c) Bought equipment on account, $600. (d) Paid cash on account for equipment purchased in transaction (c), $400. (e) Withdrew cash for personal use, $900. FOOT AND BALANCE T ACCOUNTS Foot and balance the T accounts prepared in Exercise 3: SA if necessary E 3-6A (LO2) Gabbal after (el: $3,000 (D)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts